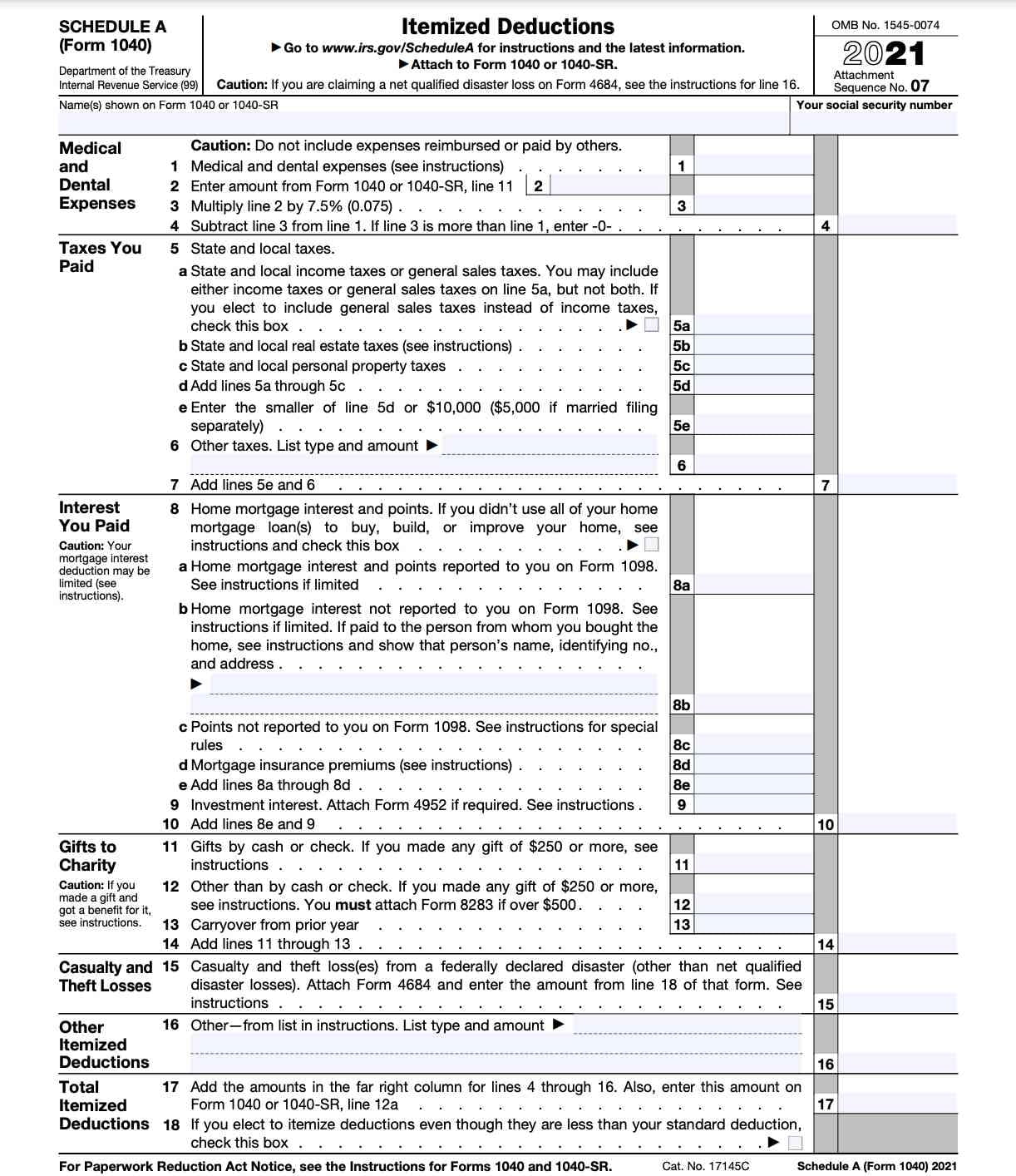

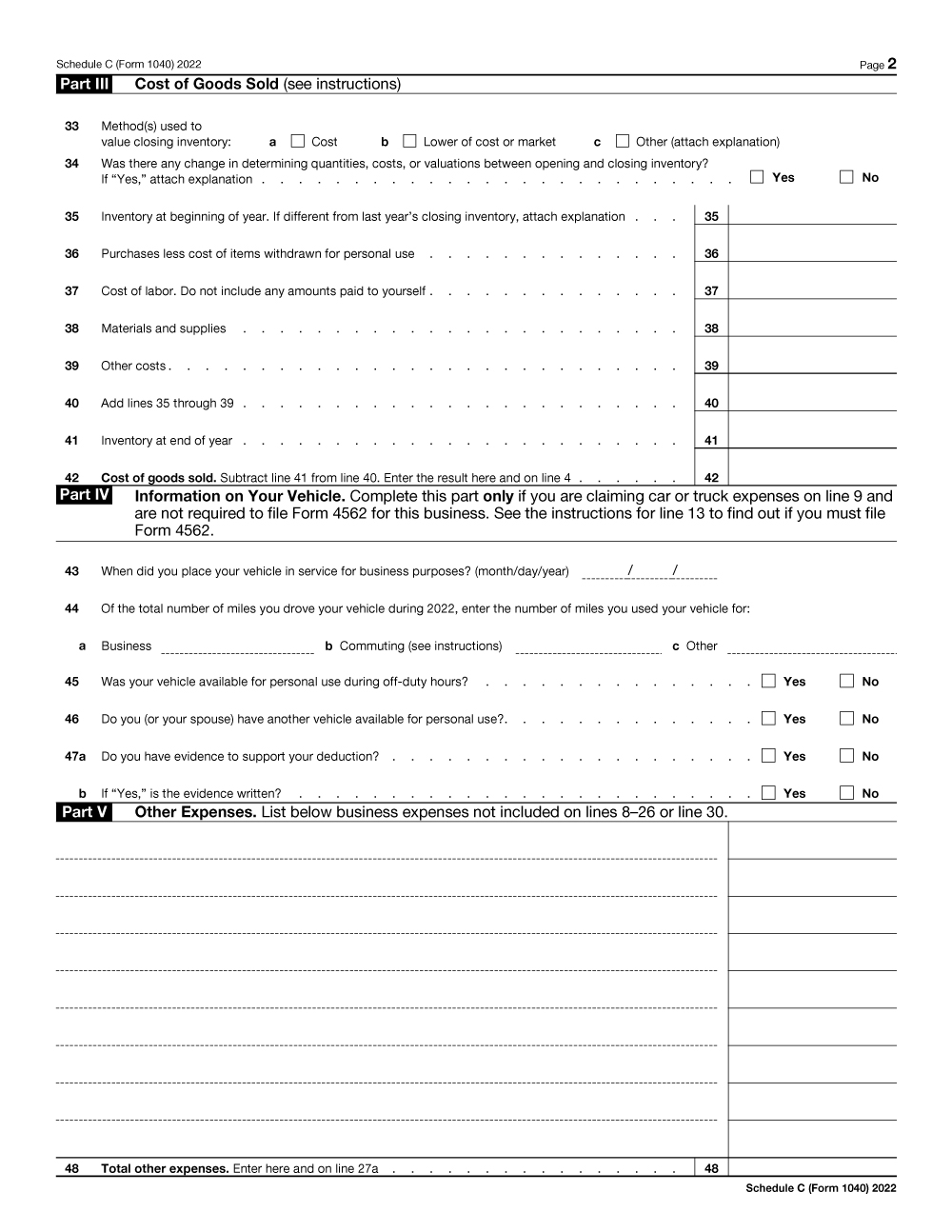

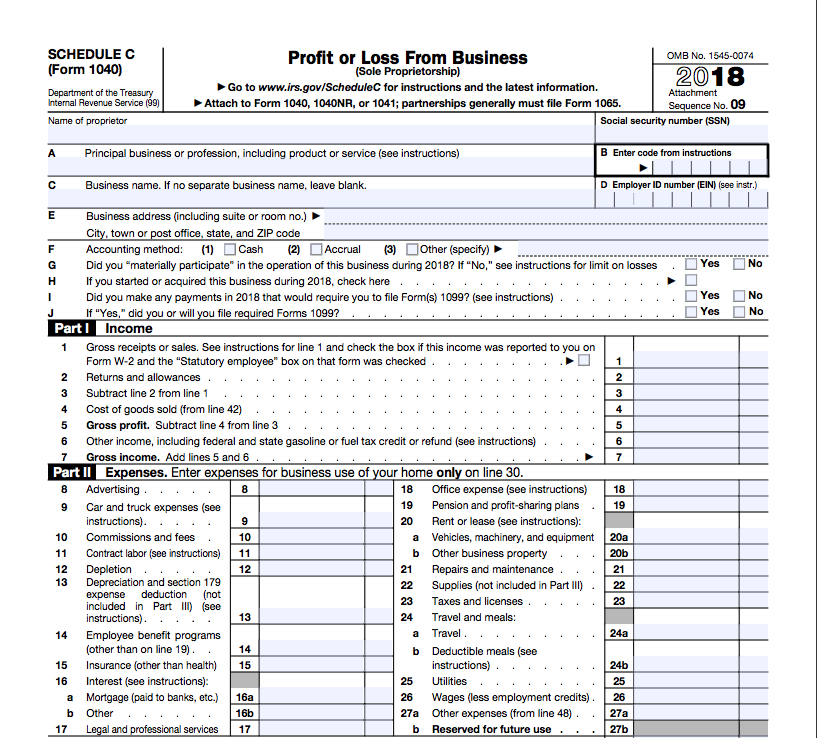

Schedule C Tax Form 2023 Printable - Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. For real estate transactions, be sure to. If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Accurate completion of this schedule. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. This essential form also helps. Go to www.irs.gov/schedulec for instructions and the latest information.

If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Accurate completion of this schedule. For real estate transactions, be sure to. If no separate business name, leave blank.

This essential form also helps. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. For real estate transactions, be sure to. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Accurate completion of this schedule.

Printable 1040 Schedule C

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Go to www.irs.gov/schedulec for instructions and the latest information. This essential form also helps. If no separate business.

Schedule C (Form 1040) 2023 Instructions

If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. If no separate business name, leave blank. Accurate completion of this schedule. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. For real estate transactions, be sure to.

Schedule C (Form 1040) 2023 Instructions

If no separate business name, leave blank. For real estate transactions, be sure to. Go to www.irs.gov/schedulec for instructions and the latest information. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from.

Tax Forms Schedule C at Mindy Beaty blog

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. For real estate transactions, be sure to. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c to report income or loss from a business.

Schedule C 2023 Form Printable Forms Free Online

Accurate completion of this schedule. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or loss.

Schedule C Tax Calculator

This essential form also helps. Go to www.irs.gov/schedulec for instructions and the latest information. Accurate completion of this schedule. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship.

Enterprise Express Tax Systems LLC on LinkedIn Who needs a schedule C

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. Accurate completion of this schedule. For real estate transactions, be sure to.

Printable Schedule C 2023

For real estate transactions, be sure to. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. Accurate completion of this schedule. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship.

Tax Return 2023 Chart Printable Forms Free Online

Accurate completion of this schedule. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. This essential form also helps. If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

Printable Schedule C Form 2023 Schedule Printable

Go to www.irs.gov/schedulec for instructions and the latest information. Accurate completion of this schedule. This essential form also helps. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship.

Schedule C (Form 1040) Is Used To Report Income Or Loss From A Business Operated As A Sole Proprietorship.

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. For real estate transactions, be sure to. This essential form also helps. If no separate business name, leave blank.

Accurate Completion Of This Schedule.

Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale.

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)