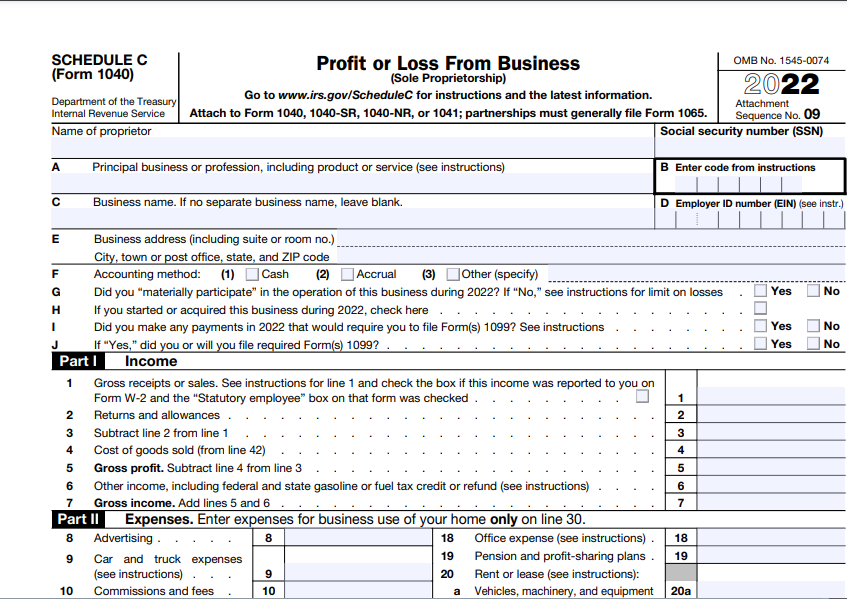

Schedule C Form For 2023 - If no separate business name, leave blank. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. 100k+ visitors in the past month Learn how to complete schedule c for irs form 1040 sole proprietorship, ensuring you report your business income, expenses, and deductions. Go to www.irs.gov/schedulec for instructions and the latest information. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

If no separate business name, leave blank. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. 100k+ visitors in the past month Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.irs.gov/schedulec for instructions and the latest information. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Learn how to complete schedule c for irs form 1040 sole proprietorship, ensuring you report your business income, expenses, and deductions.

Go to www.irs.gov/schedulec for instructions and the latest information. Learn how to complete schedule c for irs form 1040 sole proprietorship, ensuring you report your business income, expenses, and deductions. If no separate business name, leave blank. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. 100k+ visitors in the past month Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

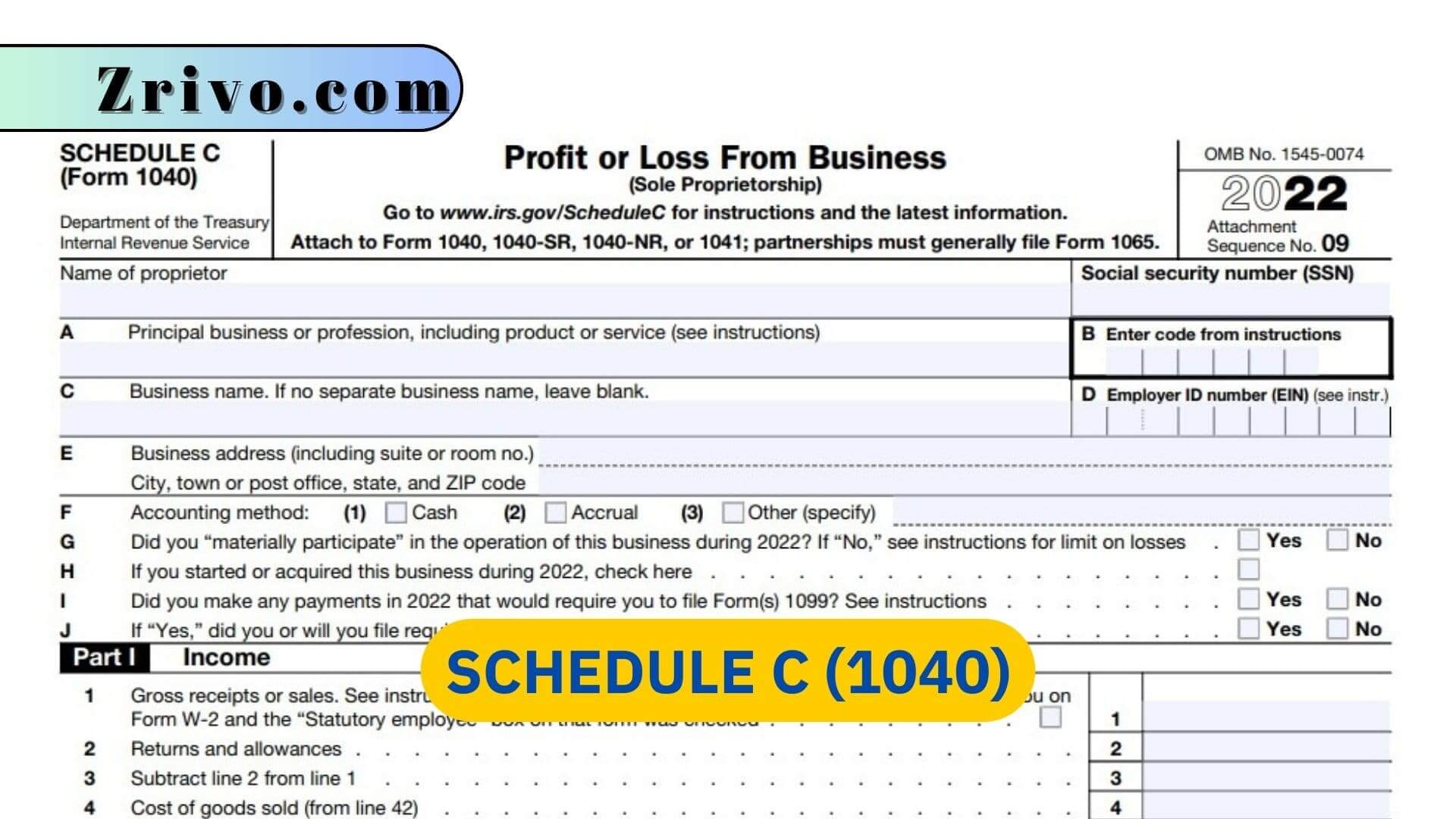

Schedule C (1040) 2023 2024

100k+ visitors in the past month If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. Learn how to complete schedule c for irs form 1040 sole proprietorship, ensuring you report your business income, expenses, and deductions. If no separate business name, leave blank. Information about schedule c.

2023 Form IRS Instructions 1040 Schedule C Fill Online, Printable

Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Learn how to complete schedule c for irs form 1040 sole proprietorship, ensuring you report your business income, expenses, and deductions. Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to.

Understanding the Schedule C Tax Form

Learn how to complete schedule c for irs form 1040 sole proprietorship, ensuring you report your business income, expenses, and deductions. 100k+ visitors in the past month Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Information about schedule c (form 1040), profit or loss from business, used to report income or.

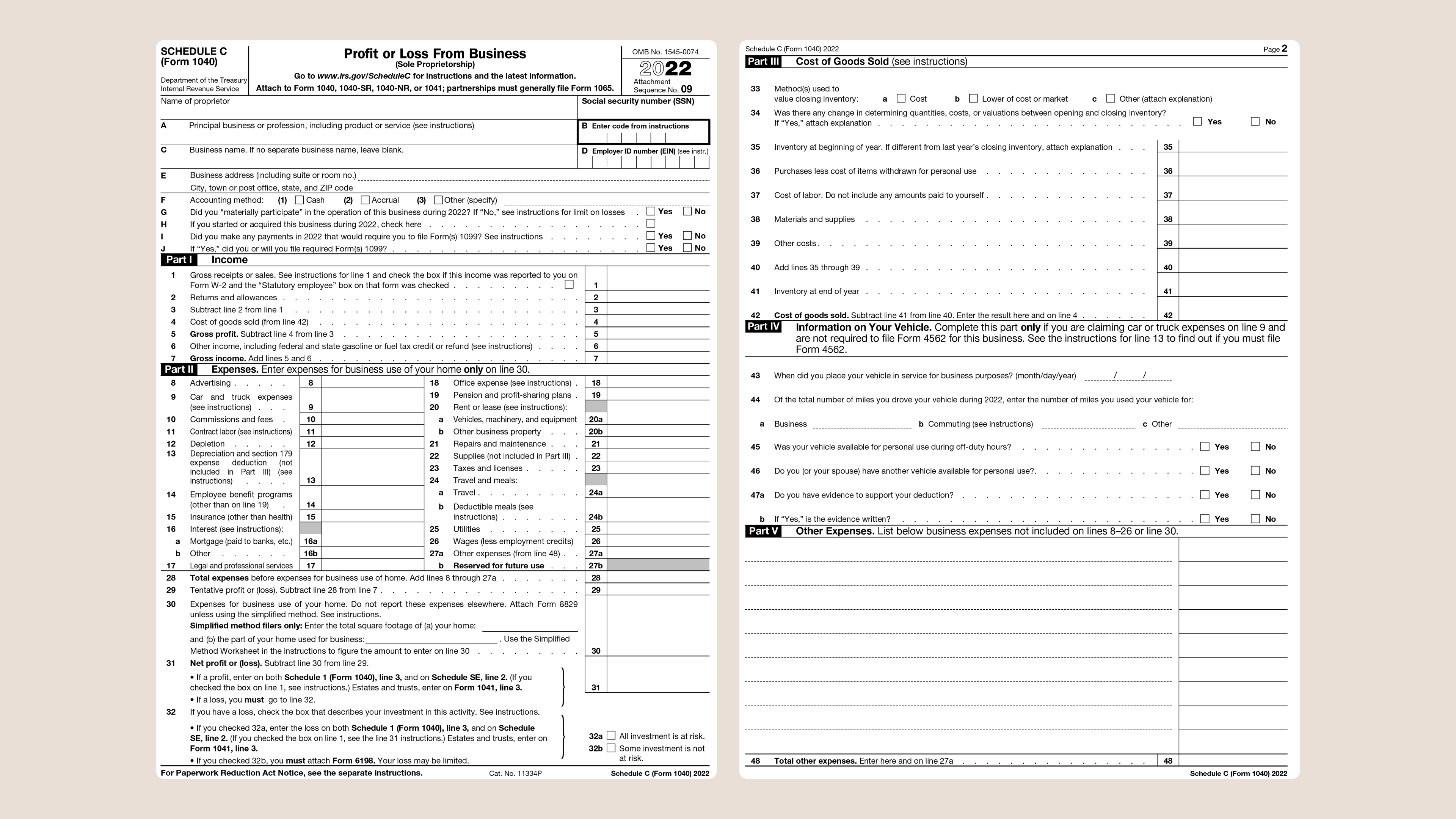

Printable Schedule C 2023

If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. 100k+ visitors in the past month Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. If no separate business name, leave blank. Learn how to complete schedule c for irs.

IRS Form 1040 Schedule C. Profit or Loss From Business Forms Docs

100k+ visitors in the past month If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. Learn how to complete schedule c for irs form 1040 sole proprietorship, ensuring you report your business income, expenses, and deductions. Information about schedule c (form 1040), profit or loss from business,.

Schedule C (Form 1040) 2023 Instructions

Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Learn how to complete schedule c for irs form 1040 sole proprietorship, ensuring you report your business income, expenses, and deductions. 100k+ visitors in the past month Go to www.irs.gov/schedulec for instructions and the latest information. If you purchased any business assets (furniture,.

Tax Return 2023 Chart Printable Forms Free Online

100k+ visitors in the past month If no separate business name, leave blank. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. Information about schedule c (form 1040), profit or.

Printable Schedule C 2023

Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. 100k+ visitors in the past month If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted.

Schedule C 2023 Form Printable Forms Free Online

If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. Learn how to complete schedule c for irs form 1040 sole proprietorship, ensuring you report your business income, expenses, and deductions. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c..

Schedule C What Is It, How To Fill, Example, Vs Schedule E

Go to www.irs.gov/schedulec for instructions and the latest information. 100k+ visitors in the past month Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Learn how to complete schedule.

Maximize Your Business Deductions And Accurately Calculate Your Profit Or Loss With Federal Form 1040 Schedule C.

If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. Go to www.irs.gov/schedulec for instructions and the latest information. 100k+ visitors in the past month Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

If No Separate Business Name, Leave Blank.

Learn how to complete schedule c for irs form 1040 sole proprietorship, ensuring you report your business income, expenses, and deductions.

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)