King County Property Tax Exemption Form 2020 - For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Click here to apply online, or apply. Homeowners can get easy instructions about applying for a property. The king county assessor’s new tax relief portal is now live! To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. Under the exemption program, the value of your washington state residence is frozen for property tax purposes, and you become exempt from all.

Click here to apply online, or apply. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. The king county assessor’s new tax relief portal is now live! Under the exemption program, the value of your washington state residence is frozen for property tax purposes, and you become exempt from all. Homeowners can get easy instructions about applying for a property.

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Homeowners can get easy instructions about applying for a property. Click here to apply online, or apply. Under the exemption program, the value of your washington state residence is frozen for property tax purposes, and you become exempt from all. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. The king county assessor’s new tax relief portal is now live!

King County Senior Property Tax Exemption 2025 Karen K. Ater

Click here to apply online, or apply. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. The king county assessor’s new tax relief portal is now live! Homeowners can get easy instructions about applying for a property. To be eligible for the property tax exemption, you must.

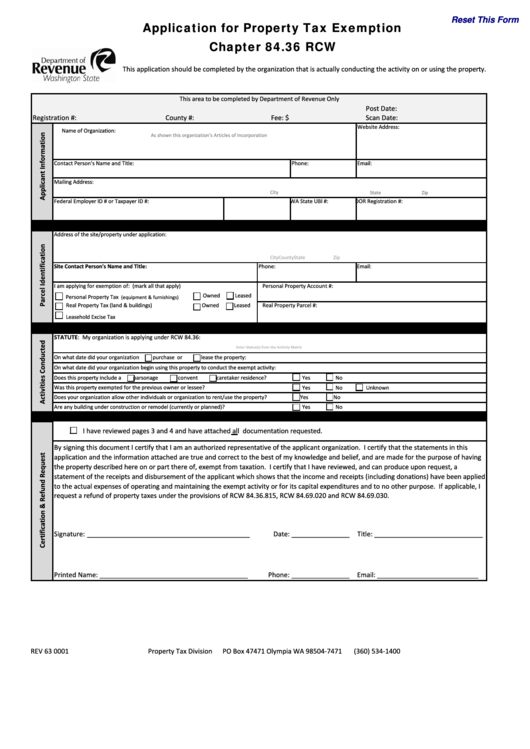

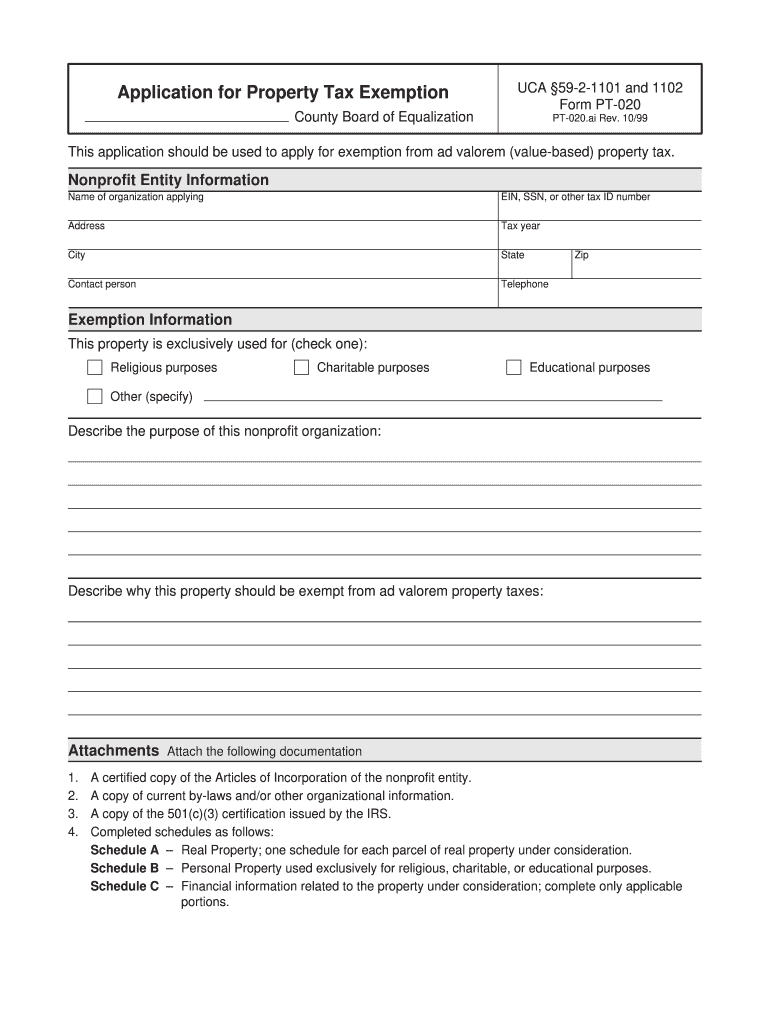

Fillable Application For Property Tax Exemption printable pdf download

The king county assessor’s new tax relief portal is now live! For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Click here to apply online, or apply. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have.

King County Senior Property Tax Exemption 2025 Britt L. Yokley

Homeowners can get easy instructions about applying for a property. The king county assessor’s new tax relief portal is now live! Click here to apply online, or apply. Under the exemption program, the value of your washington state residence is frozen for property tax purposes, and you become exempt from all. To be eligible for the property tax exemption, you.

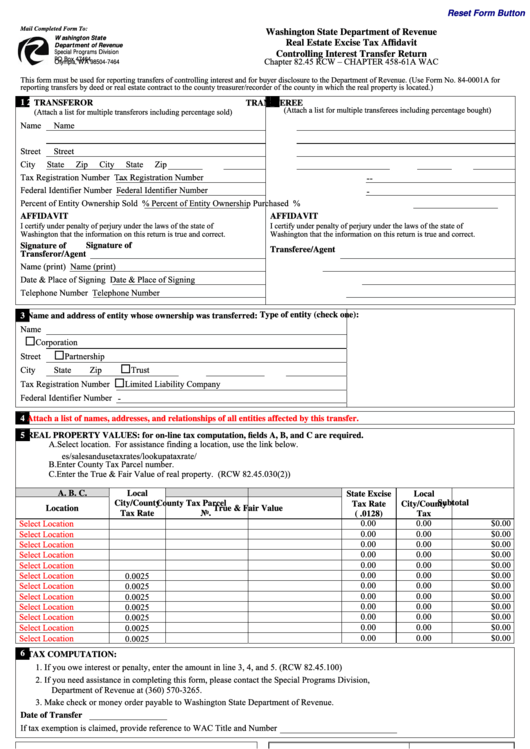

King County Real Estate Excise Tax Affidavit Form 2024

Under the exemption program, the value of your washington state residence is frozen for property tax purposes, and you become exempt from all. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. The king county assessor’s new tax relief portal is now live! To be eligible for.

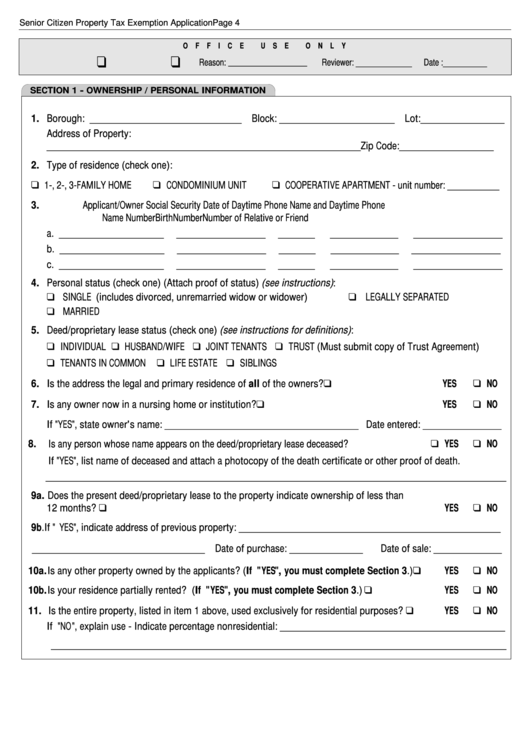

Property Tax Exemption for Seniors Form Larimer County

To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. Under the exemption program, the value of your washington state residence is frozen for property tax purposes, and you become exempt from all. Click here to apply online, or apply. For a reduction on your 2025, 2026.

King County Senior Property Tax Exemption 2025 Lark Aurelia

Click here to apply online, or apply. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. Homeowners can get easy instructions about applying for a property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is.

King County Property Tax Exemption 2025 Stephen E. Stanley

Homeowners can get easy instructions about applying for a property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Click here to apply online, or apply. Under the exemption program, the value of your washington state residence is frozen for property tax purposes, and you become exempt.

Fillable Online Long Form Property Tax Exemption for Seniors Fax

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Under the exemption program, the value of your washington state residence is frozen for property tax purposes, and you become exempt from all. To be eligible for the property tax exemption, you must own and occupy a primary.

King County Property Tax Exemption 2025 Stephen E. Stanley

The king county assessor’s new tax relief portal is now live! Under the exemption program, the value of your washington state residence is frozen for property tax purposes, and you become exempt from all. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. Homeowners can get.

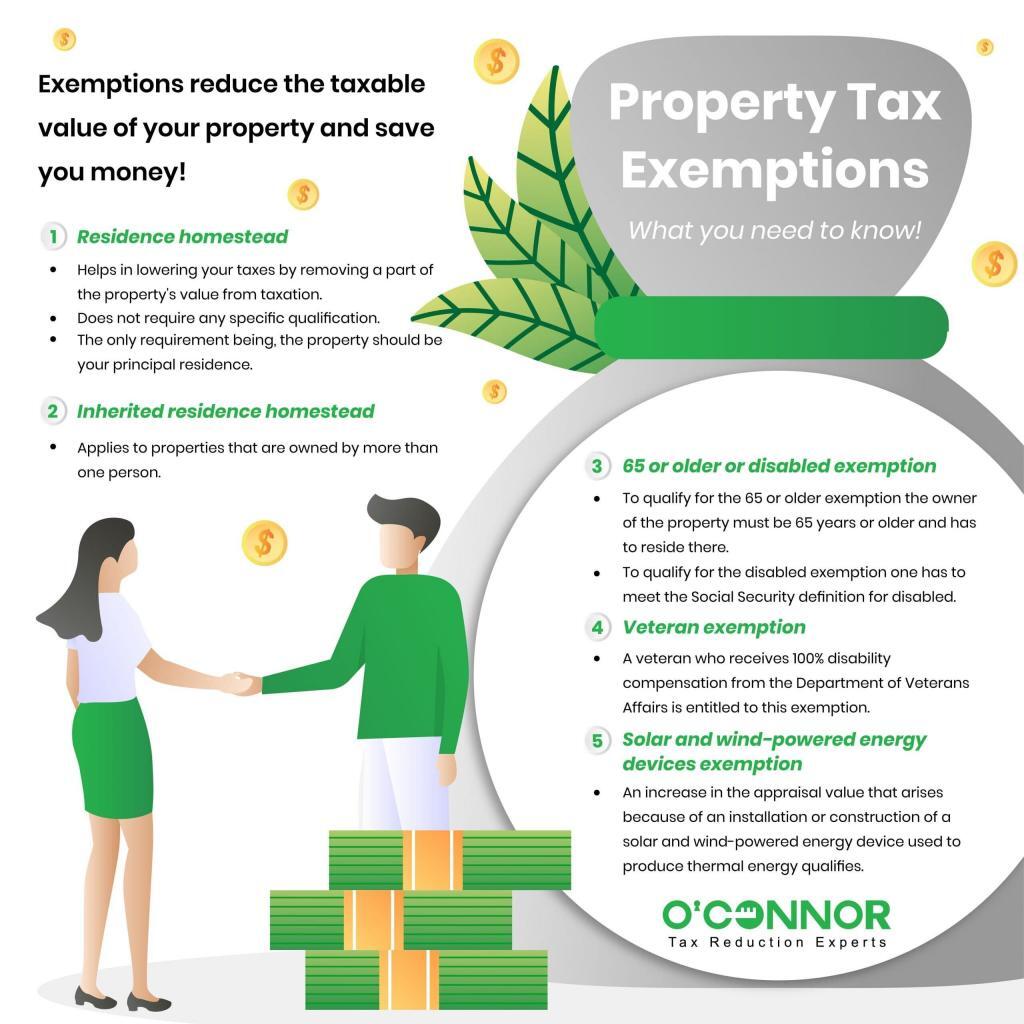

Fillable Online Property Tax Exemption Forms Fax Email Print pdfFiller

Click here to apply online, or apply. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Under the exemption program, the value of your washington state residence is frozen for property tax purposes, and you become exempt from all. The king county assessor’s new tax relief portal.

Under The Exemption Program, The Value Of Your Washington State Residence Is Frozen For Property Tax Purposes, And You Become Exempt From All.

Click here to apply online, or apply. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Homeowners can get easy instructions about applying for a property. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income.