How To Track Business Income - By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. Using software to track your expenses can save you time and money and help your employees operate more efficiently. As a small business, you need to have a full and complete understanding of both your income and expenses. To track small business expenses effectively, start by opening a. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. How do small businesses keep track of expenses? That’s why tracking both is pivotal.

That’s why tracking both is pivotal. To track small business expenses effectively, start by opening a. Using software to track your expenses can save you time and money and help your employees operate more efficiently. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. As a small business, you need to have a full and complete understanding of both your income and expenses. How do small businesses keep track of expenses? By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business.

By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. That’s why tracking both is pivotal. Using software to track your expenses can save you time and money and help your employees operate more efficiently. To track small business expenses effectively, start by opening a. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. How do small businesses keep track of expenses? As a small business, you need to have a full and complete understanding of both your income and expenses.

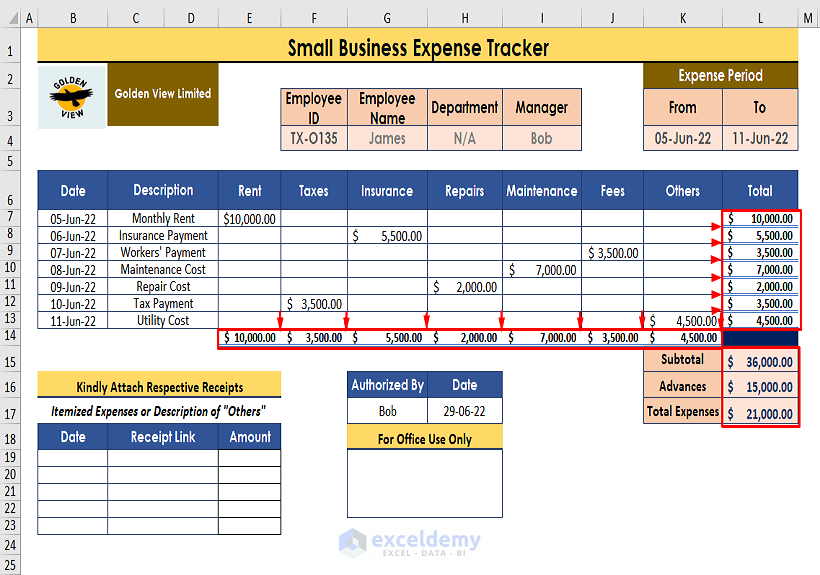

Template To Track Business Expenses

That’s why tracking both is pivotal. Using software to track your expenses can save you time and money and help your employees operate more efficiently. To track small business expenses effectively, start by opening a. By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. As a small business, you.

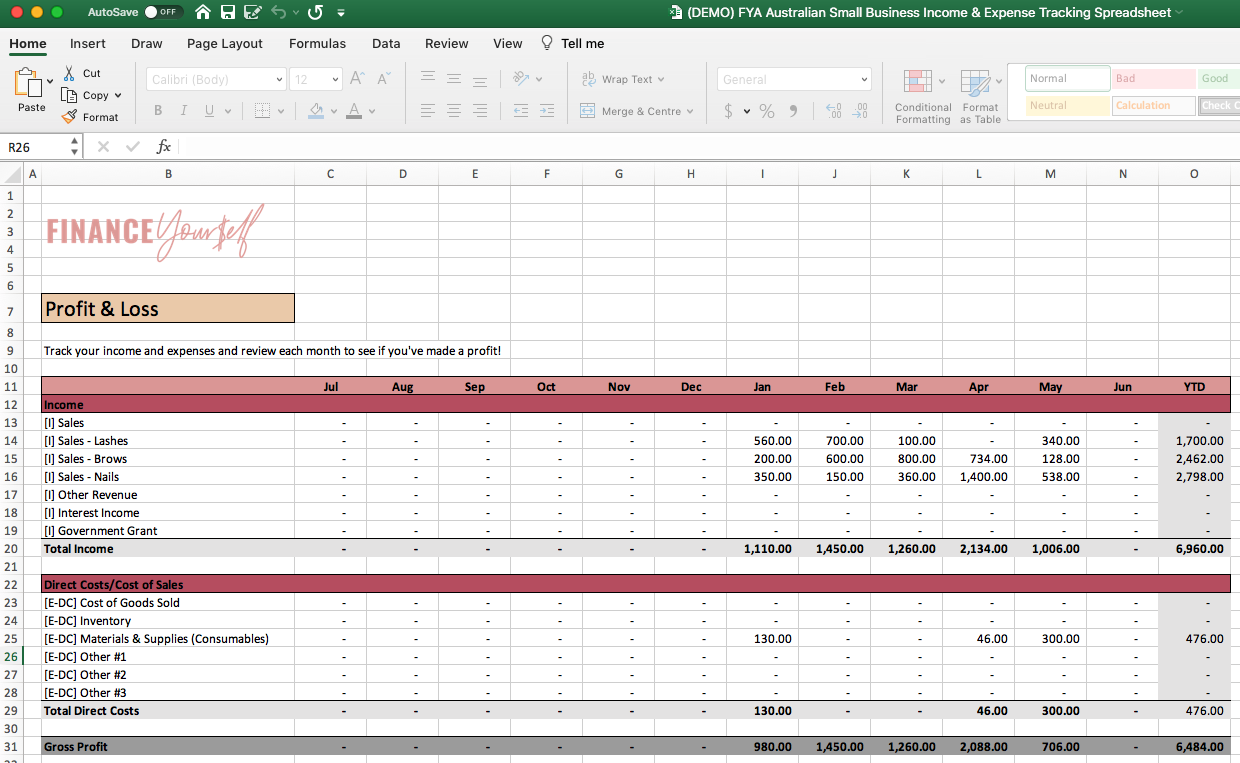

Monthly business and expense template masvlero

That’s why tracking both is pivotal. To track small business expenses effectively, start by opening a. How do small businesses keep track of expenses? By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. Using software to track your expenses can save you time and money and help your employees.

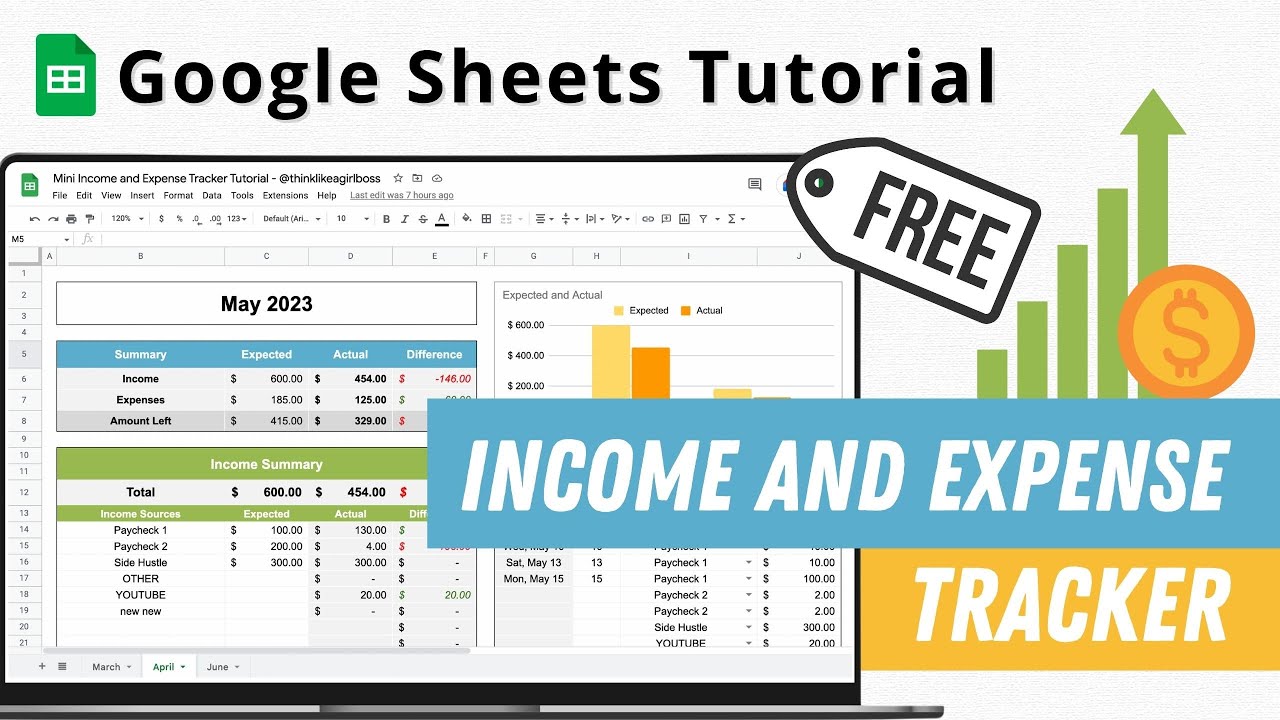

Small business and expense tracker gertynano

How do small businesses keep track of expenses? By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. To track small business expenses effectively, start by opening a. That’s why tracking both is pivotal. Using software to track your expenses can save you time and money and help your employees.

How to Keep Track of Small Business Expenses in Excel (2 Ways)

By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. How do small businesses keep track of expenses? To track small business expenses effectively, start by opening a. Using software to.

Free And Expense Tracker Templates For Google Sheets And

By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. Using software to track your expenses can save you time and money and help your employees operate more efficiently. To track.

FREE Australian Small Business & Expense Tracking Spreadsheet

Using software to track your expenses can save you time and money and help your employees operate more efficiently. As a small business, you need to have a full and complete understanding of both your income and expenses. How do small businesses keep track of expenses? Tracking your expenses allows you to monitor the growth of your business, build financial.

How to Build an and Expense Tracker from Scratch Google Sheets

Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. As a small business, you need to have a full and complete understanding of both your income and expenses. To track small business expenses effectively, start by opening a. Using software to track your expenses can save you time and money.

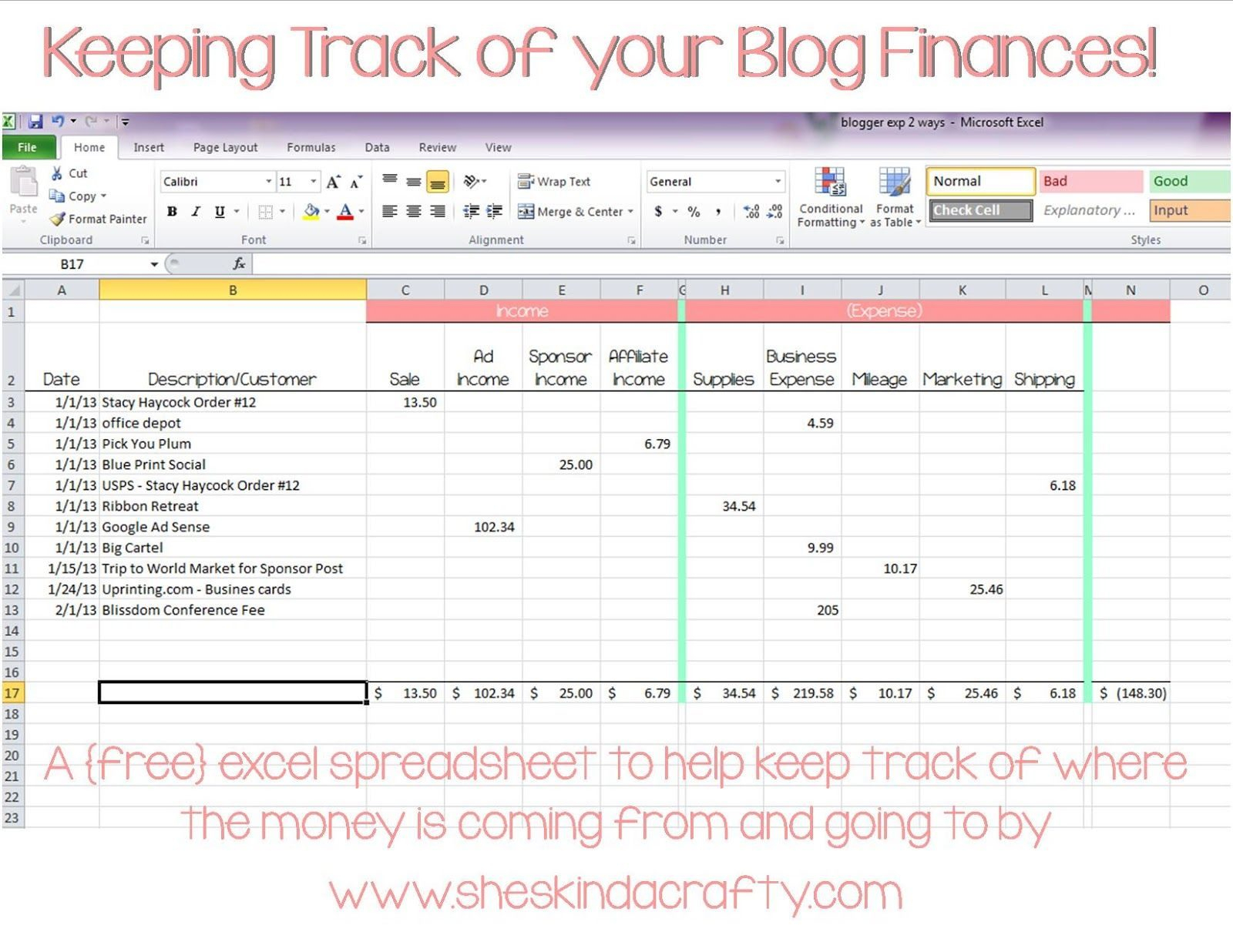

Excel and expense tracker punchper

To track small business expenses effectively, start by opening a. That’s why tracking both is pivotal. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. Using software to track your expenses can save you time and money and help your employees operate more efficiently. How do small businesses keep track.

Simple spreadsheets to keep track of business and expenses for

By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. As a small business, you need to have a full and complete understanding of both your income and expenses. Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. How do.

Free Template Excel Spreadsheet for Business Expenses

Tracking your expenses allows you to monitor the growth of your business, build financial statements, keep track of deductibles,. How do small businesses keep track of expenses? To track small business expenses effectively, start by opening a. As a small business, you need to have a full and complete understanding of both your income and expenses. That’s why tracking both.

Using Software To Track Your Expenses Can Save You Time And Money And Help Your Employees Operate More Efficiently.

How do small businesses keep track of expenses? By tracking expenses, a business can plan better, anticipate slowdowns in cash flow and make sure the most important business. To track small business expenses effectively, start by opening a. That’s why tracking both is pivotal.

Tracking Your Expenses Allows You To Monitor The Growth Of Your Business, Build Financial Statements, Keep Track Of Deductibles,.

As a small business, you need to have a full and complete understanding of both your income and expenses.