How To Calculate Npv In Finance - Net present value (npv) is the present value of all future cash flows of a project. Net present value is a financial metric used to determine the value of an investment by. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. What is net present value (npv)? Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows. Calculate npv by subtracting the initial investment from the sum of the present values of cash inflows.

Net present value (npv) is the present value of all future cash flows of a project. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value is a financial metric used to determine the value of an investment by. Calculate npv by subtracting the initial investment from the sum of the present values of cash inflows. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows. What is net present value (npv)?

Net present value is a financial metric used to determine the value of an investment by. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows. What is net present value (npv)? Net present value (npv) is the present value of all future cash flows of a project. Calculate npv by subtracting the initial investment from the sum of the present values of cash inflows. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and.

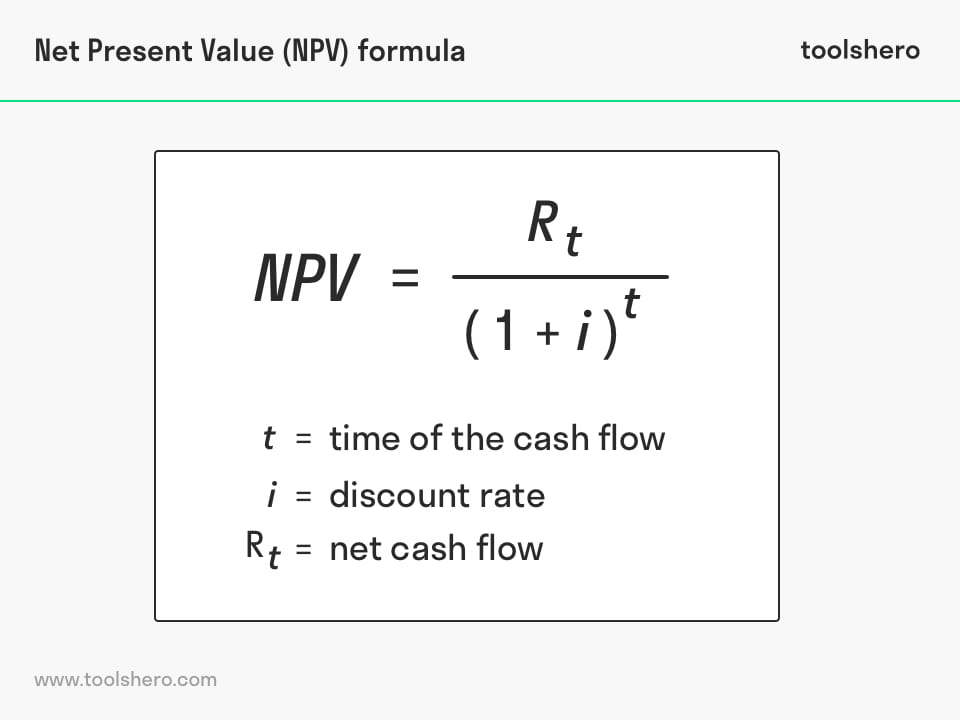

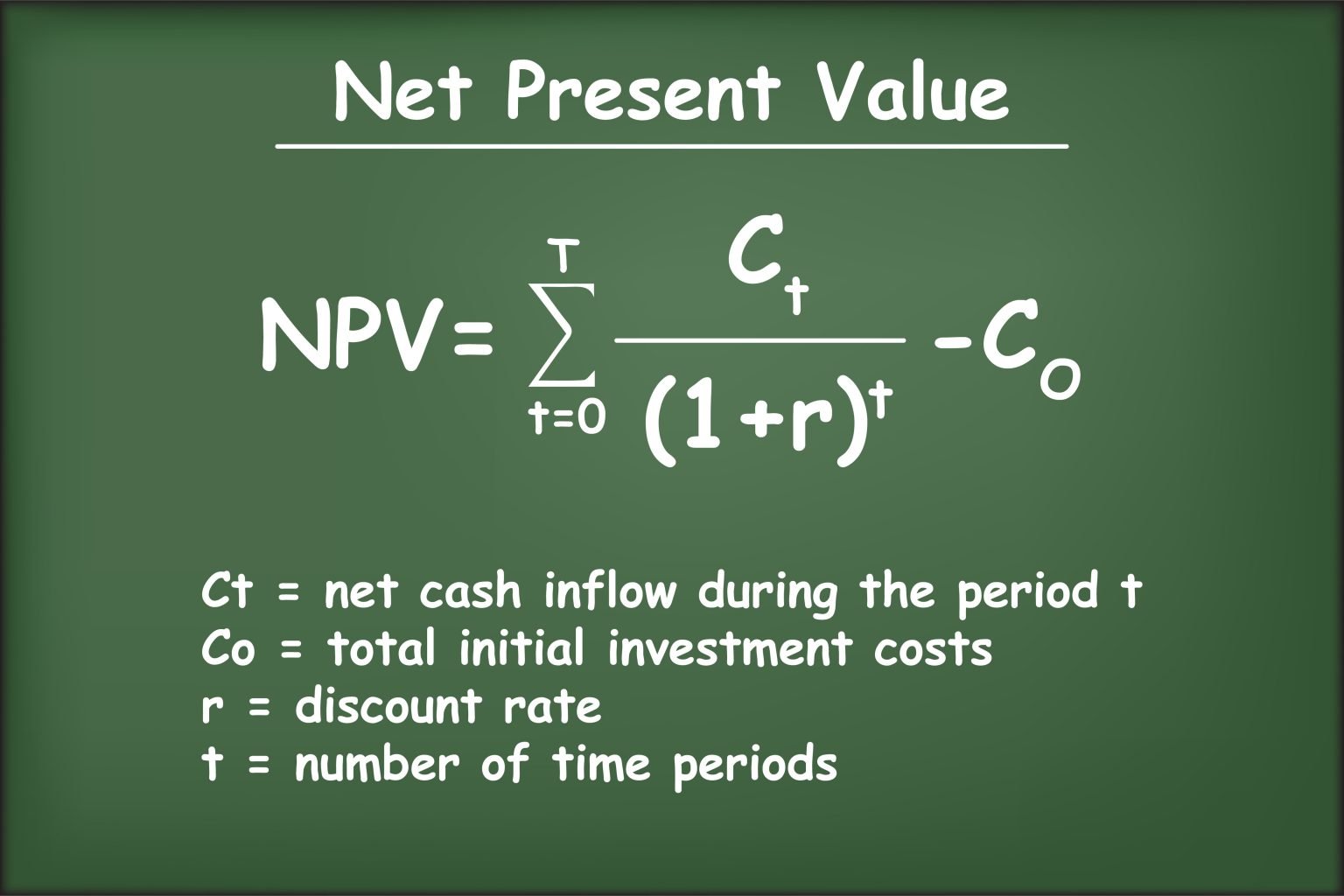

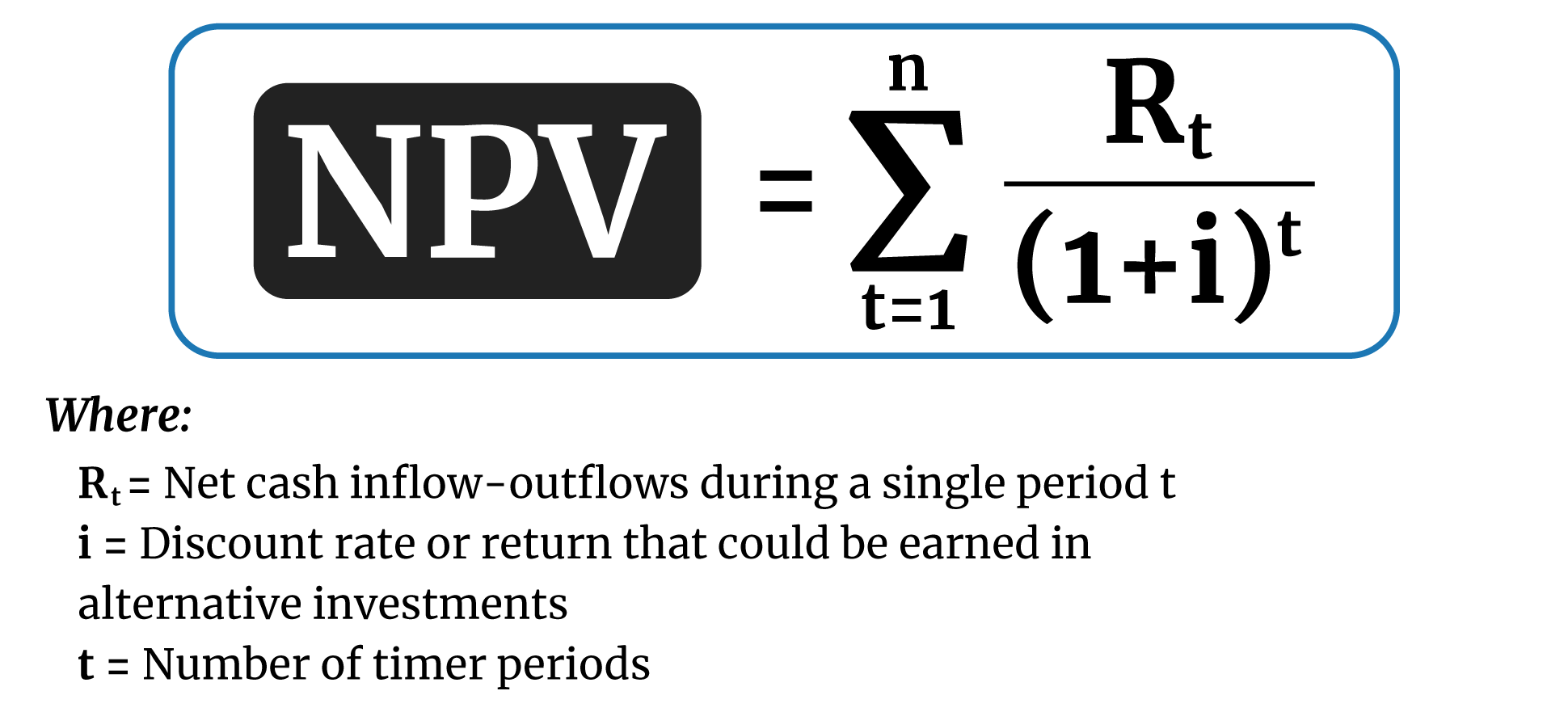

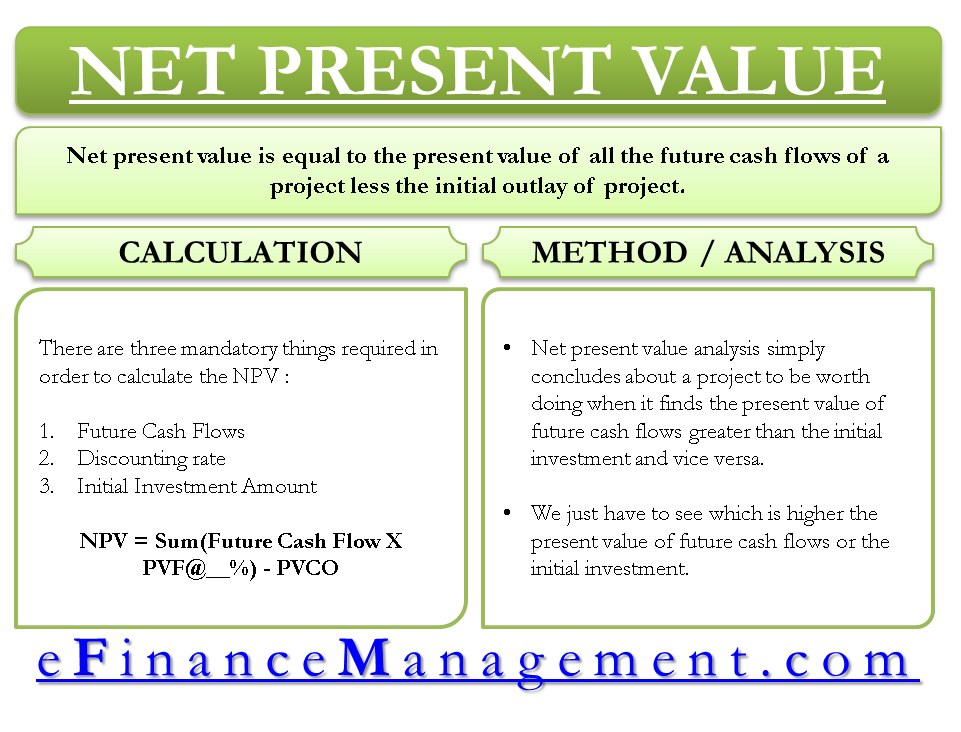

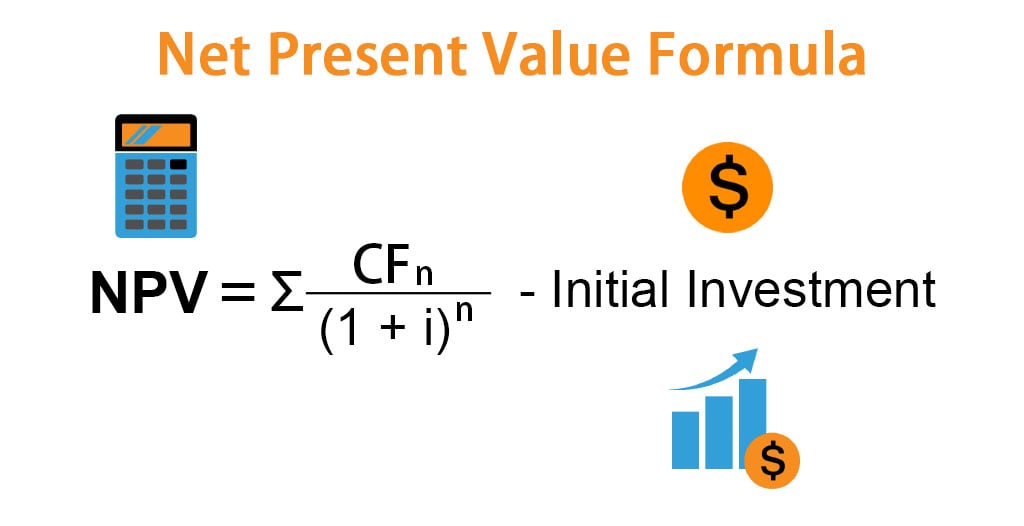

Present Value Formula

Calculate npv by subtracting the initial investment from the sum of the present values of cash inflows. What is net present value (npv)? Net present value (npv) is the present value of all future cash flows of a project. Net present value is a financial metric used to determine the value of an investment by. Net present value, npv, is.

Net Present Value Excel Template

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Calculate npv by subtracting the initial investment from the sum of the present values of cash inflows. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows. Net.

How To Calculate Npv With Infinite Discount Rate Design Talk

What is net present value (npv)? How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows. Calculate npv by subtracting the initial investment from the sum of the.

Net Present Value Calculating and Using Payment Savvy

Net present value (npv) is the present value of all future cash flows of a project. What is net present value (npv)? Calculate npv by subtracting the initial investment from the sum of the present values of cash inflows. Net present value is a financial metric used to determine the value of an investment by. Net present value, npv, is.

Net Present Value Formula

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Calculate npv by subtracting the initial investment from the sum of the present values of cash inflows. Net present value (npv) is the present value of all future cash flows of a project. Net present value, npv, is a.

Net Present Value Formula On Excel at sasfloatblog Blog

Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows. Net present value is a financial metric used to determine the value of an investment by. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Calculate npv.

How to calculate NPV and IRR in Excel / Principles of finance / Episode

Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows. Net present value (npv) is the present value of all future cash flows of a project. What is net present value (npv)? How to calculate net present value (npv) the net present value (npv) represents the discounted values of.

Detailed Steps To Calculate Net Present Value And Internal Rate Of

Net present value (npv) is the present value of all future cash flows of a project. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. What is net present value (npv)? Calculate npv by subtracting the initial investment from the sum of the present values of cash inflows..

How To Calculate Net Present Value With Discount Rate In Excel Design

What is net present value (npv)? Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value is a financial metric used to determine the value.

Net Present Value Calculator

Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows. Net present value is a financial metric used to determine the value of an investment by. Net present value (npv) is the present value of all future cash flows of a project. What is net present value (npv)? How.

What Is Net Present Value (Npv)?

Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows. Net present value is a financial metric used to determine the value of an investment by. Calculate npv by subtracting the initial investment from the sum of the present values of cash inflows. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and.

:max_bytes(150000):strip_icc()/ScreenShot2019-06-20at10.46.59AM-f30499c2303c44a5a883c6c1e676569b.png)