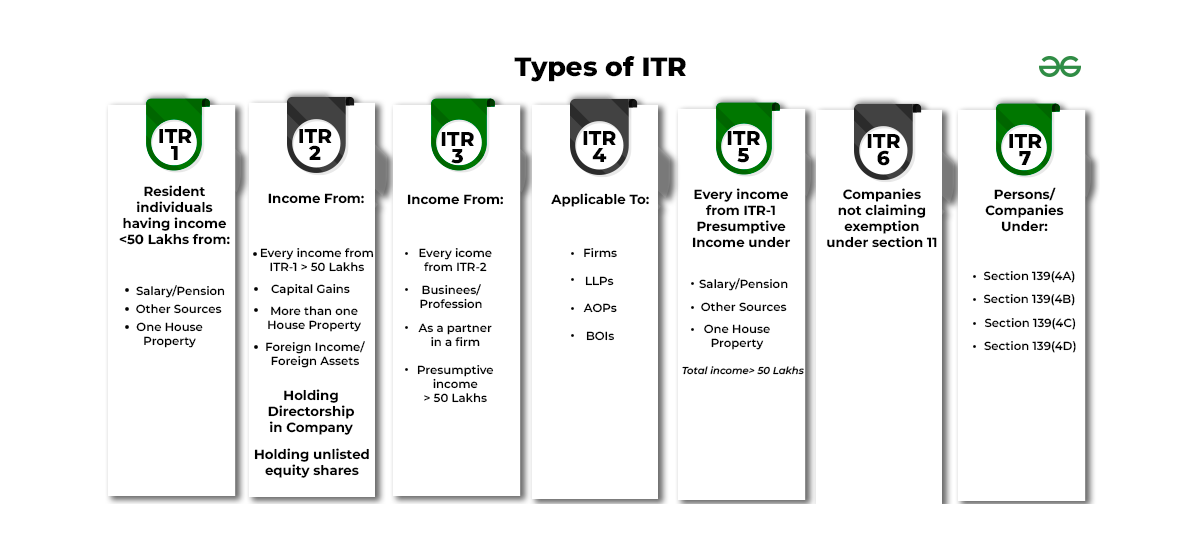

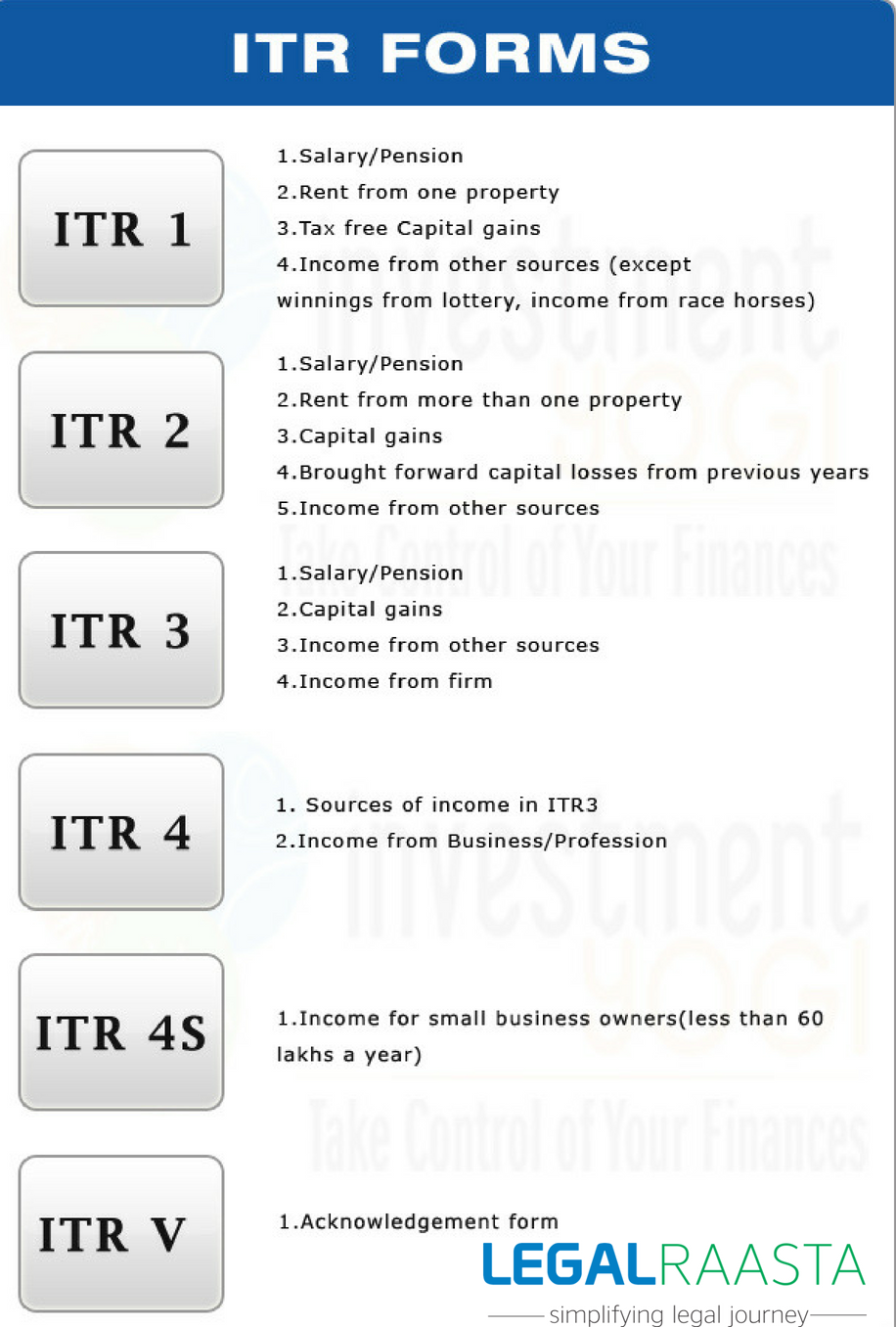

Itr 1 2 3 4 5 Meaning - According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms. If individuals seek to obtain a refund. Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form. Filing income tax returns (itr) is essential for individuals and businesses for the following:

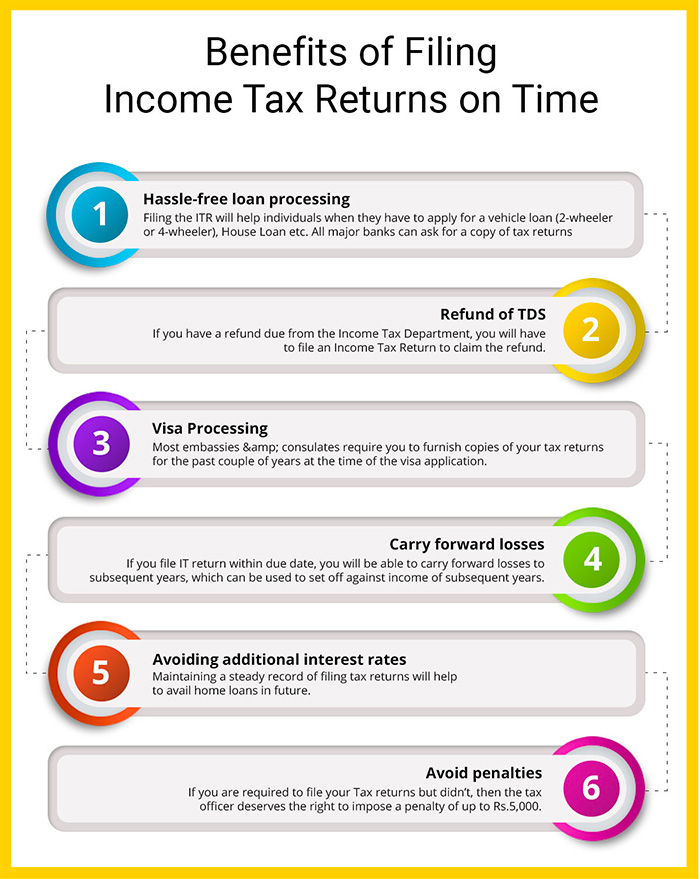

Filing income tax returns (itr) is essential for individuals and businesses for the following: If individuals seek to obtain a refund. According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms. Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form.

If individuals seek to obtain a refund. According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms. Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form. Filing income tax returns (itr) is essential for individuals and businesses for the following:

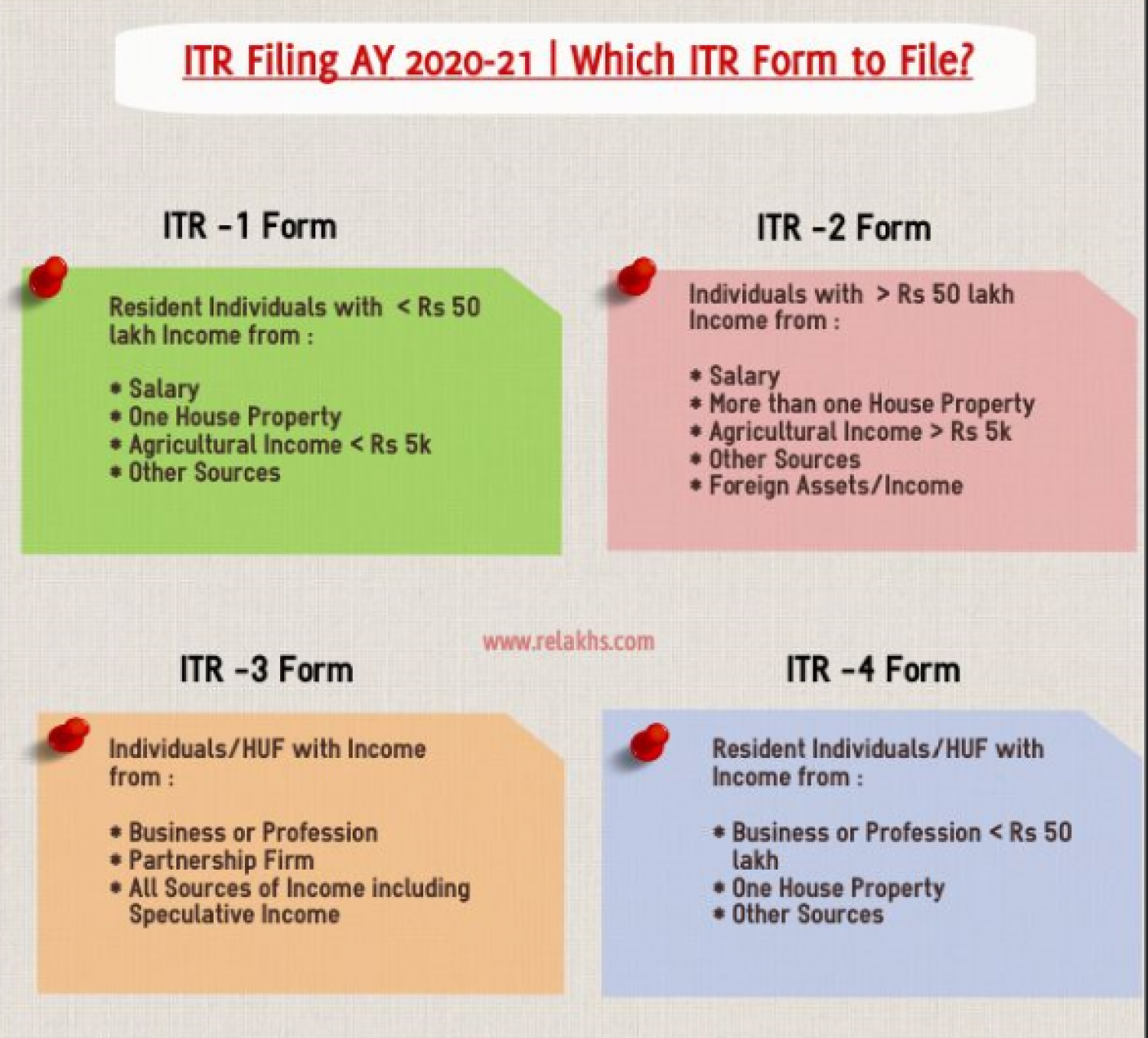

Tax Return (ITR) Forms for AY 202122 issued

Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form. If individuals seek to obtain a refund. According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms. Filing income tax returns (itr) is essential for individuals and businesses for the following:

What is ITR 1 2 3 4 5 6 ITR 1 2 3 4 5 6 meaning How to choose itr

According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms. Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form. If individuals seek to obtain a refund. Filing income tax returns (itr) is essential for individuals and businesses for the following:

Types of ITR Which ITR Should I File?

Filing income tax returns (itr) is essential for individuals and businesses for the following: If individuals seek to obtain a refund. Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form. According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms.

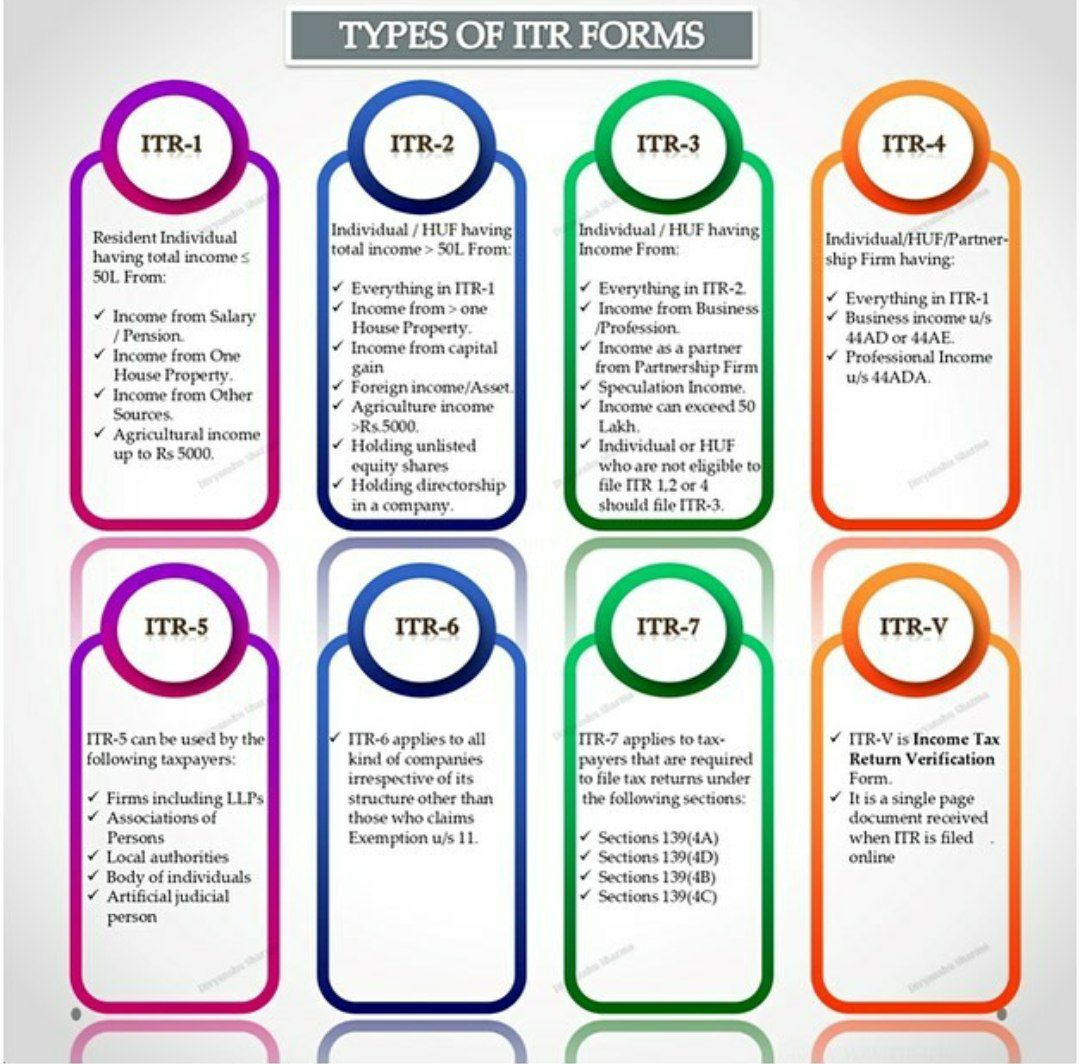

Definition & Meaning of ITR Forms Tax2win

Filing income tax returns (itr) is essential for individuals and businesses for the following: According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms. If individuals seek to obtain a refund. Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form.

Tax Return Forms For FY 20202021 New ITR Form

According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms. Filing income tax returns (itr) is essential for individuals and businesses for the following: Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form. If individuals seek to obtain a refund.

ITR Forms for FY 202223 Types & Applicability IFCCL

According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms. Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form. If individuals seek to obtain a refund. Filing income tax returns (itr) is essential for individuals and businesses for the following:

Changes in ITR Forms as on 9th August Online Learning

If individuals seek to obtain a refund. Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form. Filing income tax returns (itr) is essential for individuals and businesses for the following: According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms.

Tax Form 202324 PDF Download How To Download ITR 1, ITR 2, ITR

Filing income tax returns (itr) is essential for individuals and businesses for the following: According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms. If individuals seek to obtain a refund. Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form.

Tax Return (ITR) is a form in which the taxpayers file

Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form. According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms. Filing income tax returns (itr) is essential for individuals and businesses for the following: If individuals seek to obtain a refund.

Step by Step guide to file ITR5 form tax return, Filing taxes

Filing income tax returns (itr) is essential for individuals and businesses for the following: If individuals seek to obtain a refund. According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms. Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form.

Filing Income Tax Returns (Itr) Is Essential For Individuals And Businesses For The Following:

According to income tax laws, different classes of taxpayers can file their income tax return (itr) using these forms. If individuals seek to obtain a refund. Let's understand what itr 1, 2, 3 and 4 mean and help you understand who needs to file each form.