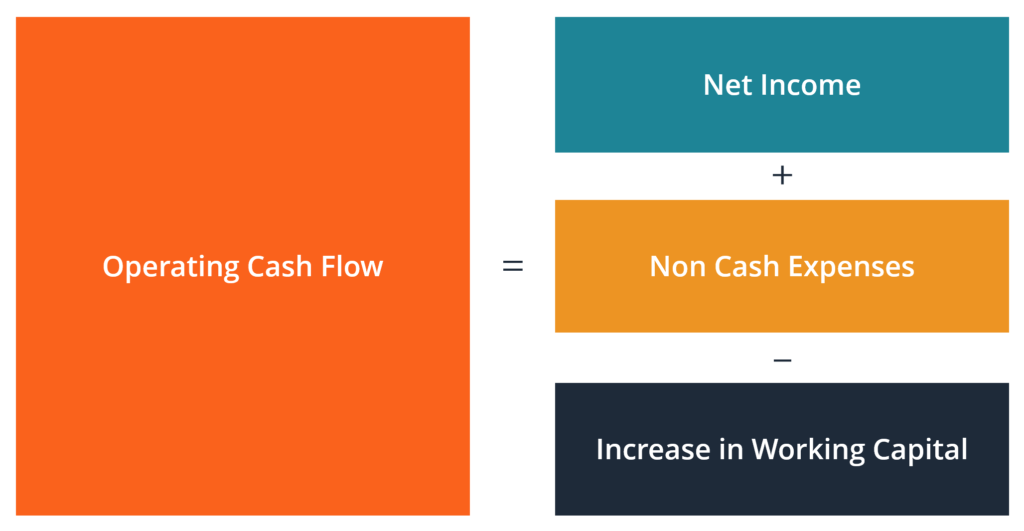

Operating Cash Flow Calc - Enter the operating income, depreciation expense, taxes, and the change in working capital to determine the operating cash. Assess the cash flow from your business operations using our operating cash flow calculator. The operating cash flow is calculated by summing the net income, noncash expenses (usually depreciation expense) and changes in working. Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. By accurately calculating the cash generated or used by core operational activities, this calculator provides insights into a business’s ability to.

Enter the operating income, depreciation expense, taxes, and the change in working capital to determine the operating cash. By accurately calculating the cash generated or used by core operational activities, this calculator provides insights into a business’s ability to. Assess the cash flow from your business operations using our operating cash flow calculator. The operating cash flow is calculated by summing the net income, noncash expenses (usually depreciation expense) and changes in working. Operating cash flow (ocf) refers to the amount of cash a company generates from its operations.

Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. Assess the cash flow from your business operations using our operating cash flow calculator. The operating cash flow is calculated by summing the net income, noncash expenses (usually depreciation expense) and changes in working. Enter the operating income, depreciation expense, taxes, and the change in working capital to determine the operating cash. By accurately calculating the cash generated or used by core operational activities, this calculator provides insights into a business’s ability to.

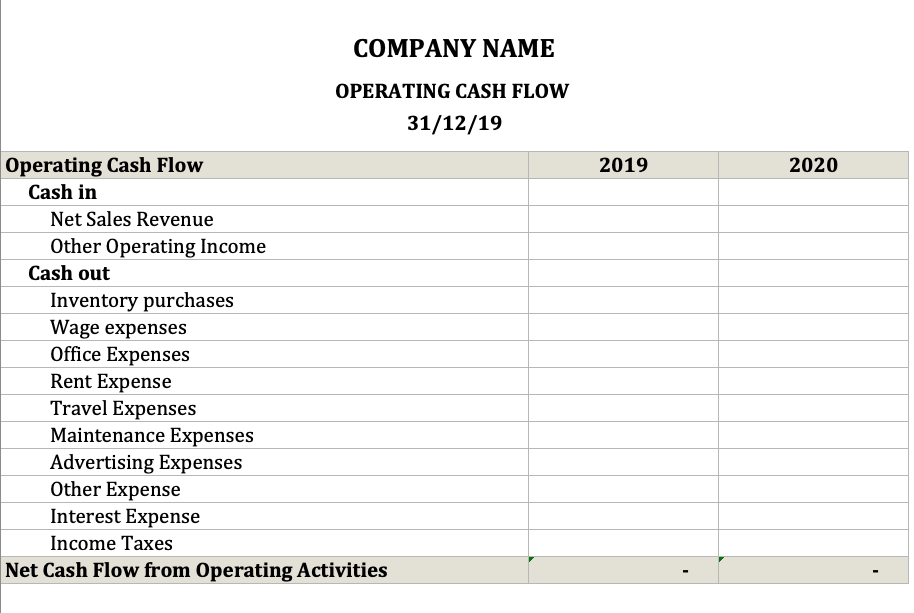

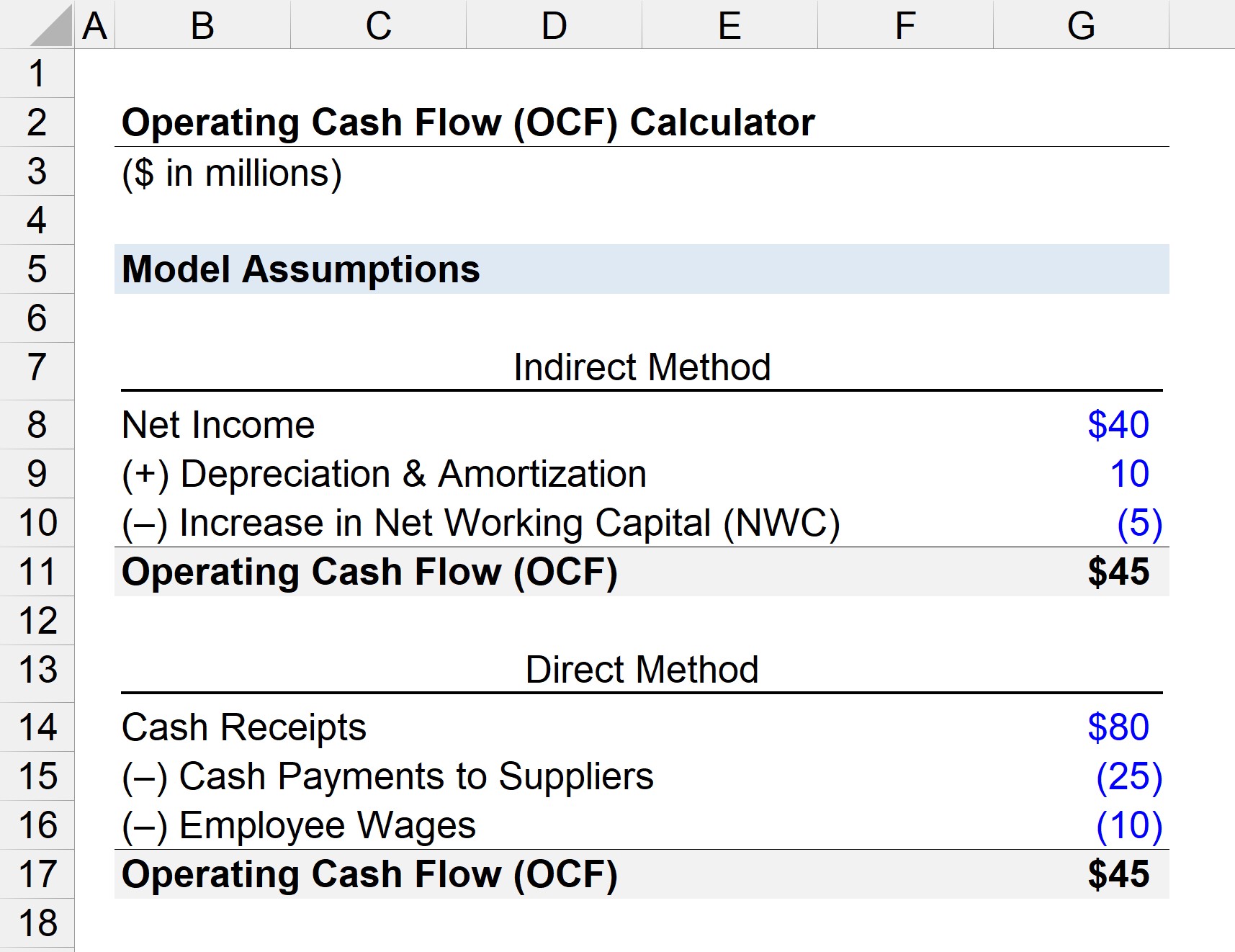

Operating Cash Flow Calculator excel template for free

Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. Enter the operating income, depreciation expense, taxes, and the change in working capital to determine the operating cash. By accurately calculating the cash generated or used by core operational activities, this calculator provides insights into a business’s ability to. Assess the cash flow from.

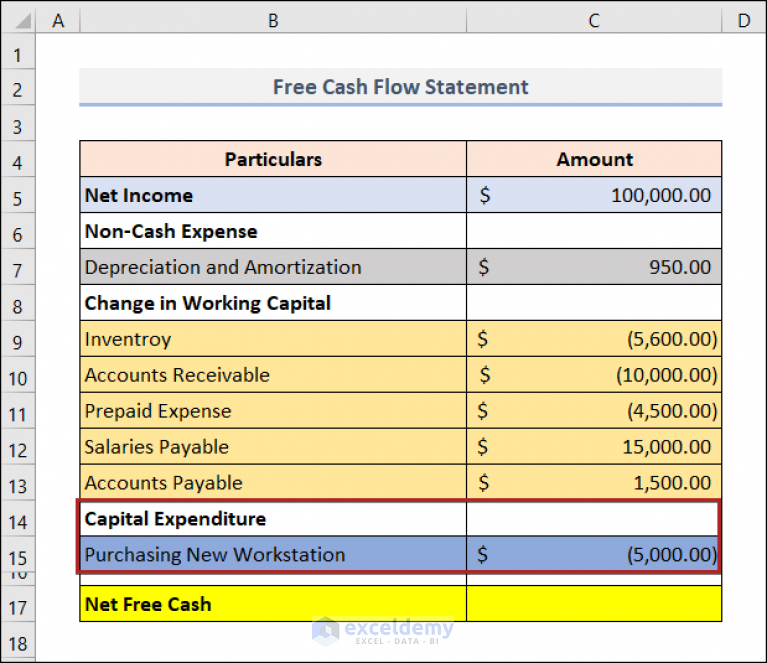

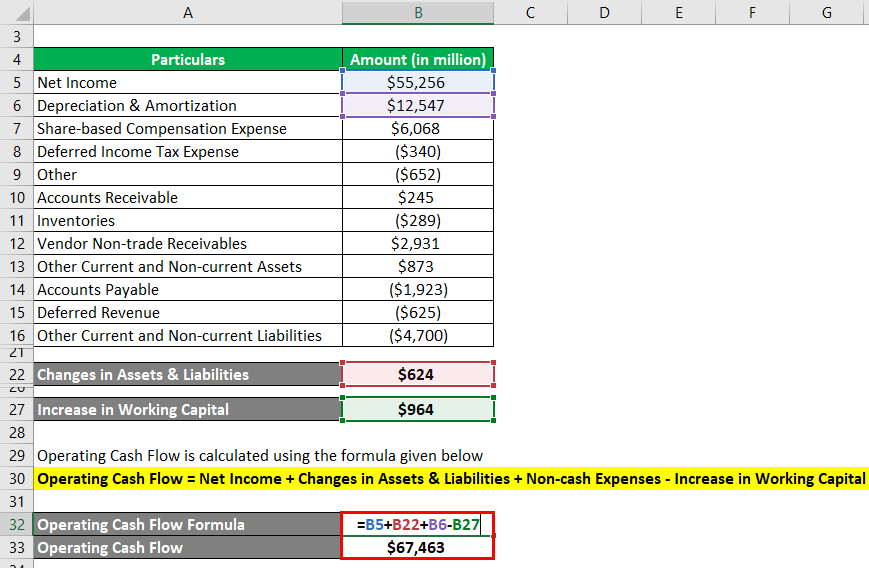

How to Calculate Operating Cash Flow in Excel (2 Easy Ways)

Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. The operating cash flow is calculated by summing the net income, noncash expenses (usually depreciation expense) and changes in working. By accurately calculating the cash generated or used by core operational activities, this calculator provides insights into a business’s ability to. Enter the operating.

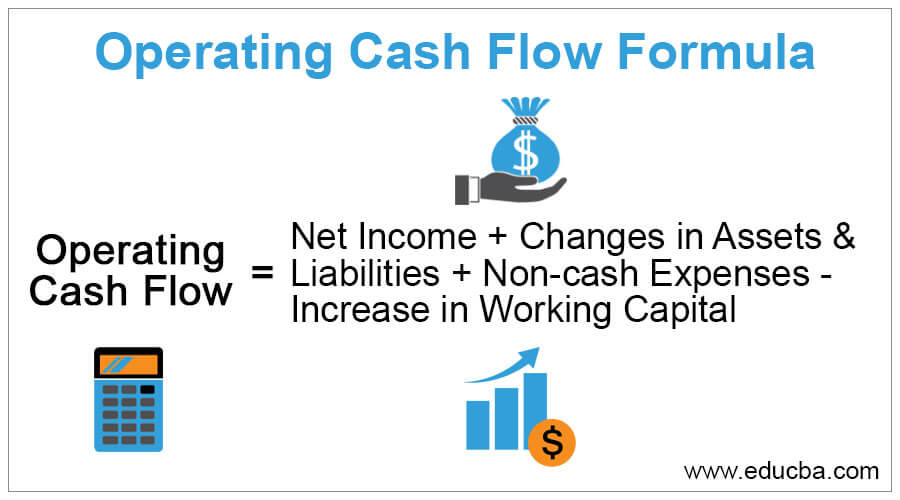

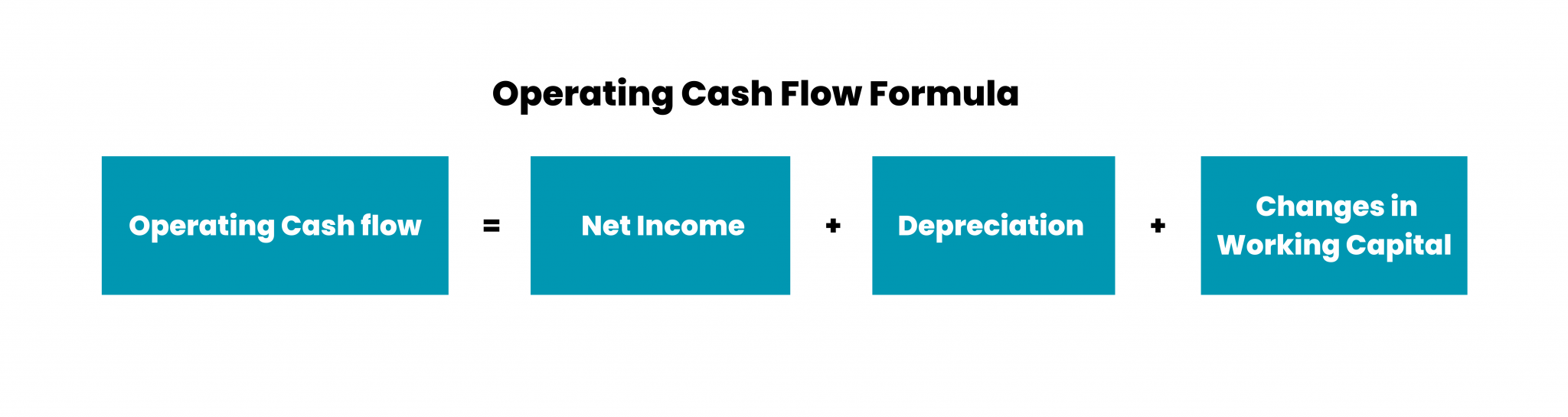

Operating Cash Flow Formula Examples with excel template & calculator

Enter the operating income, depreciation expense, taxes, and the change in working capital to determine the operating cash. Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. Assess the cash flow from your business operations using our operating cash flow calculator. By accurately calculating the cash generated or used by core operational activities,.

How to Calculate Operating Cash Flow in Excel (2 Easy Ways)

The operating cash flow is calculated by summing the net income, noncash expenses (usually depreciation expense) and changes in working. Enter the operating income, depreciation expense, taxes, and the change in working capital to determine the operating cash. Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. Assess the cash flow from your.

Operating Cash Flow Formula Examples with excel template & calculator

Assess the cash flow from your business operations using our operating cash flow calculator. The operating cash flow is calculated by summing the net income, noncash expenses (usually depreciation expense) and changes in working. Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. Enter the operating income, depreciation expense, taxes, and the change.

How To Calculate Business Cash Flow at Qiana Flowers blog

Assess the cash flow from your business operations using our operating cash flow calculator. Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. By accurately calculating the cash generated or used by core operational activities, this calculator provides insights into a business’s ability to. Enter the operating income, depreciation expense, taxes, and the.

How to Calculate Operating Cash Flow Operating Cash Flow Formula

Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. By accurately calculating the cash generated or used by core operational activities, this calculator provides insights into a business’s ability to. Enter the operating income, depreciation expense, taxes, and the change in working capital to determine the operating cash. Assess the cash flow from.

Operating Cash Flow Template

By accurately calculating the cash generated or used by core operational activities, this calculator provides insights into a business’s ability to. Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. Enter the operating income, depreciation expense, taxes, and the change in working capital to determine the operating cash. The operating cash flow is.

Operating Cash Flow Overview, Example, Formula

Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. Enter the operating income, depreciation expense, taxes, and the change in working capital to determine the operating cash. Assess the cash flow from your business operations using our operating cash flow calculator. The operating cash flow is calculated by summing the net income, noncash.

How to Calculate Operating Cash Flow in Excel (2 Easy Ways)

Assess the cash flow from your business operations using our operating cash flow calculator. By accurately calculating the cash generated or used by core operational activities, this calculator provides insights into a business’s ability to. Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. The operating cash flow is calculated by summing the.

Assess The Cash Flow From Your Business Operations Using Our Operating Cash Flow Calculator.

The operating cash flow is calculated by summing the net income, noncash expenses (usually depreciation expense) and changes in working. By accurately calculating the cash generated or used by core operational activities, this calculator provides insights into a business’s ability to. Operating cash flow (ocf) refers to the amount of cash a company generates from its operations. Enter the operating income, depreciation expense, taxes, and the change in working capital to determine the operating cash.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)