Tennessee Tax Return 2024 - On may 10, 2024, tennessee gov. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. On the left, click on the type of form you need. Quarterly estimated tax payments normally due. You can find forms relevant to conducting business with the department of revenue here. Franchise and excise taxes may be reduced by a credit on industrial machinery and research and development equipment purchased during the. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. 2024 contributions to iras and health savings accounts for eligible taxpayers. Bill lee approved legislation which eliminates the property measure for computing the tennessee.

Bill lee approved legislation which eliminates the property measure for computing the tennessee. You can find forms relevant to conducting business with the department of revenue here. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. On may 10, 2024, tennessee gov. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. 2024 contributions to iras and health savings accounts for eligible taxpayers. Franchise and excise taxes may be reduced by a credit on industrial machinery and research and development equipment purchased during the. On the left, click on the type of form you need. Quarterly estimated tax payments normally due.

Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. On the left, click on the type of form you need. Bill lee approved legislation which eliminates the property measure for computing the tennessee. You can find forms relevant to conducting business with the department of revenue here. Quarterly estimated tax payments normally due. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. Franchise and excise taxes may be reduced by a credit on industrial machinery and research and development equipment purchased during the. On may 10, 2024, tennessee gov. 2024 contributions to iras and health savings accounts for eligible taxpayers.

Tennessee Tax Rebate 2025 A Comprehensive Guide

Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. Quarterly estimated tax payments normally due. Franchise and excise taxes may be reduced by a credit on industrial machinery and research and development equipment purchased during the. You can find forms relevant to conducting business with the department of revenue.

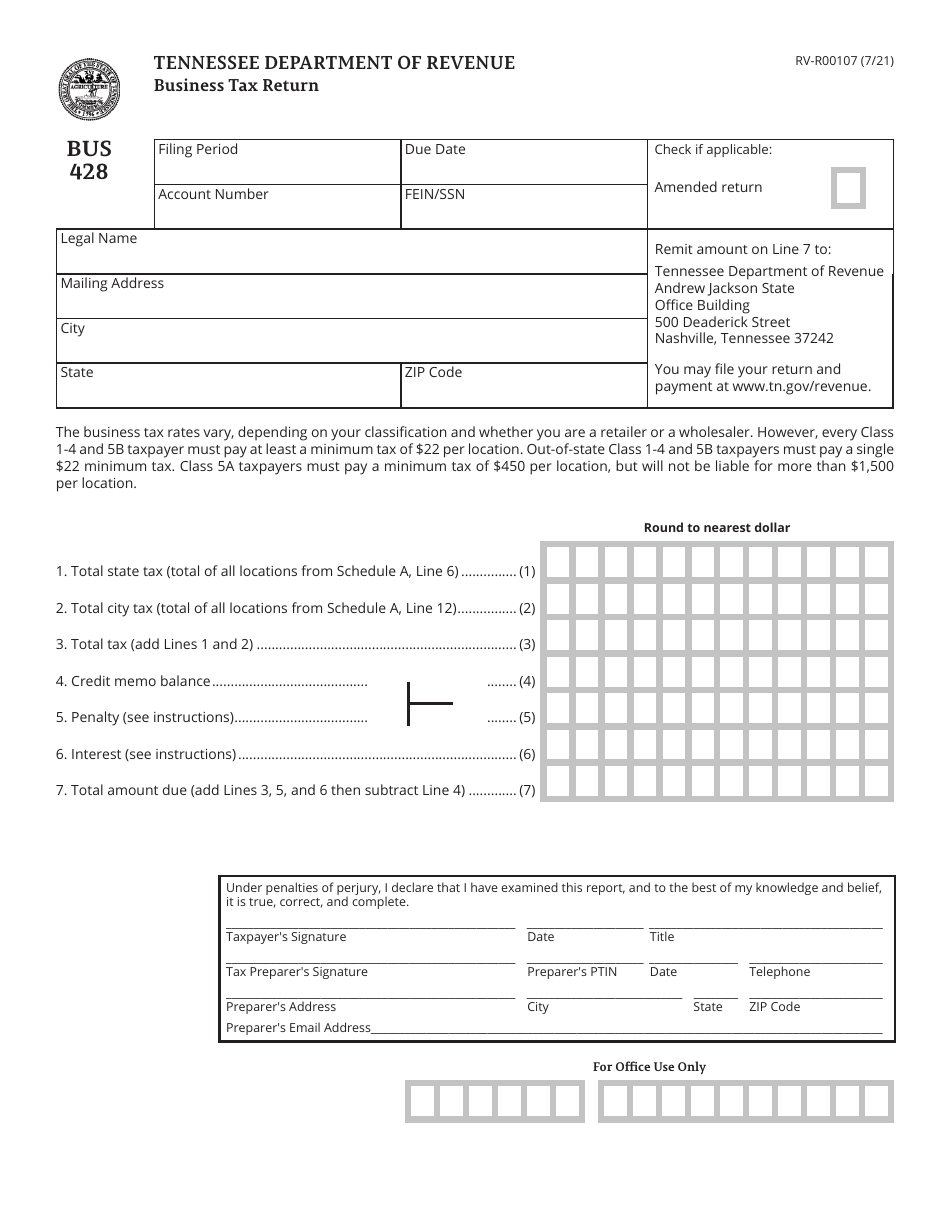

Form BUS428 (RVR00107) Download Printable PDF or Fill Online Business

On the left, click on the type of form you need. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. On may 10, 2024, tennessee gov..

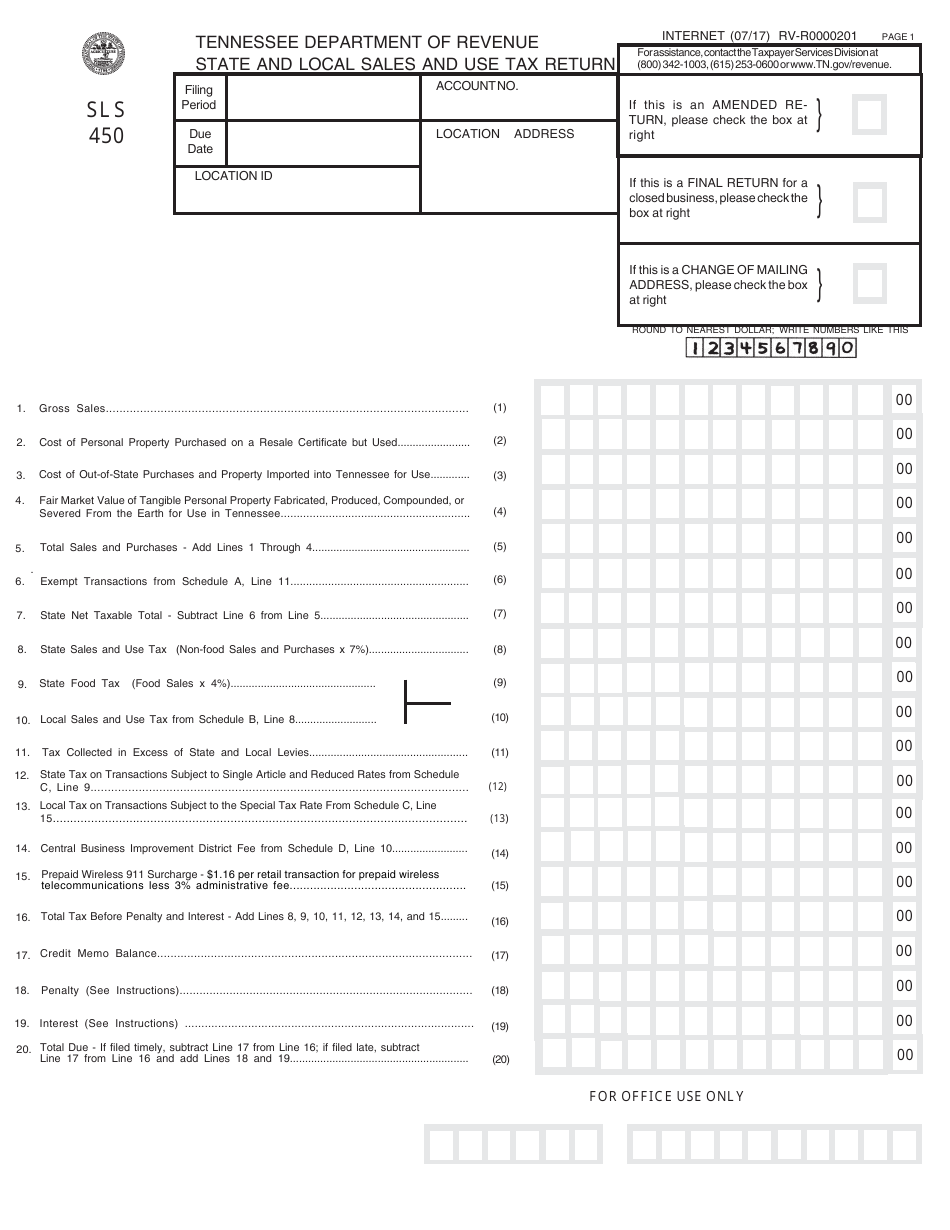

Tennessee Sales Tax 2024 Form Ketty Cariotta

Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. On may 10, 2024, tennessee gov. You can find forms relevant to conducting business with the department of revenue here. On the left, click on the type of form you need. Franchise and excise taxes may be.

When can I file my taxes for 2024? what's 1099K form? What to know in

Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. Bill lee approved legislation which eliminates the property measure for computing the tennessee. You can find forms relevant to conducting business with the department of revenue here. Quarterly estimated tax payments normally due. Franchise and excise taxes.

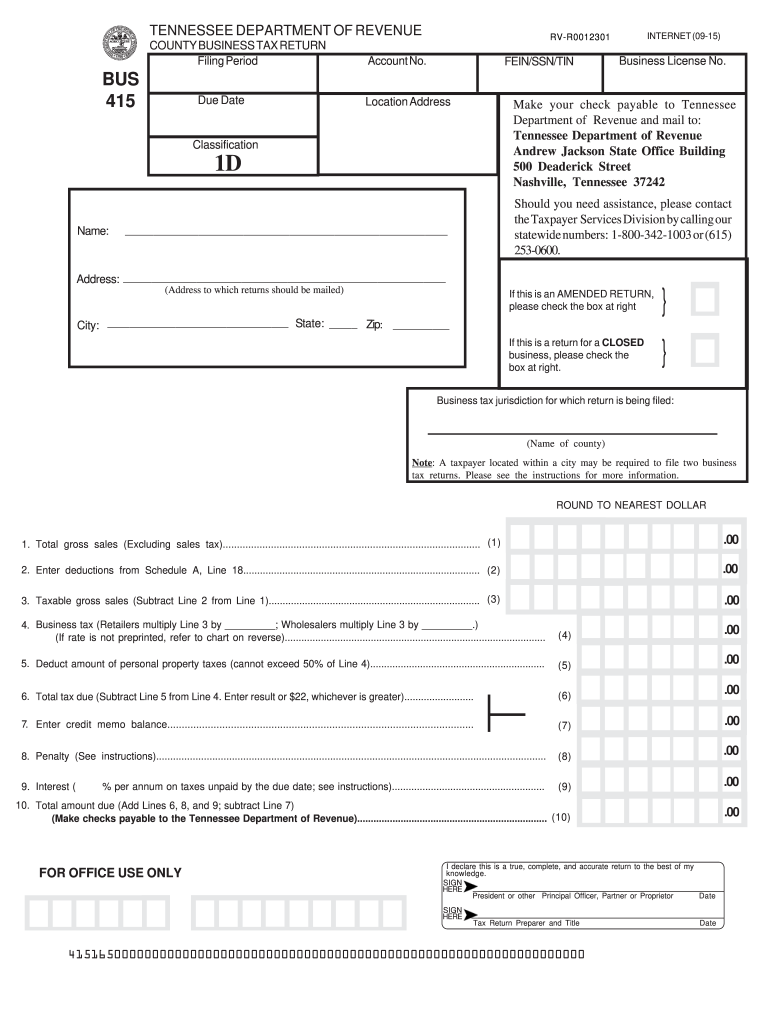

Tn fae 170 instructions Fill out & sign online DocHub

2024 contributions to iras and health savings accounts for eligible taxpayers. You can find forms relevant to conducting business with the department of revenue here. On may 10, 2024, tennessee gov. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. Franchise and excise taxes may be.

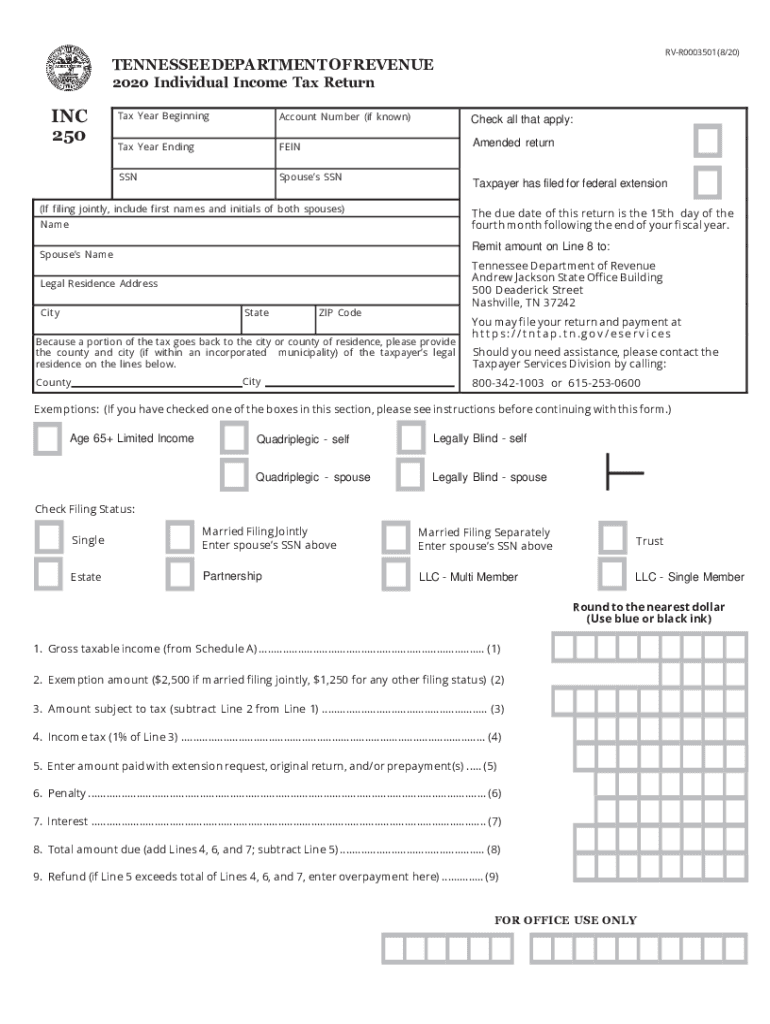

Tn Revenue Tax 20202025 Form Fill Out and Sign Printable PDF

On may 10, 2024, tennessee gov. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. 2024 contributions to iras and health savings accounts for eligible taxpayers. On the left, click on the type of form you need. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax.

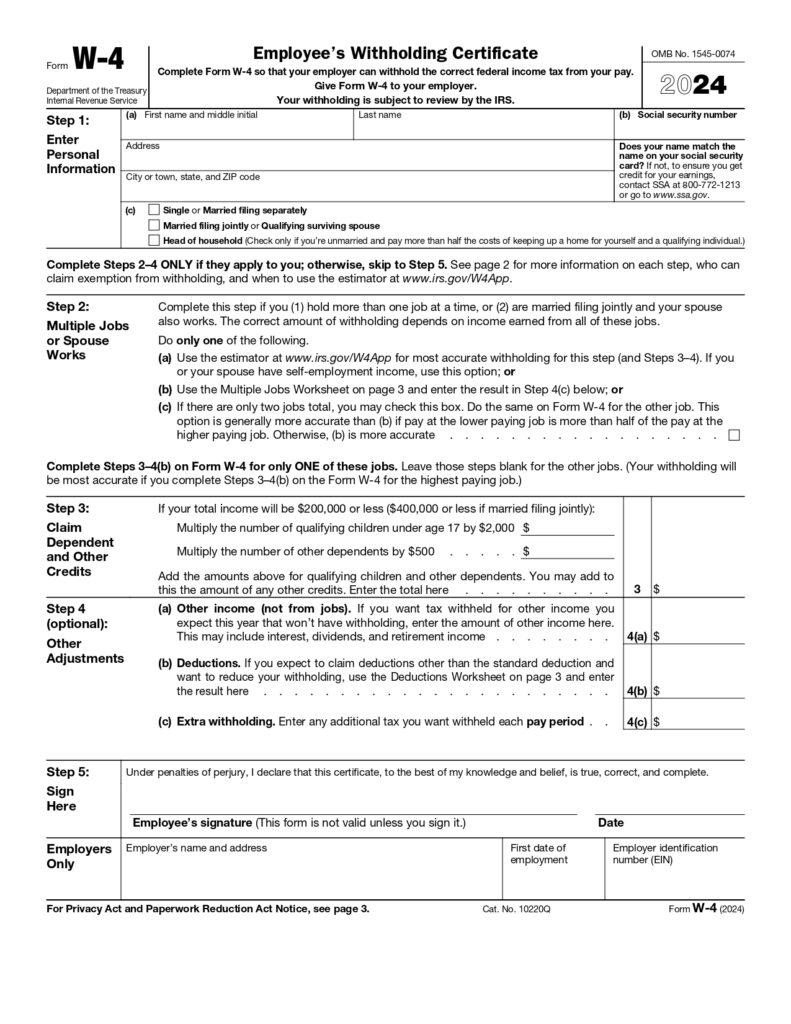

Irs 2024 Tax Forms Genni Christiane

2024 contributions to iras and health savings accounts for eligible taxpayers. Quarterly estimated tax payments normally due. On may 10, 2024, tennessee gov. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from.

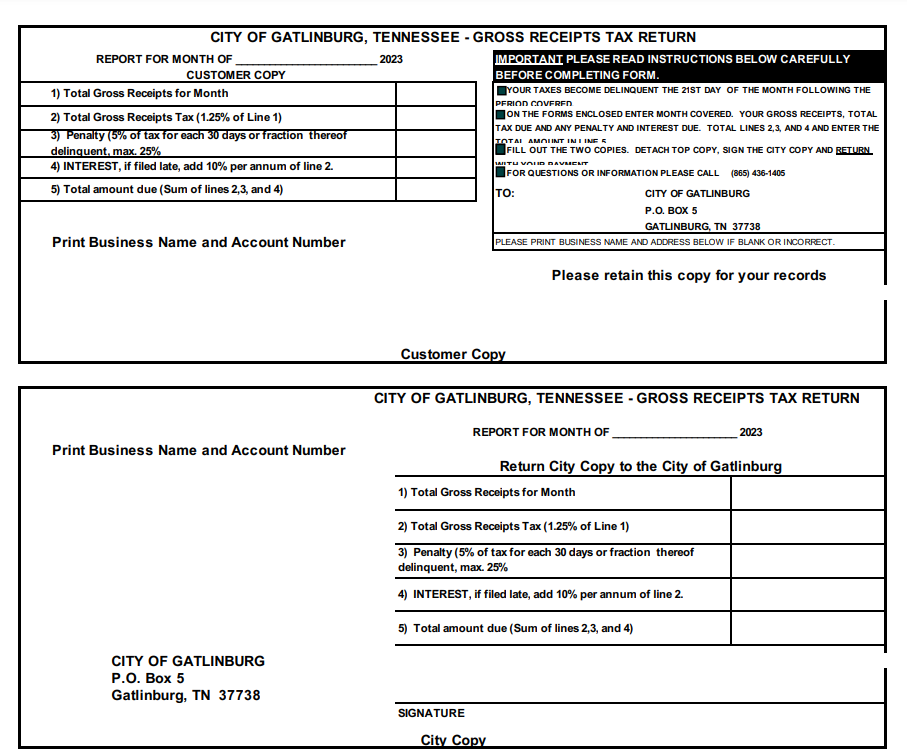

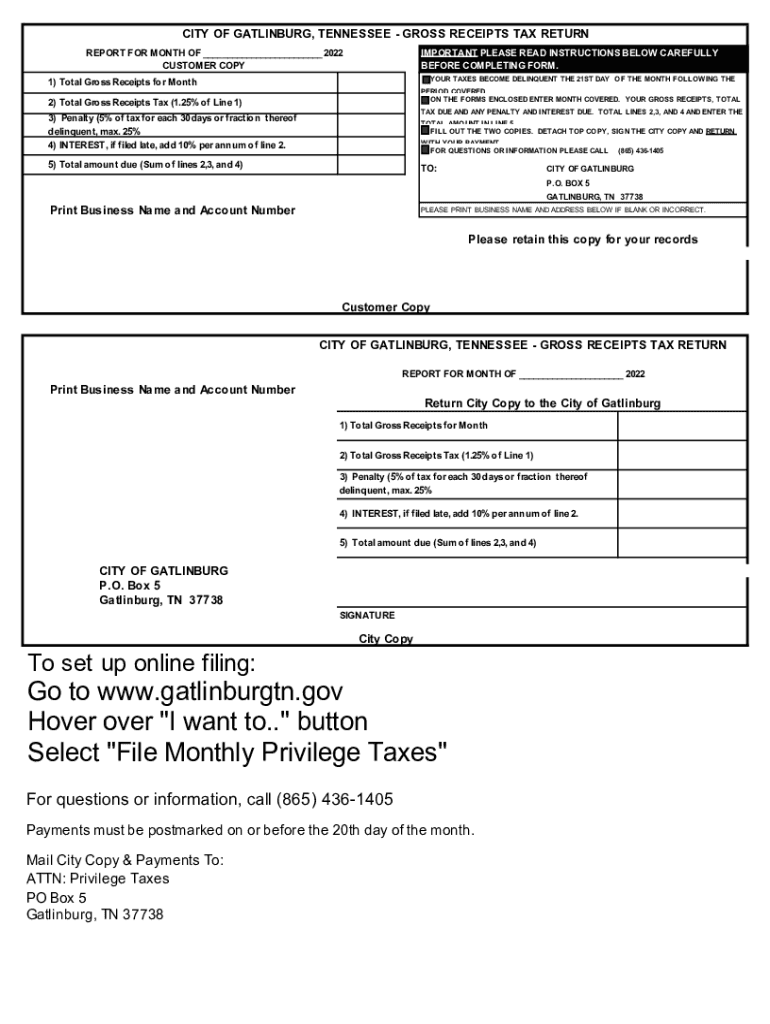

Gross Receipts 20222024 Form Fill Out and Sign Printable PDF

On may 10, 2024, tennessee gov. You can find forms relevant to conducting business with the department of revenue here. Franchise and excise taxes may be reduced by a credit on industrial machinery and research and development equipment purchased during the. Bill lee approved legislation which eliminates the property measure for computing the tennessee. Quarterly estimated tax payments normally due.

Tennessee Tax Rates & Rankings Tax Foundation

Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. You can find forms relevant to conducting business with the department of revenue here. 2024 contributions to iras and health savings accounts for eligible taxpayers. Bill lee approved legislation which eliminates the property measure for computing the.

Tennessee Sales Tax 2024 Form Ketty Cariotta

Quarterly estimated tax payments normally due. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. On may 10, 2024, tennessee gov. 2024 contributions to iras and health savings accounts for eligible taxpayers. You can find forms relevant to conducting business with the department of revenue here.

On The Left, Click On The Type Of Form You Need.

You can find forms relevant to conducting business with the department of revenue here. Taxpayers incorporated or otherwise formed in tennessee must prorate the franchise tax on the initial return from the date formed or the date. Franchise tax property measure (schedule g) refunds on may 10, 2024, governor bill lee signed public chapter 950 (2024), which. Bill lee approved legislation which eliminates the property measure for computing the tennessee.

Quarterly Estimated Tax Payments Normally Due.

Franchise and excise taxes may be reduced by a credit on industrial machinery and research and development equipment purchased during the. 2024 contributions to iras and health savings accounts for eligible taxpayers. On may 10, 2024, tennessee gov.