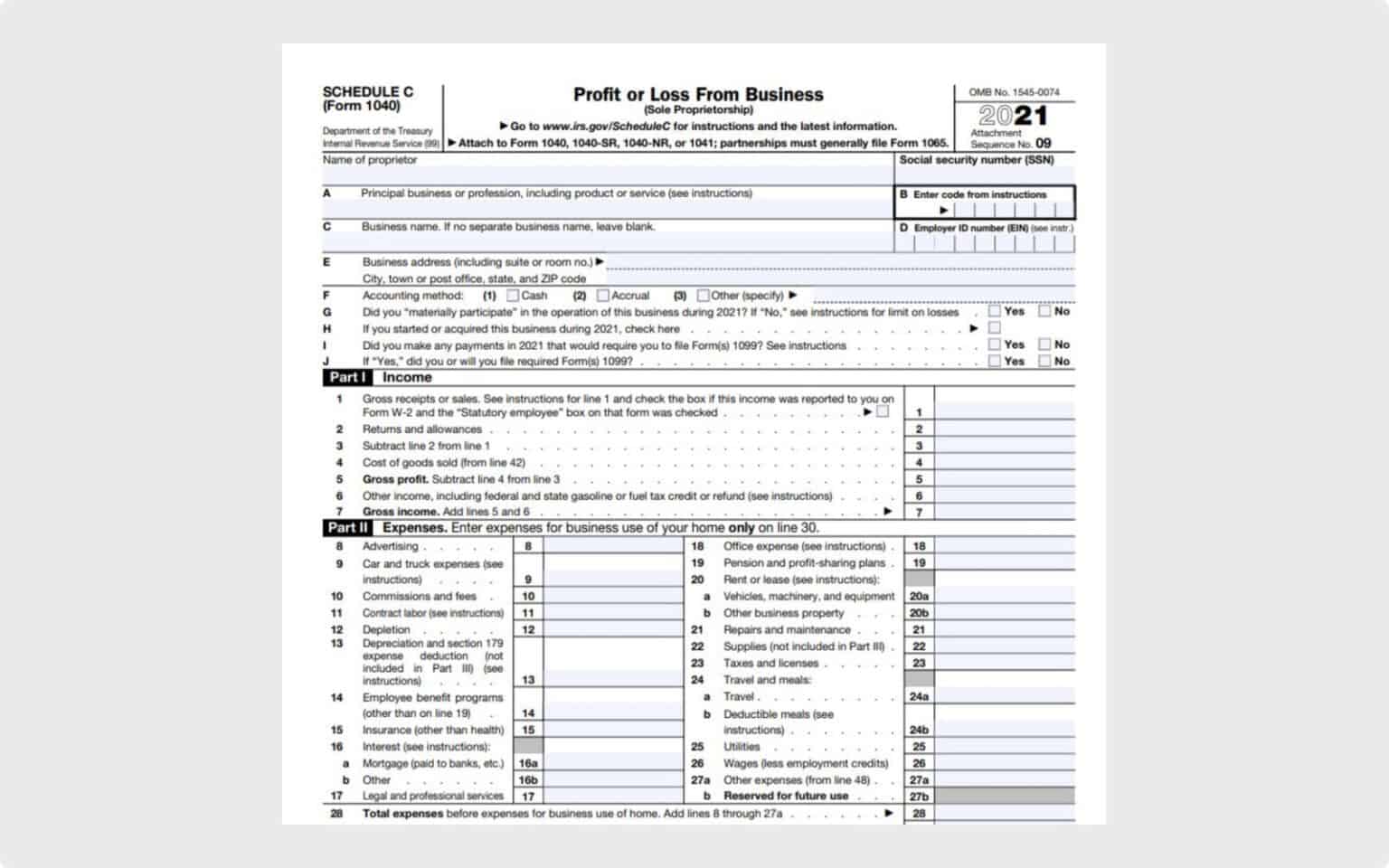

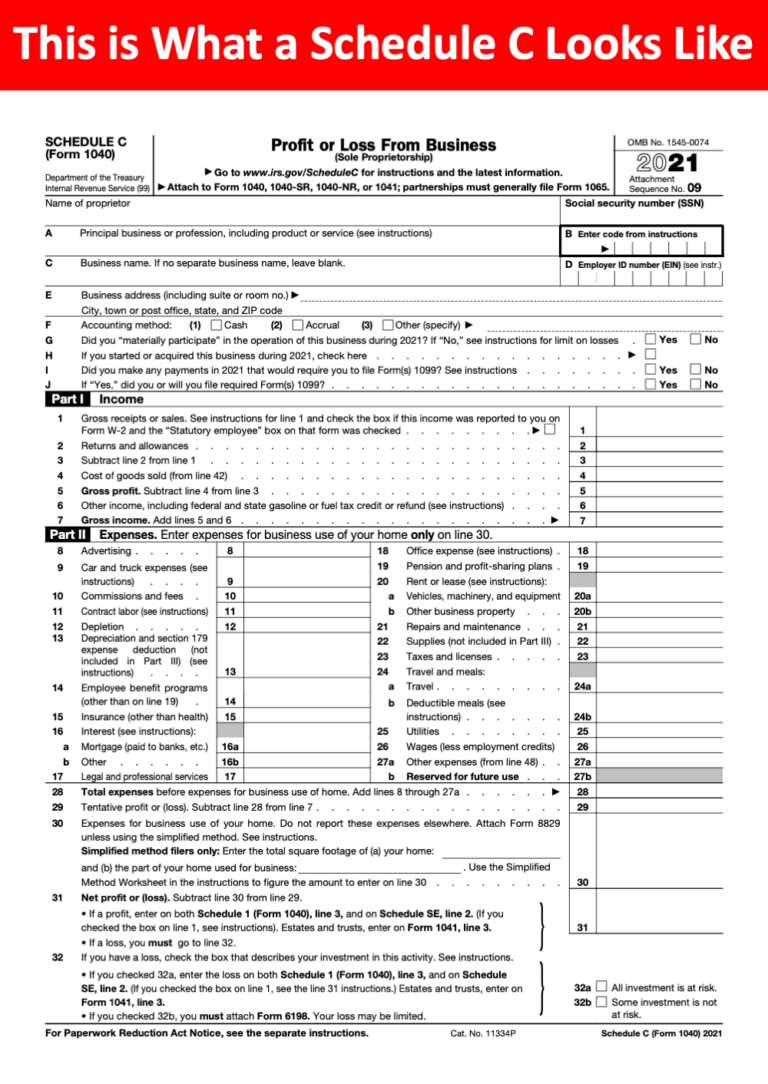

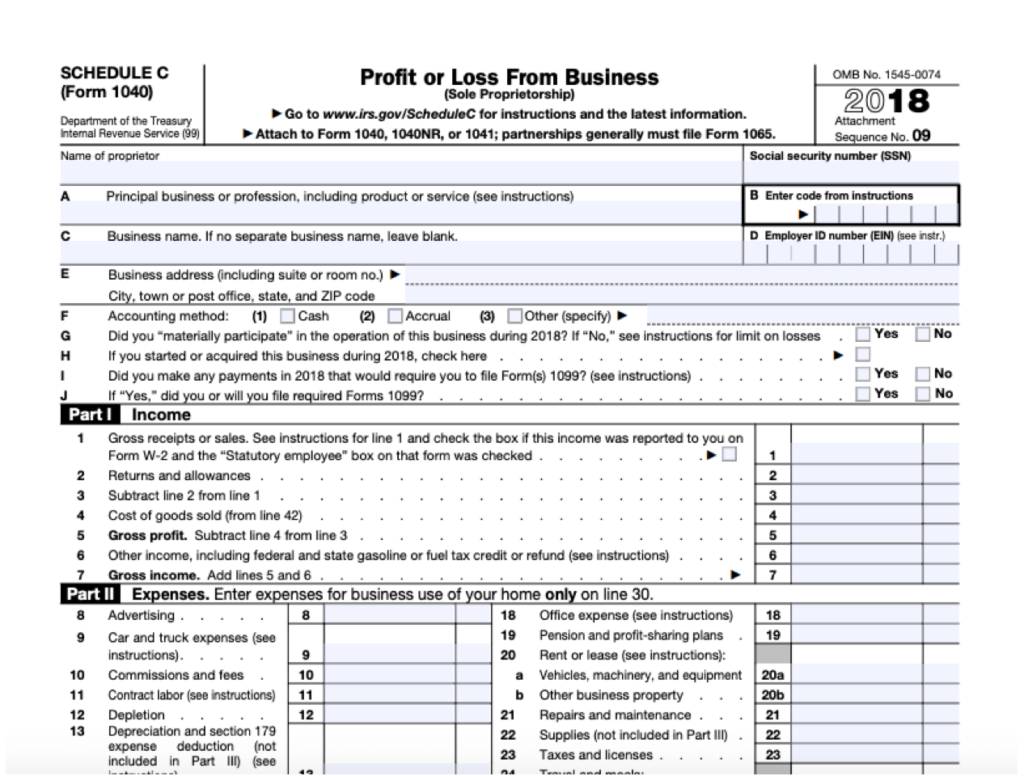

Irs Form Schedule C 2024 - Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Use your 2024 tax return as a guide in figuring your 2025 tax, but be sure to consider the following. For additional information, see the. Gross income includes gains, but not losses, reported on form 8949 or schedule d. Gross income from a business means, for example,. For 2024, the maximum amount of self.

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). For 2024, the maximum amount of self. Gross income includes gains, but not losses, reported on form 8949 or schedule d. For additional information, see the. Use your 2024 tax return as a guide in figuring your 2025 tax, but be sure to consider the following. Gross income from a business means, for example,.

Gross income includes gains, but not losses, reported on form 8949 or schedule d. Gross income from a business means, for example,. For additional information, see the. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Use your 2024 tax return as a guide in figuring your 2025 tax, but be sure to consider the following. For 2024, the maximum amount of self.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

For 2024, the maximum amount of self. Use your 2024 tax return as a guide in figuring your 2025 tax, but be sure to consider the following. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). For additional information, see the. Gross income includes gains, but not losses, reported on form.

Irs Fillable Forms 2024 Schedule C Penny Blondell

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Gross income includes gains, but not losses, reported on form 8949 or schedule d. Gross income from a business means, for example,. Use your 2024 tax return as a guide in figuring your 2025 tax, but be sure to consider the following..

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Use your 2024 tax return as a guide in figuring your 2025 tax, but be sure to consider the following. For 2024, the maximum amount of self. For additional information, see the. Gross income includes gains, but not losses, reported on form 8949 or schedule d. Gross income from a business means, for example,.

2024 Schedule C Form Maren Florentia

For additional information, see the. For 2024, the maximum amount of self. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Gross income from a business means, for example,. Use your 2024 tax return as a guide in figuring your 2025 tax, but be sure to consider the following.

Schedule C Instructions 2024 Instructions Ivett Letisha

For additional information, see the. Gross income includes gains, but not losses, reported on form 8949 or schedule d. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Gross income from a business means, for example,. Use your 2024 tax return as a guide in figuring your 2025 tax, but be.

How to a Sole Proprietorship (Guide) SimplifyLLC

Gross income includes gains, but not losses, reported on form 8949 or schedule d. For 2024, the maximum amount of self. Use your 2024 tax return as a guide in figuring your 2025 tax, but be sure to consider the following. For additional information, see the. Report income or loss from a business or profession as a sole proprietor using.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Use your 2024 tax return as a guide in figuring your 2025 tax, but be sure to consider the following. For 2024, the maximum amount of self. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). For additional information, see the. Gross income includes gains, but not losses, reported on form.

2024 Schedule C Form Maren Florentia

For additional information, see the. Gross income from a business means, for example,. Use your 2024 tax return as a guide in figuring your 2025 tax, but be sure to consider the following. Gross income includes gains, but not losses, reported on form 8949 or schedule d. Report income or loss from a business or profession as a sole proprietor.

2024 Schedule C Form 1040 Forms Lissa Phillis

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). For 2024, the maximum amount of self. For additional information, see the. Gross income from a business means, for example,. Use your 2024 tax return as a guide in figuring your 2025 tax, but be sure to consider the following.

Instructions For Schedule C 2024 Retha Hyacinthia

Gross income from a business means, for example,. Use your 2024 tax return as a guide in figuring your 2025 tax, but be sure to consider the following. For additional information, see the. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Gross income includes gains, but not losses, reported on.

Gross Income Includes Gains, But Not Losses, Reported On Form 8949 Or Schedule D.

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Gross income from a business means, for example,. For 2024, the maximum amount of self. Use your 2024 tax return as a guide in figuring your 2025 tax, but be sure to consider the following.