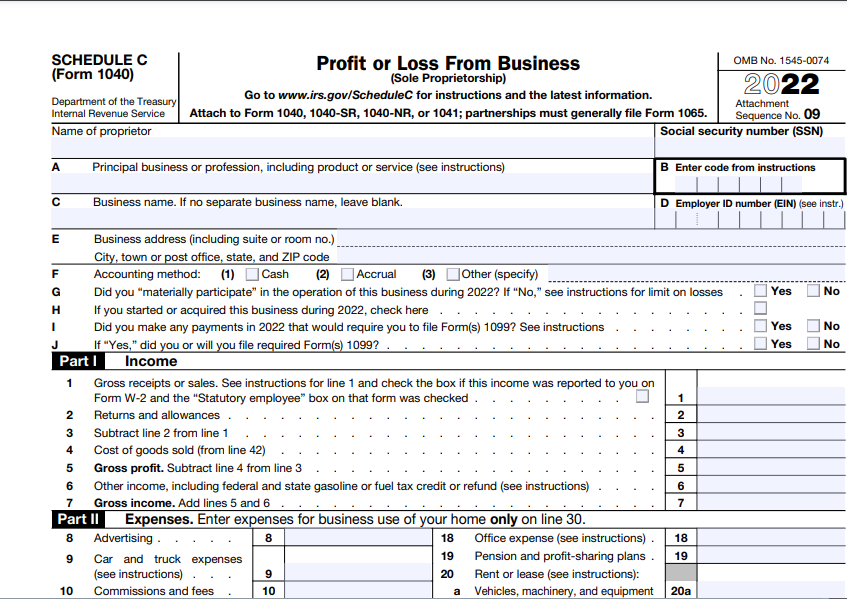

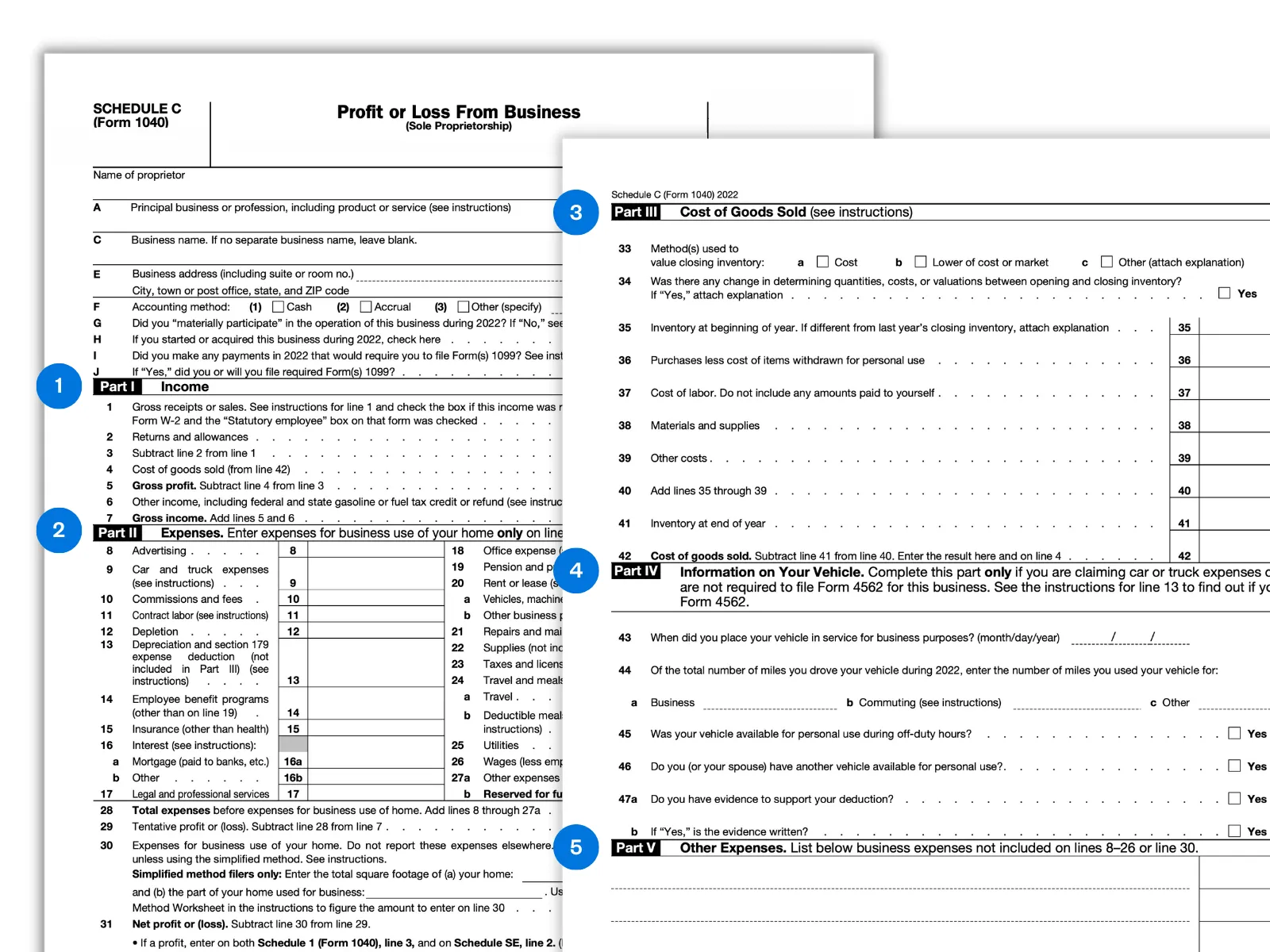

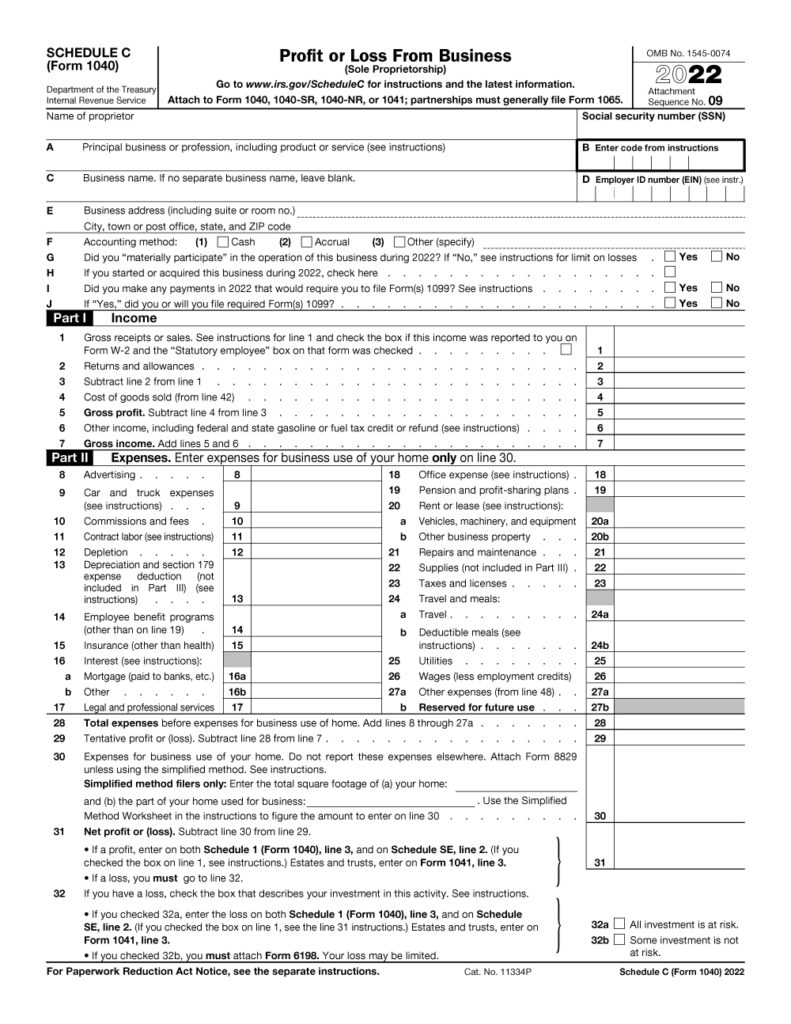

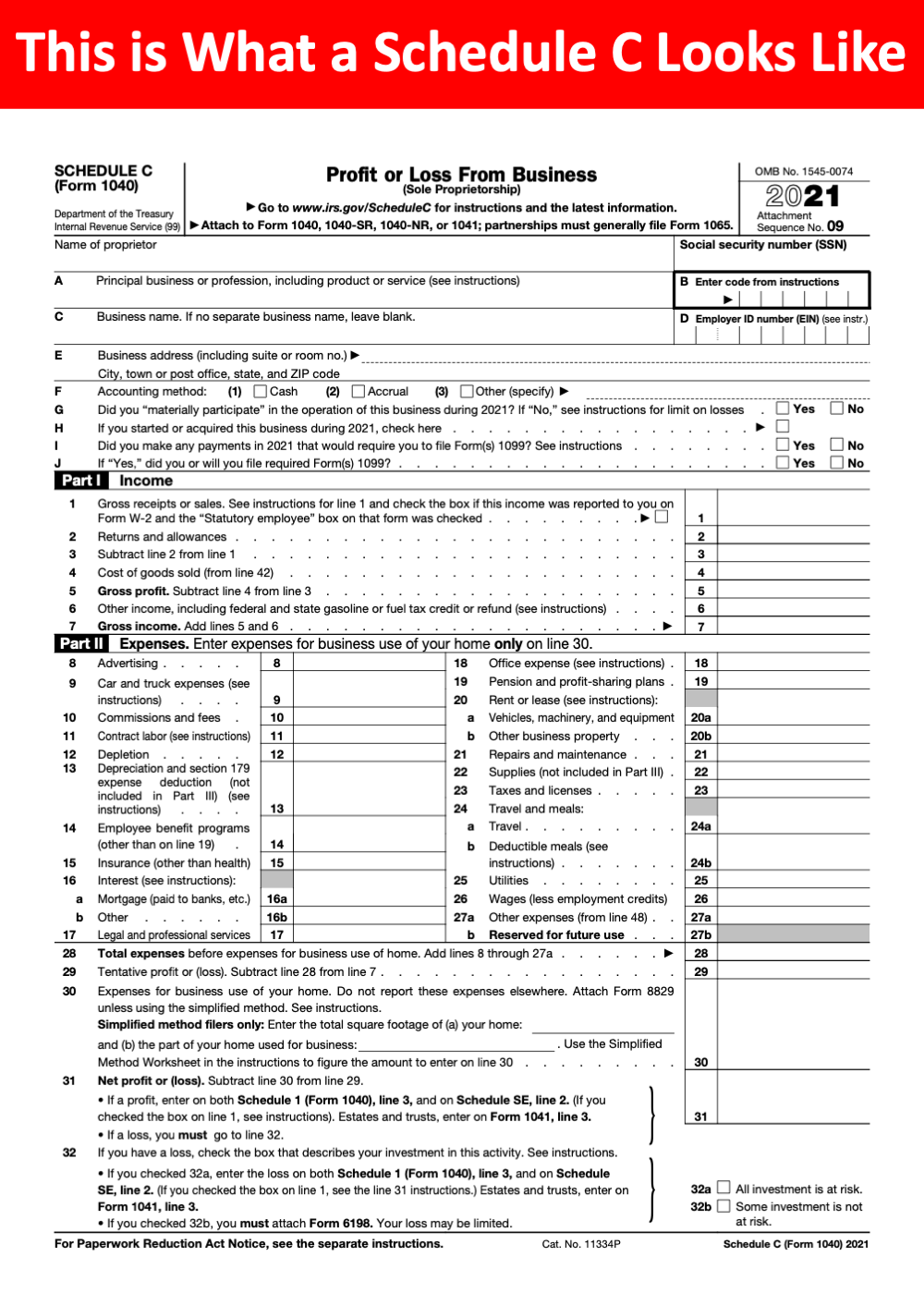

Federal Schedule C Form 2023 - Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. And, you can fill out & download a schedule c form. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Check out our guide for a detailed filing instructions. Click here to go to the home page. Filing a schedule c with your 2023 taxes? The purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Accurate completion of this schedule.

The purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Click here to go to the home page. Check out our guide for a detailed filing instructions. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If no separate business name, leave blank. Filing a schedule c with your 2023 taxes? Accurate completion of this schedule. And, you can fill out & download a schedule c form. Go to www.irs.gov/schedulec for instructions and the latest information.

And, you can fill out & download a schedule c form. Go to www.irs.gov/schedulec for instructions and the latest information. Filing a schedule c with your 2023 taxes? Check out our guide for a detailed filing instructions. If no separate business name, leave blank. Accurate completion of this schedule. The purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Click here to go to the home page. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

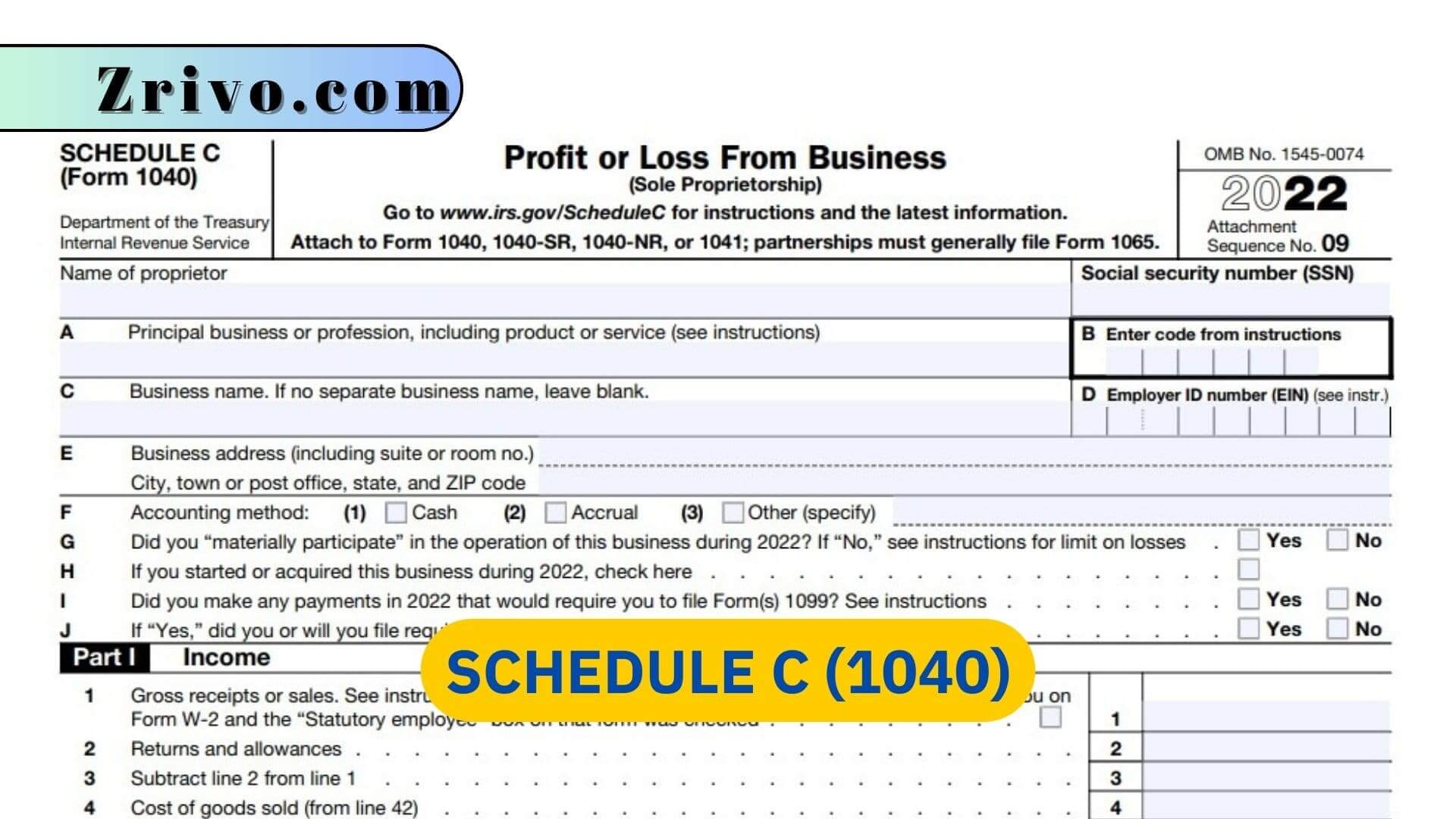

Schedule C (1040) 2023 2024

Go to www.irs.gov/schedulec for instructions and the latest information. Click here to go to the home page. Check out our guide for a detailed filing instructions. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Accurate completion of this schedule.

Schedule C Form Everything You Need to Know Ramsey

Check out our guide for a detailed filing instructions. Go to www.irs.gov/schedulec for instructions and the latest information. The purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Filing a schedule c with your 2023 taxes? If no separate business name, leave blank.

Schedule C Tax Form Who Needs To File & How To Do It

Check out our guide for a detailed filing instructions. The purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Filing a schedule c with your 2023.

Irs 2024 Form 1040 Schedule C Tasha Fredelia

And, you can fill out & download a schedule c form. Click here to go to the home page. Check out our guide for a detailed filing instructions. The purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Filing a schedule c with your 2023 taxes?

Schedule C (Form 1040) 2023 Instructions

Accurate completion of this schedule. And, you can fill out & download a schedule c form. Filing a schedule c with your 2023 taxes? Check out our guide for a detailed filing instructions. The purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship.

Schedule C 2023 Form Printable Forms Free Online

Go to www.irs.gov/schedulec for instructions and the latest information. Click here to go to the home page. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. And, you can fill out & download a schedule c form. If no separate business name, leave blank.

Printable Schedule C 2023

Accurate completion of this schedule. Check out our guide for a detailed filing instructions. The purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Click here to go to the home page. Go to www.irs.gov/schedulec for instructions and the latest information.

2023 fillable schedule c Fill out & sign online DocHub

Filing a schedule c with your 2023 taxes? Check out our guide for a detailed filing instructions. The purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information.

Printable Schedule C

Go to www.irs.gov/schedulec for instructions and the latest information. Click here to go to the home page. The purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Filing a schedule c with your 2023 taxes? Accurate completion of this schedule.

IRS Form 1040 Schedule C. Profit or Loss From Business Forms Docs

Go to www.irs.gov/schedulec for instructions and the latest information. Click here to go to the home page. The purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or.

And, You Can Fill Out & Download A Schedule C Form.

Filing a schedule c with your 2023 taxes? If no separate business name, leave blank. Accurate completion of this schedule. Click here to go to the home page.

The Purpose Of Schedule C (Form 1040) Is To Report Income Or Loss From A Business Operated As A Sole Proprietorship.

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.irs.gov/schedulec for instructions and the latest information. Check out our guide for a detailed filing instructions.

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)