Malaysia Tax Invoice Requirements - A receipt or other document can be a tax invoice if it has all the particulars of a full tax invoice or simplified tax invoice approved by the director. Mysstmandatory for registered manufacturer who sells taxable goodshard copy or electronically Lhdn just released new guidelines again! Learn everything about tax invoices in malaysia, including required details, issuance deadlines, and the upcoming. When you charge gst, you need to issue a tax invoice showing the amount of gst and the price of the supplies separately. Yes, taxpayers can continue to claim tax deductions or personal tax relief using existing documentation until such time the legislation.

A receipt or other document can be a tax invoice if it has all the particulars of a full tax invoice or simplified tax invoice approved by the director. Mysstmandatory for registered manufacturer who sells taxable goodshard copy or electronically When you charge gst, you need to issue a tax invoice showing the amount of gst and the price of the supplies separately. Lhdn just released new guidelines again! Yes, taxpayers can continue to claim tax deductions or personal tax relief using existing documentation until such time the legislation. Learn everything about tax invoices in malaysia, including required details, issuance deadlines, and the upcoming.

Learn everything about tax invoices in malaysia, including required details, issuance deadlines, and the upcoming. When you charge gst, you need to issue a tax invoice showing the amount of gst and the price of the supplies separately. Yes, taxpayers can continue to claim tax deductions or personal tax relief using existing documentation until such time the legislation. Lhdn just released new guidelines again! Mysstmandatory for registered manufacturer who sells taxable goodshard copy or electronically A receipt or other document can be a tax invoice if it has all the particulars of a full tax invoice or simplified tax invoice approved by the director.

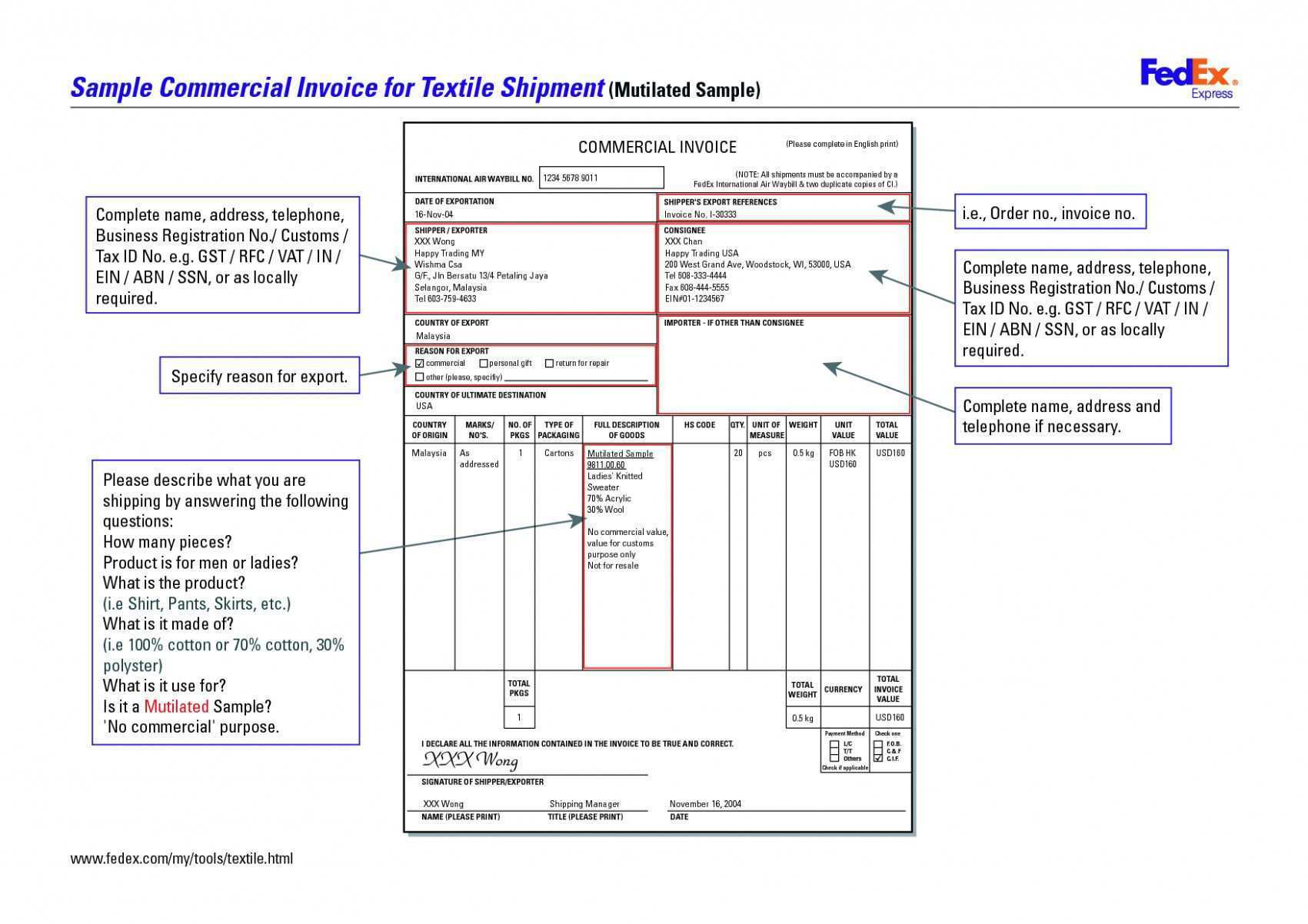

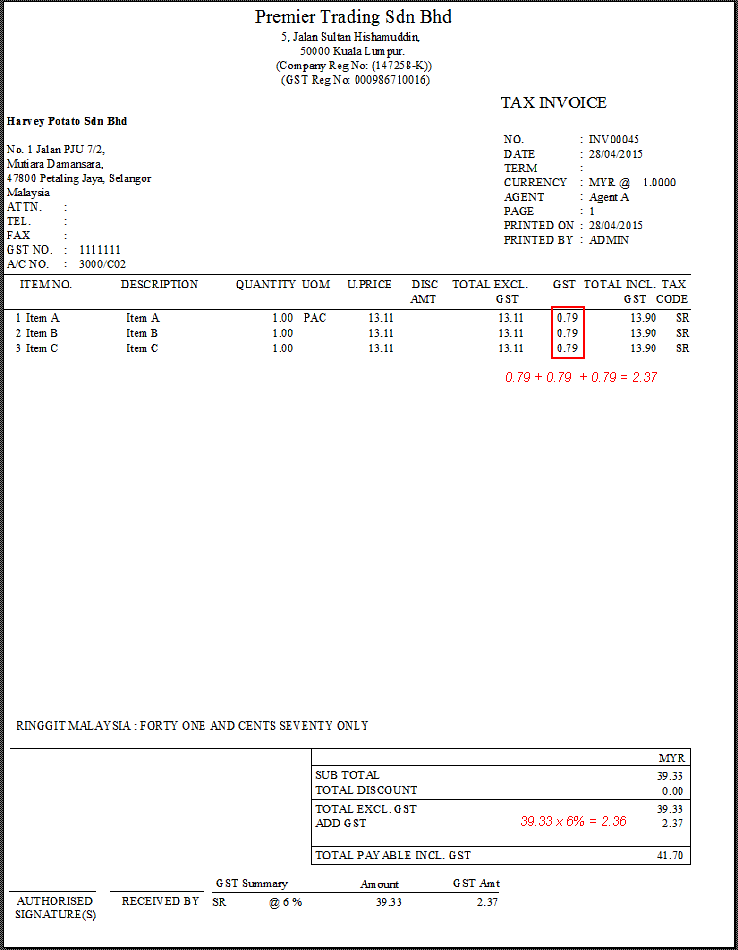

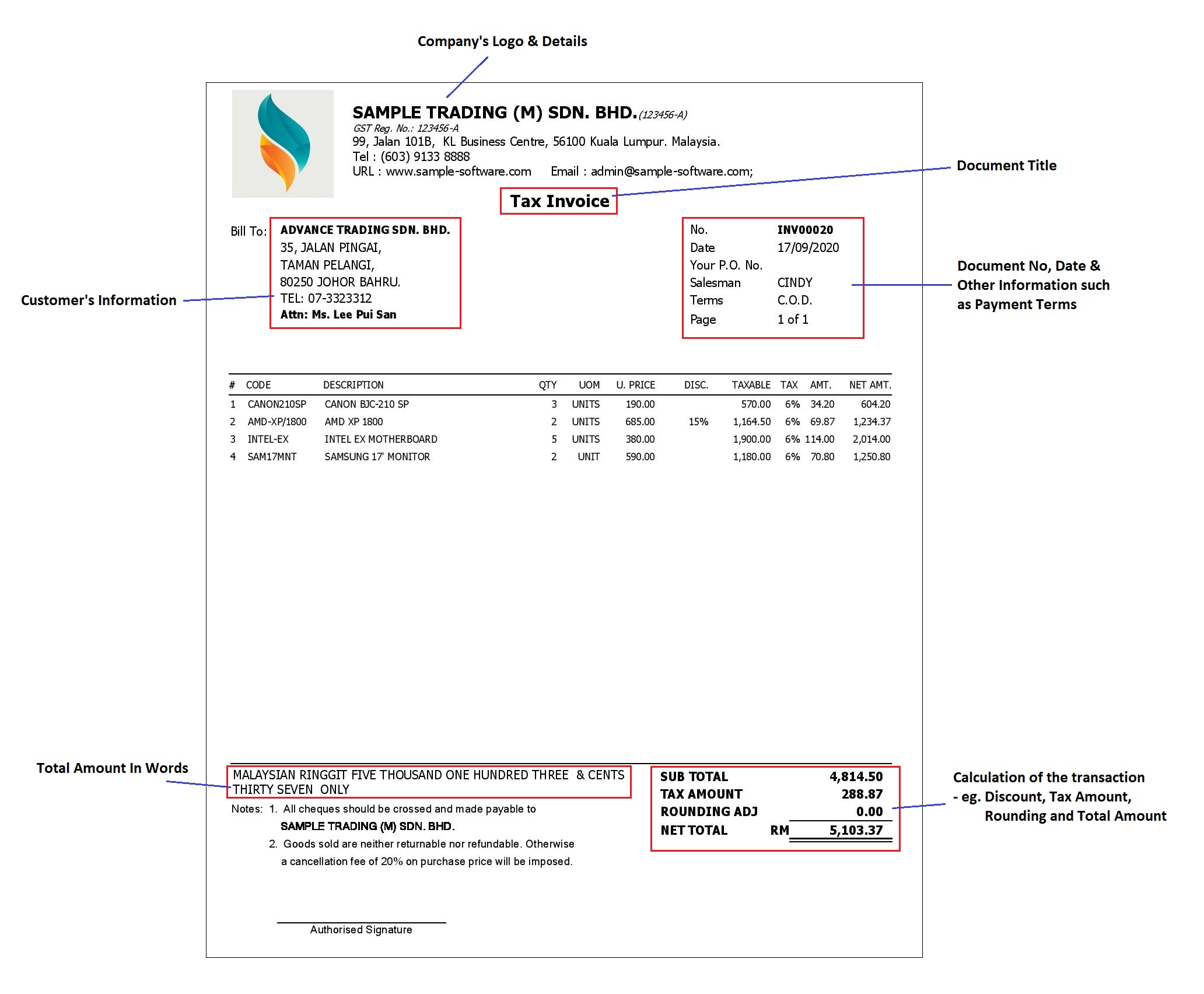

Tax Invoice Goods & Services Tax MYOB Accounting Malaysia

A receipt or other document can be a tax invoice if it has all the particulars of a full tax invoice or simplified tax invoice approved by the director. Yes, taxpayers can continue to claim tax deductions or personal tax relief using existing documentation until such time the legislation. When you charge gst, you need to issue a tax invoice.

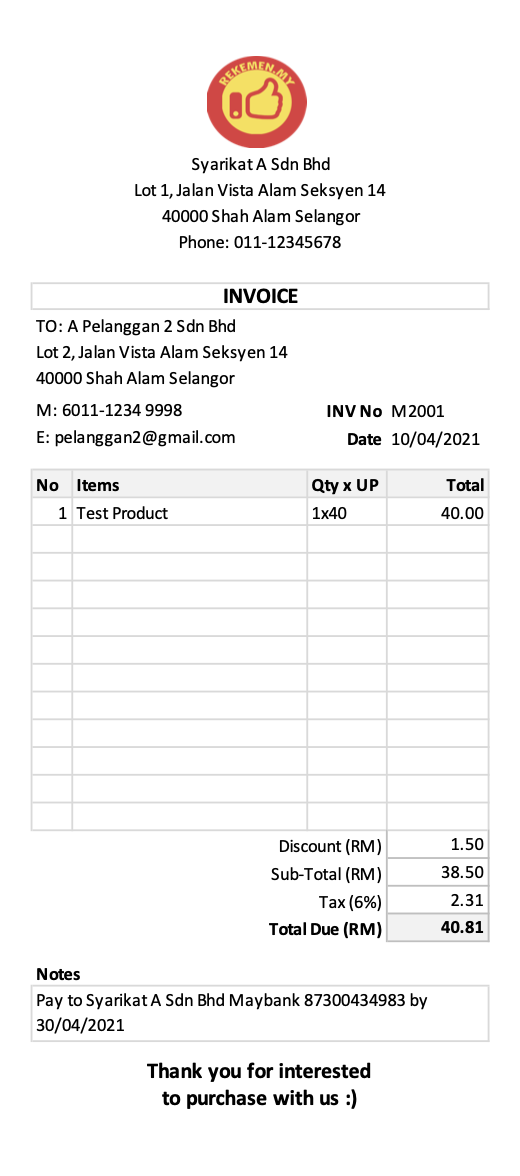

Tax Invoice Template Excel Malaysia New Invoice

A receipt or other document can be a tax invoice if it has all the particulars of a full tax invoice or simplified tax invoice approved by the director. Mysstmandatory for registered manufacturer who sells taxable goodshard copy or electronically Learn everything about tax invoices in malaysia, including required details, issuance deadlines, and the upcoming. When you charge gst, you.

77 The Best Tax Invoice Format Malaysia Now With Tax vrogue.co

Learn everything about tax invoices in malaysia, including required details, issuance deadlines, and the upcoming. A receipt or other document can be a tax invoice if it has all the particulars of a full tax invoice or simplified tax invoice approved by the director. Lhdn just released new guidelines again! Mysstmandatory for registered manufacturer who sells taxable goodshard copy or.

Tax Invoice In Malay / Tax Invoice Templates Quickly Create Free Tax

A receipt or other document can be a tax invoice if it has all the particulars of a full tax invoice or simplified tax invoice approved by the director. Lhdn just released new guidelines again! Learn everything about tax invoices in malaysia, including required details, issuance deadlines, and the upcoming. Yes, taxpayers can continue to claim tax deductions or personal.

47 Printable Tax Invoice Example Malaysia Formating for Tax Invoice

Lhdn just released new guidelines again! A receipt or other document can be a tax invoice if it has all the particulars of a full tax invoice or simplified tax invoice approved by the director. When you charge gst, you need to issue a tax invoice showing the amount of gst and the price of the supplies separately. Mysstmandatory for.

Malaysia Tax Invoice at Pauline Dane blog

Yes, taxpayers can continue to claim tax deductions or personal tax relief using existing documentation until such time the legislation. Lhdn just released new guidelines again! Learn everything about tax invoices in malaysia, including required details, issuance deadlines, and the upcoming. A receipt or other document can be a tax invoice if it has all the particulars of a full.

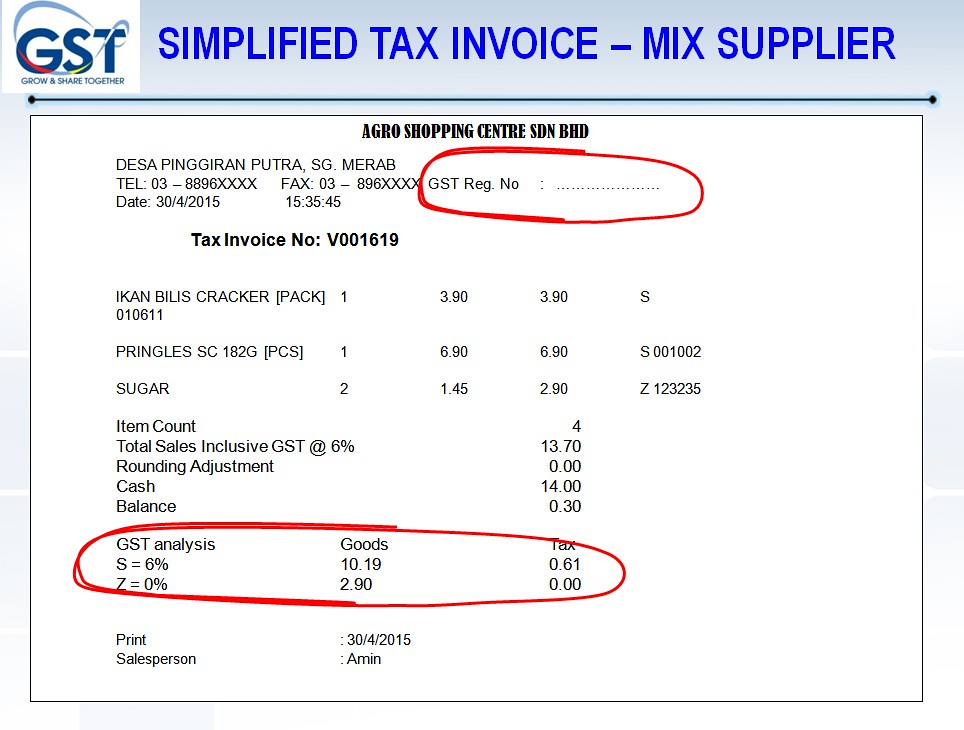

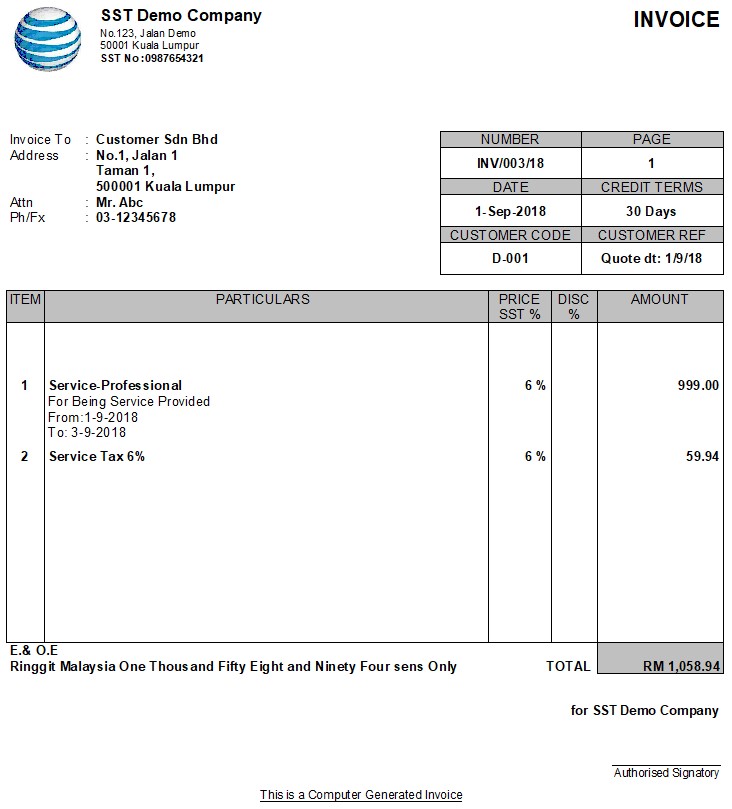

simplified tax invoice malaysia Evan Newman

A receipt or other document can be a tax invoice if it has all the particulars of a full tax invoice or simplified tax invoice approved by the director. Lhdn just released new guidelines again! When you charge gst, you need to issue a tax invoice showing the amount of gst and the price of the supplies separately. Yes, taxpayers.

SST Invoice Format Malaysia Malaysia Invoice Template Invoice

When you charge gst, you need to issue a tax invoice showing the amount of gst and the price of the supplies separately. A receipt or other document can be a tax invoice if it has all the particulars of a full tax invoice or simplified tax invoice approved by the director. Mysstmandatory for registered manufacturer who sells taxable goodshard.

Tax Invoice Malaysia Airlines / Taxation Form / Malaysia blank sales

Yes, taxpayers can continue to claim tax deductions or personal tax relief using existing documentation until such time the legislation. A receipt or other document can be a tax invoice if it has all the particulars of a full tax invoice or simplified tax invoice approved by the director. When you charge gst, you need to issue a tax invoice.

simplified tax invoice malaysia Sue Kerr

A receipt or other document can be a tax invoice if it has all the particulars of a full tax invoice or simplified tax invoice approved by the director. Lhdn just released new guidelines again! Mysstmandatory for registered manufacturer who sells taxable goodshard copy or electronically Yes, taxpayers can continue to claim tax deductions or personal tax relief using existing.

Mysstmandatory For Registered Manufacturer Who Sells Taxable Goodshard Copy Or Electronically

Yes, taxpayers can continue to claim tax deductions or personal tax relief using existing documentation until such time the legislation. Lhdn just released new guidelines again! A receipt or other document can be a tax invoice if it has all the particulars of a full tax invoice or simplified tax invoice approved by the director. When you charge gst, you need to issue a tax invoice showing the amount of gst and the price of the supplies separately.