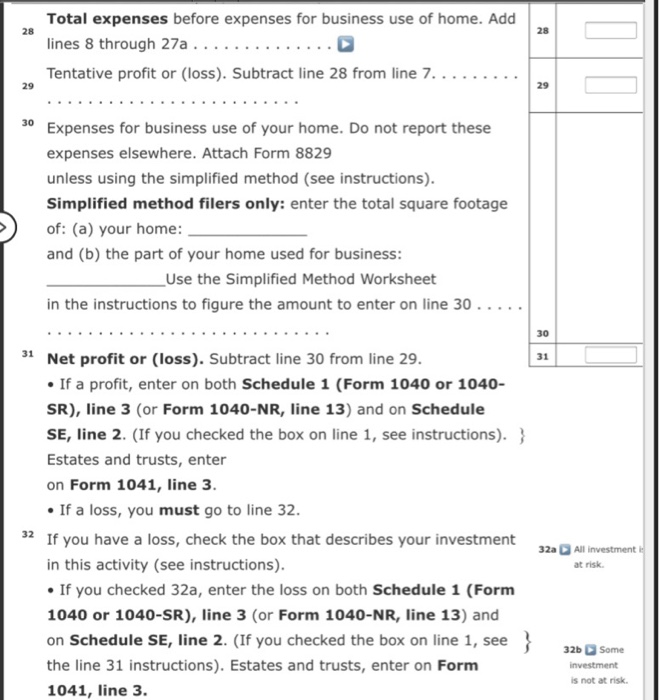

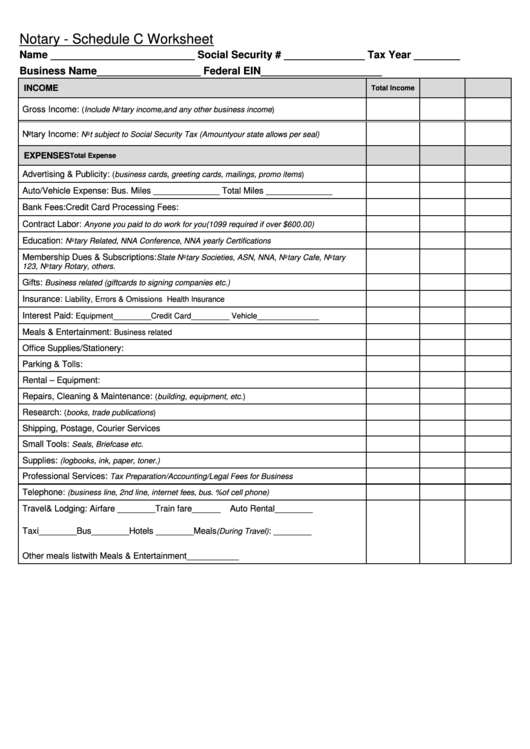

Schedule C Simplified Method Worksheet 2023 - Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Monthly qualifying income i most recent year________ Inventory at beginning of year purchases less cost of items for personal use cost of labor (do not include amounts paid to self) materials and. Net profit or (loss) buildings and machinery sold outright (no trades): 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction.

10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Monthly qualifying income i most recent year________ Net profit or (loss) buildings and machinery sold outright (no trades): Inventory at beginning of year purchases less cost of items for personal use cost of labor (do not include amounts paid to self) materials and.

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Net profit or (loss) buildings and machinery sold outright (no trades): Monthly qualifying income i most recent year________ Inventory at beginning of year purchases less cost of items for personal use cost of labor (do not include amounts paid to self) materials and. 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction.

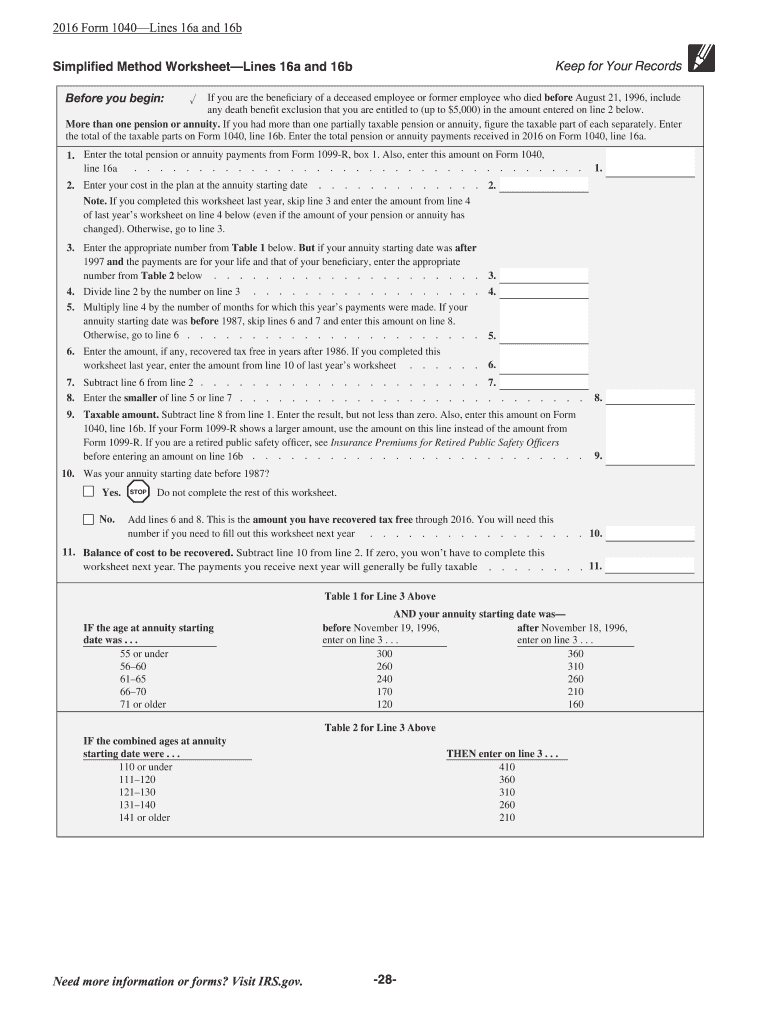

Simplified Method Worksheet

Inventory at beginning of year purchases less cost of items for personal use cost of labor (do not include amounts paid to self) materials and. 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. Net profit or (loss) buildings and machinery sold outright (no trades): Monthly qualifying income i most recent year________ Schedule c worksheet.

Schedule C Simplified Method Worksheets

Net profit or (loss) buildings and machinery sold outright (no trades): 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. Inventory at beginning of year purchases less cost of items for personal use cost of labor (do not include amounts paid to self) materials and. Monthly qualifying income i most recent year________ Schedule c worksheet.

Simplified Method Worksheet Schedule C

Inventory at beginning of year purchases less cost of items for personal use cost of labor (do not include amounts paid to self) materials and. Monthly qualifying income i most recent year________ 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have.

Simplified Method Worksheet Schedule C

Net profit or (loss) buildings and machinery sold outright (no trades): Inventory at beginning of year purchases less cost of items for personal use cost of labor (do not include amounts paid to self) materials and. 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. Schedule c worksheet for self employed businesses and/or independent contractors.

Schedule C Simplified Method Worksheet

Inventory at beginning of year purchases less cost of items for personal use cost of labor (do not include amounts paid to self) materials and. 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. Monthly qualifying income i most recent year________ Net profit or (loss) buildings and machinery sold outright (no trades): Schedule c worksheet.

Schedule C Simplified Method Worksheets

Inventory at beginning of year purchases less cost of items for personal use cost of labor (do not include amounts paid to self) materials and. Monthly qualifying income i most recent year________ Net profit or (loss) buildings and machinery sold outright (no trades): Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to.

Simplified Method Worksheet Schedule C

Monthly qualifying income i most recent year________ 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Net profit or (loss) buildings and machinery sold outright (no trades): Inventory at beginning of year purchases less cost.

Simplified Method Worksheet Schedule C

Monthly qualifying income i most recent year________ Net profit or (loss) buildings and machinery sold outright (no trades): 10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. Inventory at beginning of year purchases less cost of items for personal use cost of labor (do not include amounts paid to self) materials and. Schedule c worksheet.

Printable Schedule C 2023

Monthly qualifying income i most recent year________ Inventory at beginning of year purchases less cost of items for personal use cost of labor (do not include amounts paid to self) materials and. Net profit or (loss) buildings and machinery sold outright (no trades): Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to.

Simplified Method Worksheet Schedule C

Inventory at beginning of year purchases less cost of items for personal use cost of labor (do not include amounts paid to self) materials and. Net profit or (loss) buildings and machinery sold outright (no trades): Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Monthly qualifying income i.

Monthly Qualifying Income I Most Recent Year________

10 rows it merely simplifies the calculation and recordkeeping requirements of the allowable deduction. Net profit or (loss) buildings and machinery sold outright (no trades): Inventory at beginning of year purchases less cost of items for personal use cost of labor (do not include amounts paid to self) materials and. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule.