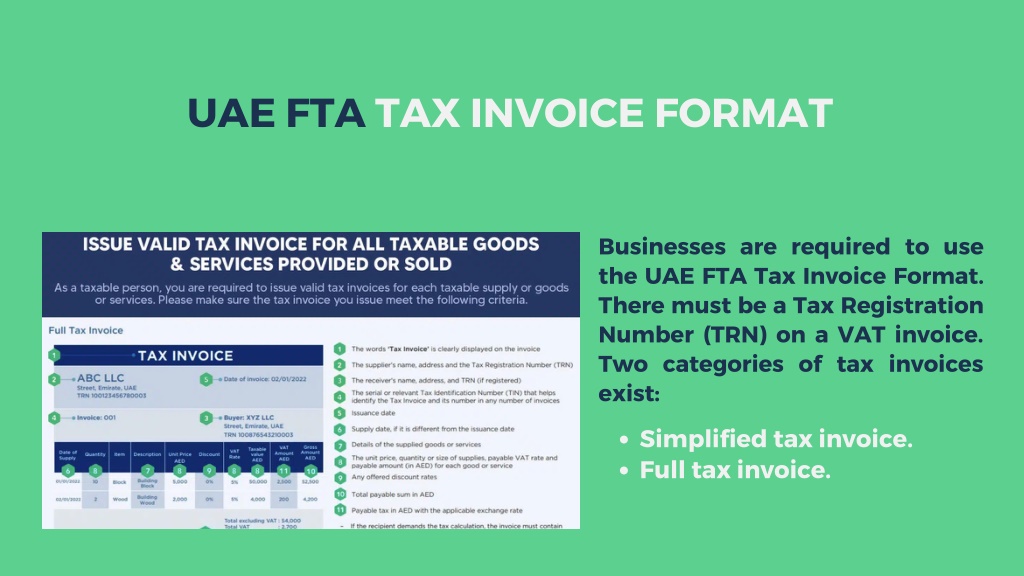

Fta Emirates Tax Invoice - Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. A tax invoice is essential under uae vat law for taxable supplies. There are two distinct categories of tax. It must include trn, invoice date, vat rate, and total amount.

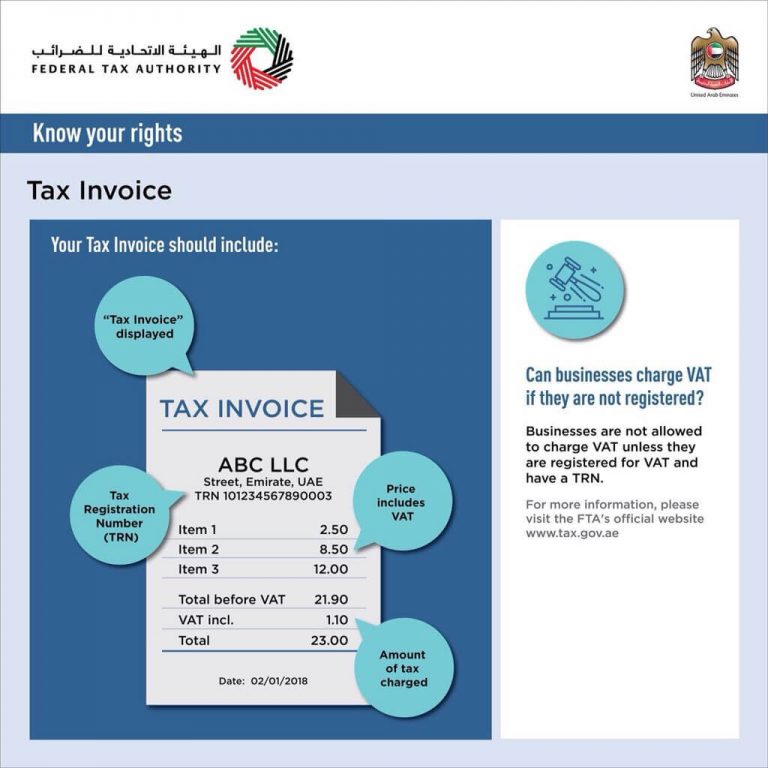

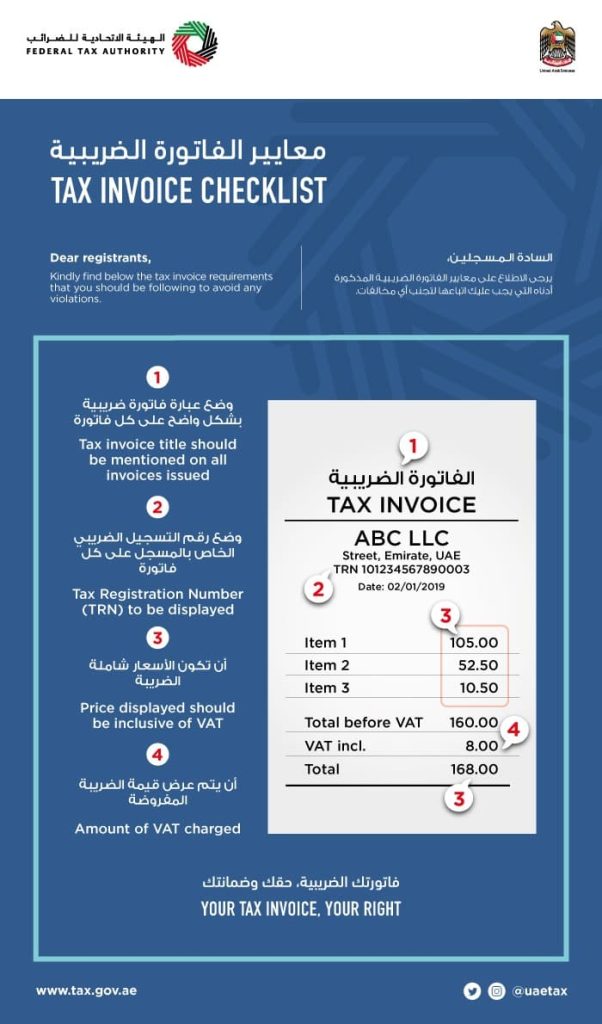

Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. A tax invoice is essential under uae vat law for taxable supplies. There are two distinct categories of tax. It must include trn, invoice date, vat rate, and total amount.

Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. It must include trn, invoice date, vat rate, and total amount. There are two distinct categories of tax. A tax invoice is essential under uae vat law for taxable supplies.

Record Sales and Print Invoices as per FTA (for UAE)

Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. A tax invoice is essential under uae vat law for taxable supplies. There are two distinct categories of tax. It must include trn, invoice date, vat rate, and total amount.

Detailed Tax Invoice All About TAX In UAE

It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. There are two distinct categories of tax. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae.

Record Sales and Print Invoices as per FTA (for UAE)

There are two distinct categories of tax. A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae.

How to Record Sales and Print Invoices as per FTA (for UAE) in

A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. There are two distinct categories of tax.

Tax Invoice Format UAE FTA VAT Invoice UAE Shuraa Tax

There are two distinct categories of tax. A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae.

PPT Tax Invoice Format UAE PowerPoint Presentation, free download

Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. There are two distinct categories of tax.

Sample Invoice In Arabic New Sample Z vrogue.co

Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. There are two distinct categories of tax.

Tax Invoice Format UAE FTA VAT Invoice UAE Shuraa Tax

Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. There are two distinct categories of tax. A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount.

VAT Invoice Format in UAE FTA Tax Invoice Format UAE

Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. There are two distinct categories of tax.

Tax Invoice Format UAE FTA VAT Invoice UAE Shuraa Tax

It must include trn, invoice date, vat rate, and total amount. There are two distinct categories of tax. A tax invoice is essential under uae vat law for taxable supplies. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae.

A Tax Invoice Is Essential Under Uae Vat Law For Taxable Supplies.

It must include trn, invoice date, vat rate, and total amount. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. There are two distinct categories of tax.