Service Charge In Malay - Any provision of taxable services; The effective date to charge sales tax and service tax would be 1 july 2025. About services tax 1.what is service tax ? • selected imported fruits (i.e. Made in the course or. This is normally applied in the hospitality. It only applies to specific goods and services, depending on whether they fall under. In malaysia, sst is not charged on everything.

This is normally applied in the hospitality. The effective date to charge sales tax and service tax would be 1 july 2025. • selected imported fruits (i.e. It only applies to specific goods and services, depending on whether they fall under. Any provision of taxable services; In malaysia, sst is not charged on everything. About services tax 1.what is service tax ? Made in the course or.

Any provision of taxable services; The effective date to charge sales tax and service tax would be 1 july 2025. This is normally applied in the hospitality. Made in the course or. About services tax 1.what is service tax ? • selected imported fruits (i.e. In malaysia, sst is not charged on everything. It only applies to specific goods and services, depending on whether they fall under.

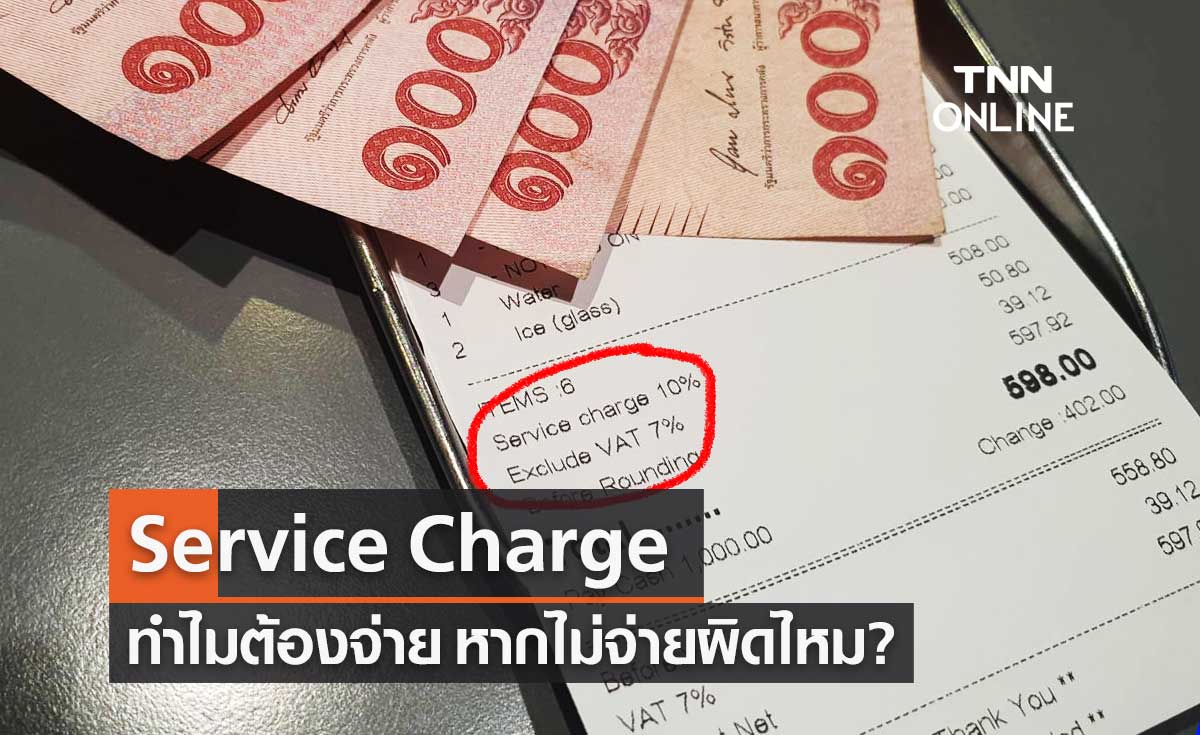

Service Charge คืออะไร ทำไมผู้บริโภคต้องจ่าย ไม่จ่ายได้ไหม?

This is normally applied in the hospitality. About services tax 1.what is service tax ? Any provision of taxable services; • selected imported fruits (i.e. Made in the course or.

Announces Revisions to the Aviation Services Charges (ASC

This is normally applied in the hospitality. • selected imported fruits (i.e. In malaysia, sst is not charged on everything. Made in the course or. The effective date to charge sales tax and service tax would be 1 july 2025.

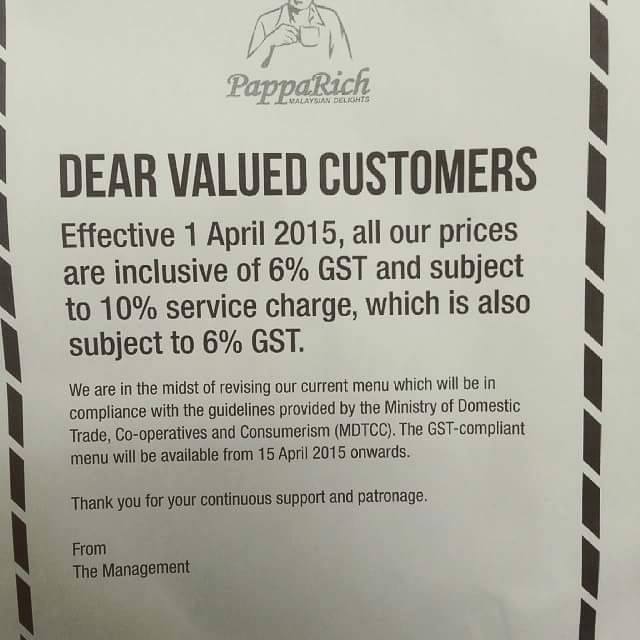

Government May Add New Service Charge for Online Shopping in Malaysia

About services tax 1.what is service tax ? The effective date to charge sales tax and service tax would be 1 july 2025. In malaysia, sst is not charged on everything. • selected imported fruits (i.e. Made in the course or.

Service charge used by businesses for their staff, not paid to govt

• selected imported fruits (i.e. Any provision of taxable services; The effective date to charge sales tax and service tax would be 1 july 2025. Made in the course or. This is normally applied in the hospitality.

มาทำงานสายตลอด บริษัทลงโทษยังไงได้บ้าง?

About services tax 1.what is service tax ? This is normally applied in the hospitality. • selected imported fruits (i.e. The effective date to charge sales tax and service tax would be 1 july 2025. Made in the course or.

Thai Hotels Service Charge 01.2023 เซอร์วิสชาร์จ มกราคม 2023

• selected imported fruits (i.e. Made in the course or. The effective date to charge sales tax and service tax would be 1 july 2025. This is normally applied in the hospitality. Any provision of taxable services;

What is the service charge in Malaysia 2024? Archives

This is normally applied in the hospitality. Any provision of taxable services; • selected imported fruits (i.e. It only applies to specific goods and services, depending on whether they fall under. Made in the course or.

హోటల్ బిల్లు లో వేసే సర్వీస్ ఛార్జ్ మీకు సర్వీస్ నచ్చితేనే

This is normally applied in the hospitality. About services tax 1.what is service tax ? The effective date to charge sales tax and service tax would be 1 july 2025. • selected imported fruits (i.e. In malaysia, sst is not charged on everything.

Service Charge Definition, Types, and Why It's Not a Tip

The effective date to charge sales tax and service tax would be 1 july 2025. About services tax 1.what is service tax ? Made in the course or. This is normally applied in the hospitality. It only applies to specific goods and services, depending on whether they fall under.

The Effective Date To Charge Sales Tax And Service Tax Would Be 1 July 2025.

This is normally applied in the hospitality. Made in the course or. • selected imported fruits (i.e. About services tax 1.what is service tax ?

It Only Applies To Specific Goods And Services, Depending On Whether They Fall Under.

In malaysia, sst is not charged on everything. Any provision of taxable services;

:max_bytes(150000):strip_icc()/Service-charge-4189213-FINAL-6fab6812d7ca4f3d9e77387076d623ca.png)