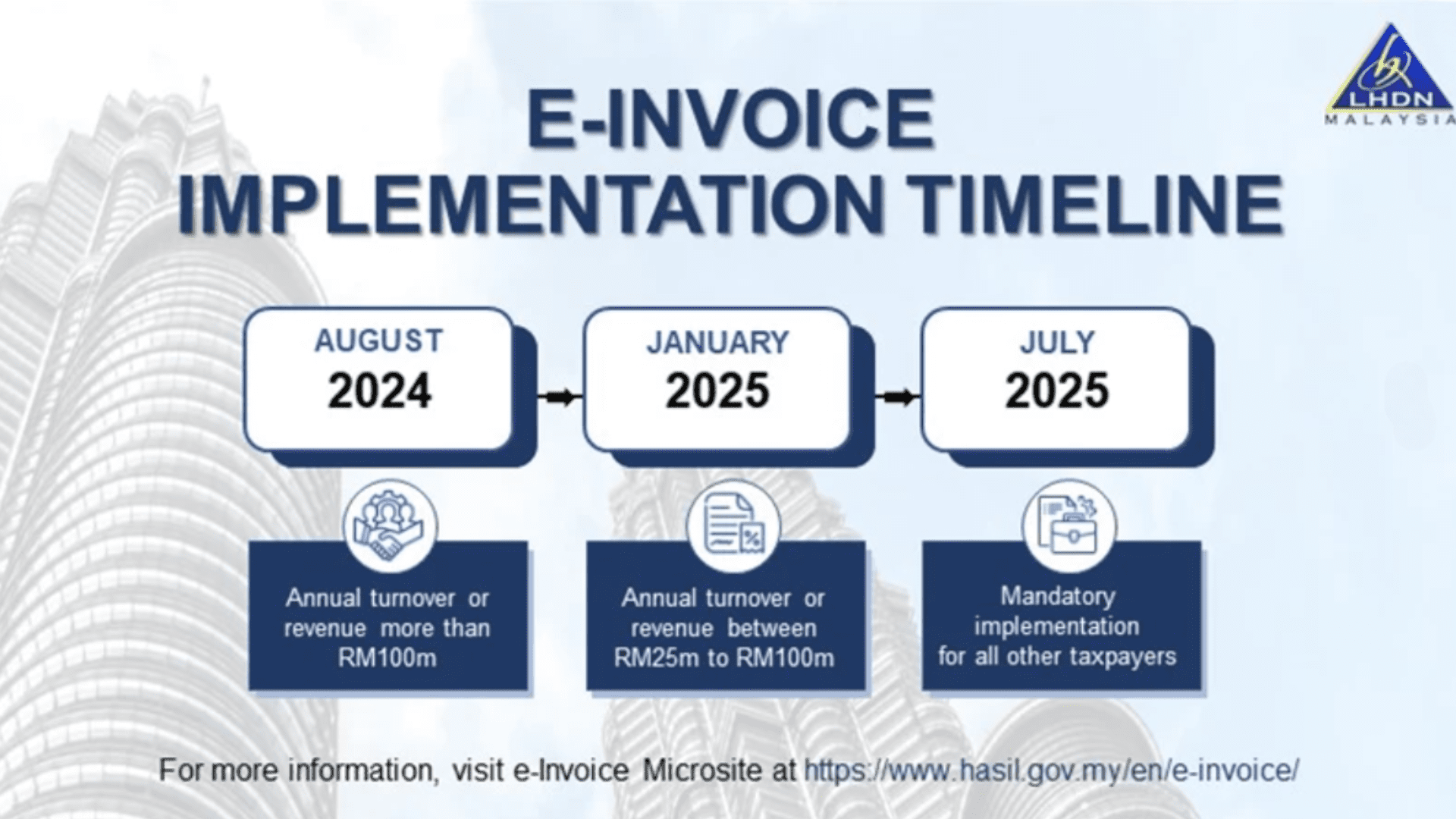

E Invoice Implementation Date Malaysia - The timeline includes implementation dates of: Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 10k+ visitors in the past month 1, 2024, for taxpayers with annual turnover or revenue.

10k+ visitors in the past month The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue. 10k+ visitors in the past month

Adapting to EInvoicing A New Era for Malaysian Businesses SiteGiant

1, 2024, for taxpayers with annual turnover or revenue. The timeline includes implementation dates of: 10k+ visitors in the past month Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

EINVOICE FREQUENTLY ASKED QUESTION (FAQ)

1, 2024, for taxpayers with annual turnover or revenue. 10k+ visitors in the past month Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. The timeline includes implementation dates of:

Pelaksanaan eInvois di Malaysia Apa maksudnya

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 1, 2024, for taxpayers with annual turnover or revenue. 10k+ visitors in the past month The timeline includes implementation dates of:

Malaysia LHDN eInvoice Guidelines 50 QnA L & Co Accountants

The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 10k+ visitors in the past month

eInvois HASiL Info Lembaga Hasil Dalam Negeri Malaysia

1, 2024, for taxpayers with annual turnover or revenue. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. The timeline includes implementation dates of: 10k+ visitors in the past month

2024 LHDN EInvoice Malaysia How it impact your business

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 10k+ visitors in the past month The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue.

National EInvoicing Initiative My Software Solutions

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 1, 2024, for taxpayers with annual turnover or revenue. The timeline includes implementation dates of: 10k+ visitors in the past month

Navigating EInvoice Regulations IRB Malaysia's 2023 Guidelines

10k+ visitors in the past month 1, 2024, for taxpayers with annual turnover or revenue. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. The timeline includes implementation dates of:

Implementation of EInvoicing Malaysia IVAOTR

10k+ visitors in the past month The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

Mandatory eInvoicing System Starting From June 2024 ShineWing TY TEOH

1, 2024, for taxpayers with annual turnover or revenue. The timeline includes implementation dates of: Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 10k+ visitors in the past month

10K+ Visitors In The Past Month

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue.

.jpeg)