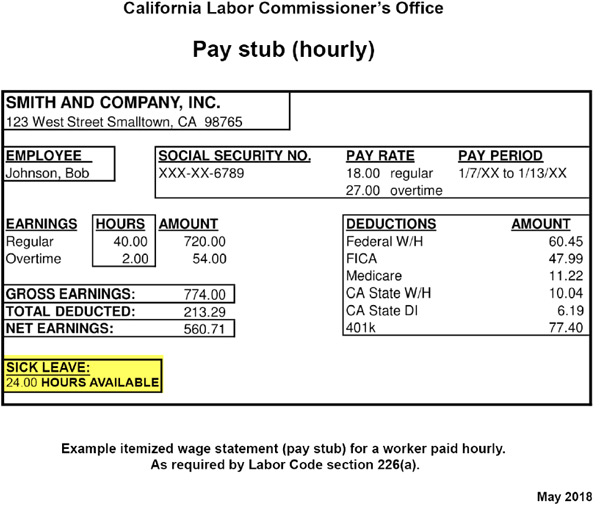

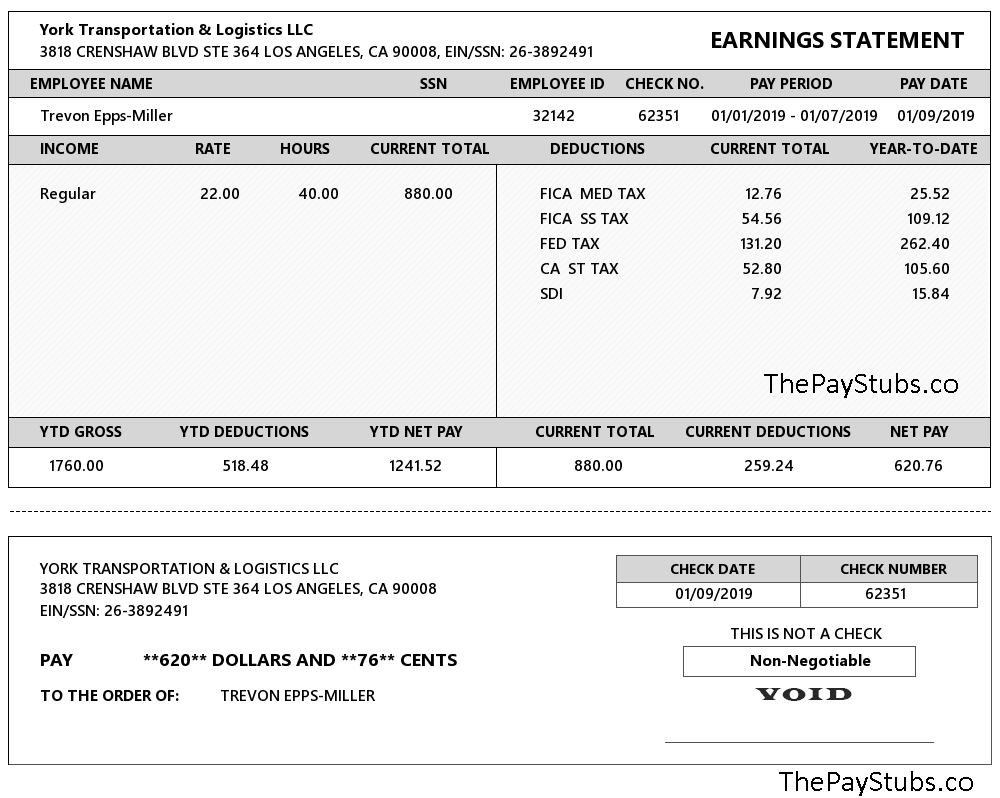

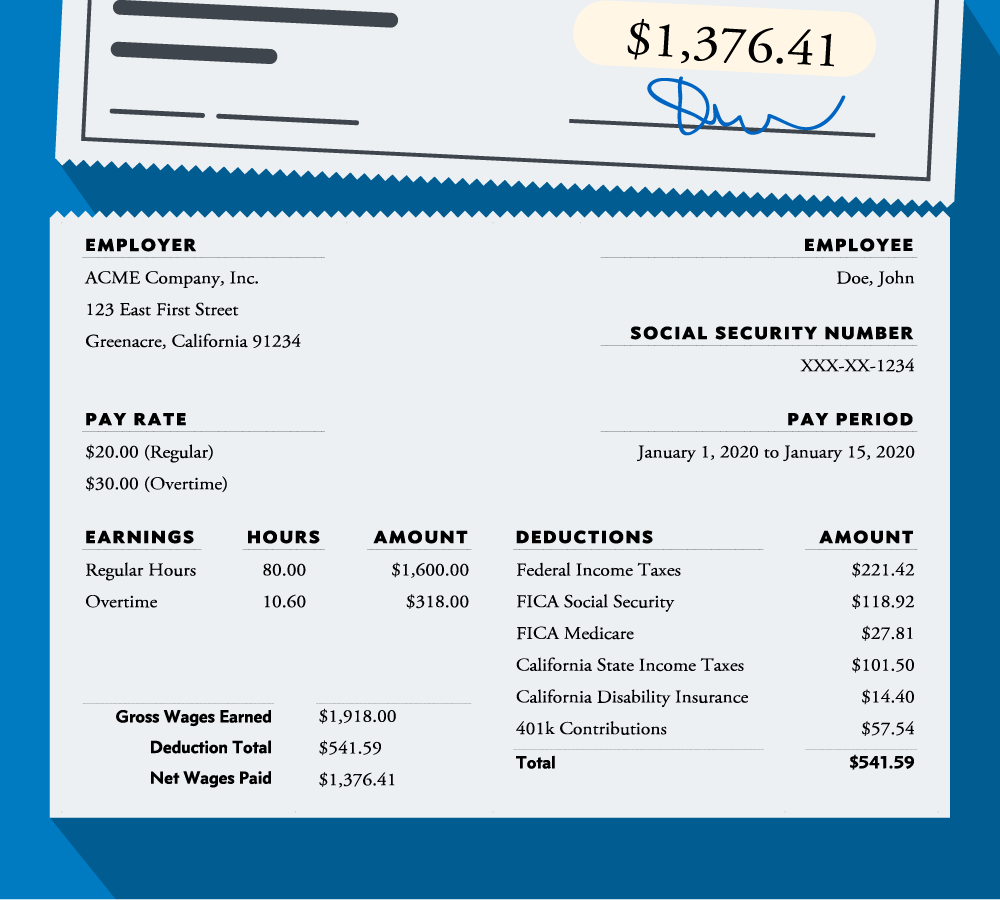

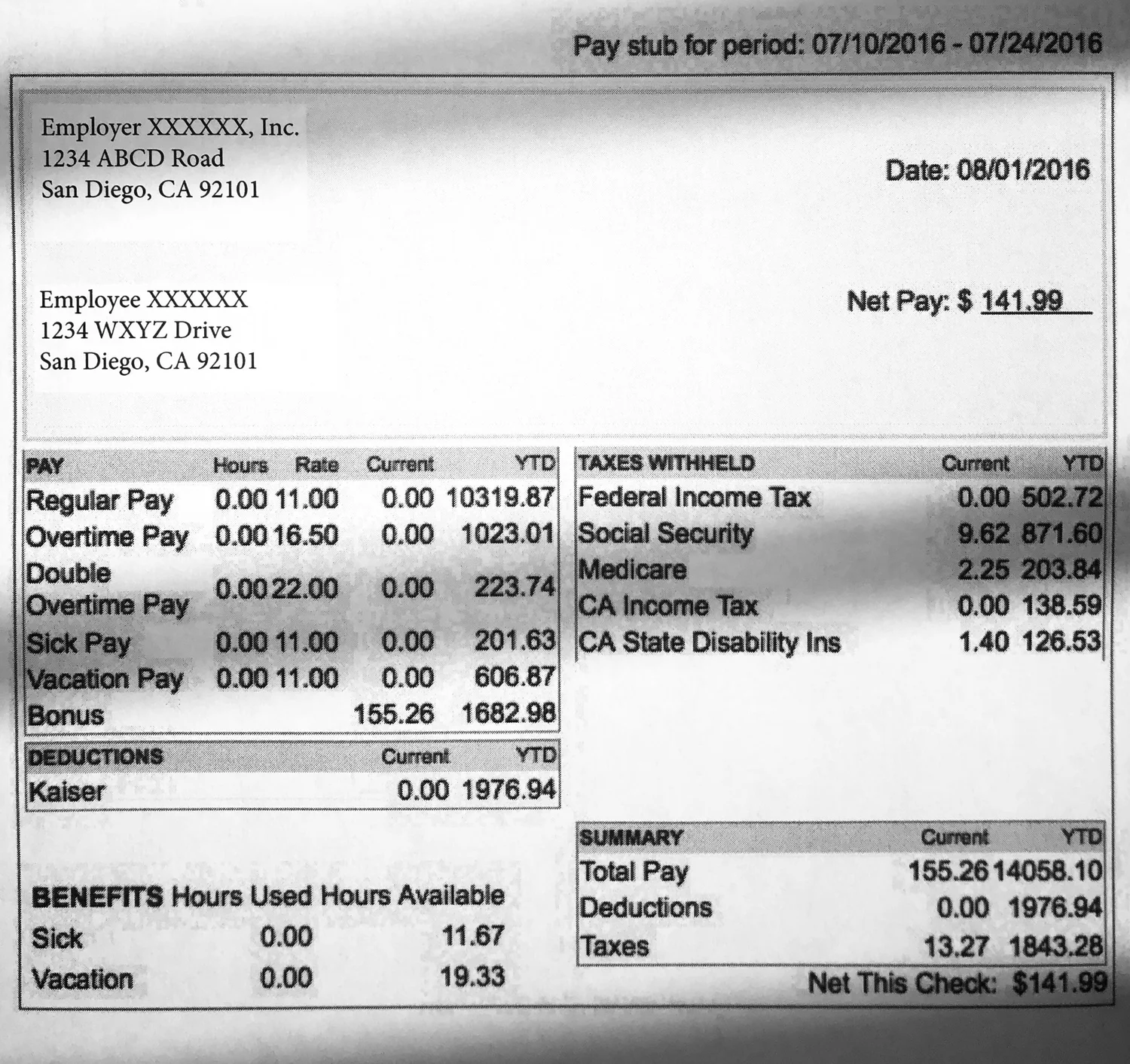

California Pay Slip Requirements - As required by labor code section 226(a). In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours. In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. Example itemized wage statement (pay stub) for a worker paid hourly.

Example itemized wage statement (pay stub) for a worker paid hourly. Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. As required by labor code section 226(a). California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours. In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in.

In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours. Example itemized wage statement (pay stub) for a worker paid hourly. In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. As required by labor code section 226(a).

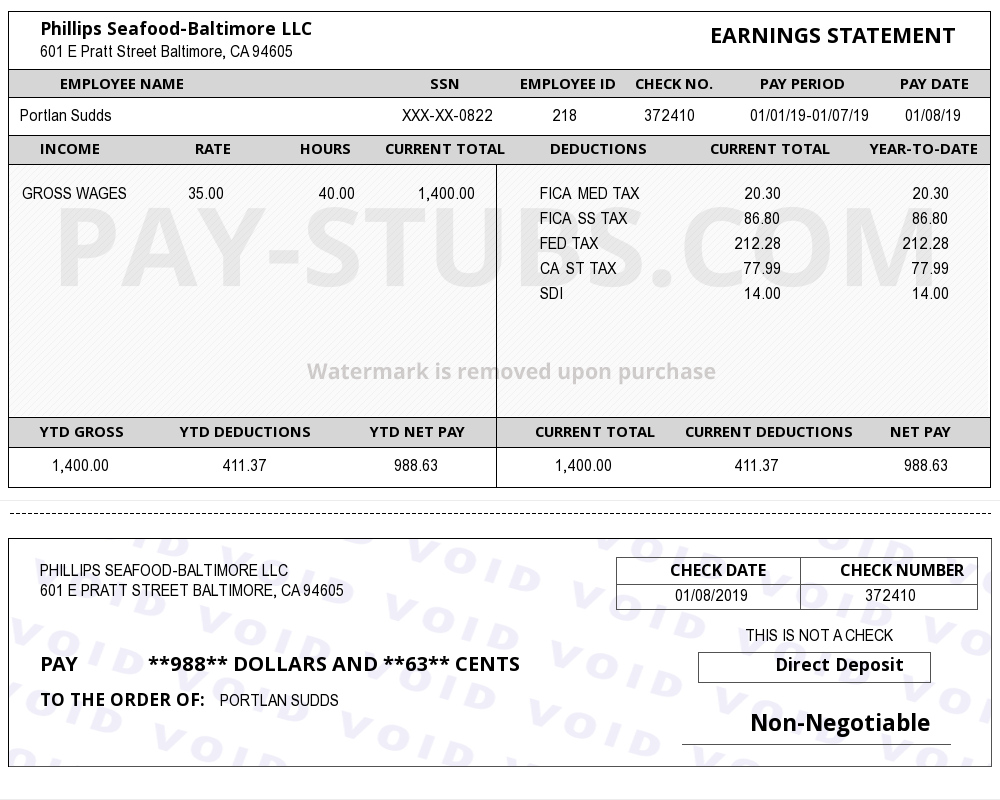

California Pay Stub Template

California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours. In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. In california, wage statements, or pay stubs as they are more commonly known, must include specific details such.

Paystub Generator

In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. Example itemized wage statement (pay stub) for a worker paid hourly. As required by labor code section 226(a). Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. In california, wages, with.

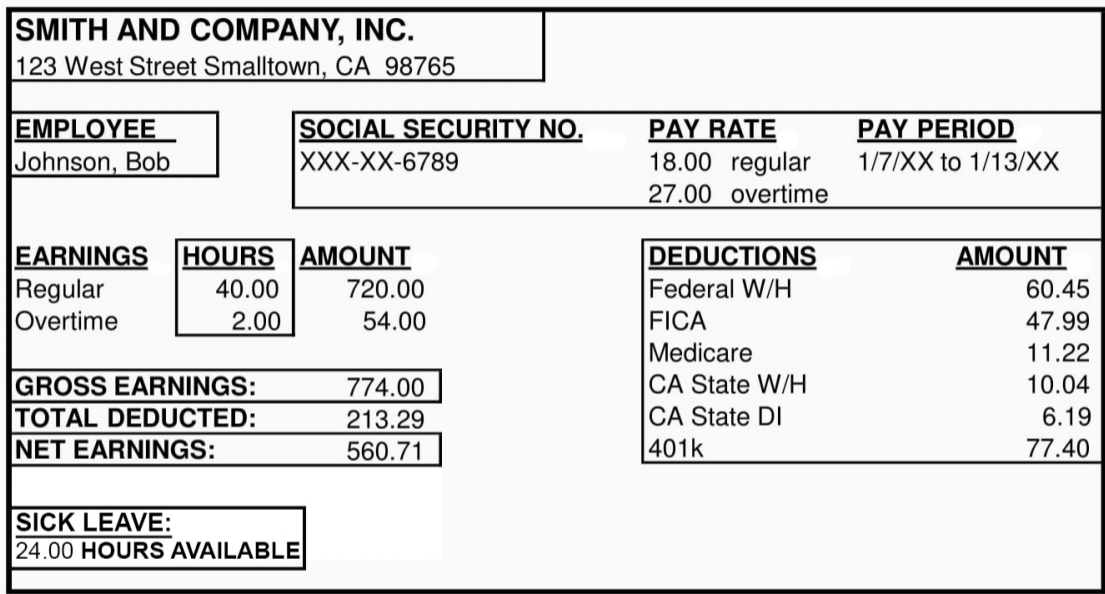

California Paystub Law (2025) CA employer refuses to give paystub?

As required by labor code section 226(a). Example itemized wage statement (pay stub) for a worker paid hourly. California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours. Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. In california, wages, with some exceptions (see.

California Pay Stub Requirements 2025 Images References Sofia L Newman

As required by labor code section 226(a). In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. Example itemized wage statement (pay stub) for a.

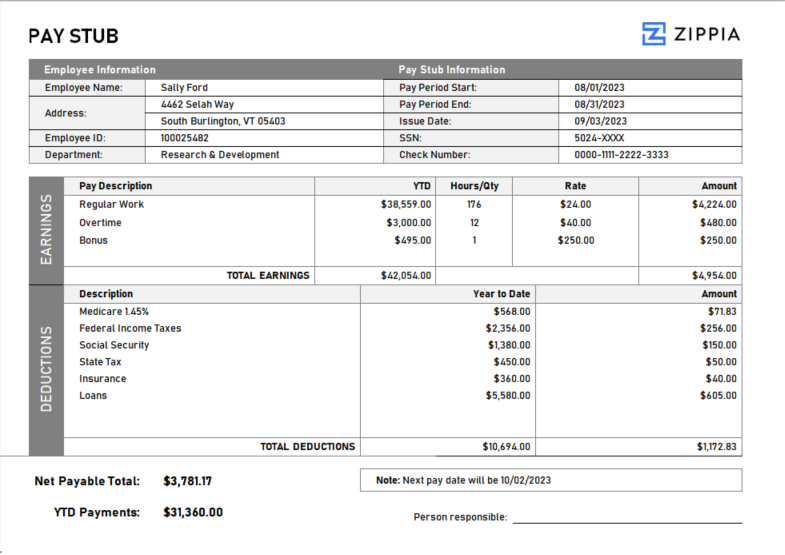

California Pay Stub Template

Example itemized wage statement (pay stub) for a worker paid hourly. California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours. As required by labor code section 226(a). In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in..

California Pay Stub Template

In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. As required by labor code section 226(a). In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. Learn what california employers must include on wage.

California Pay Stub Template

California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours. In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. In.

California Pay Stub Template

Example itemized wage statement (pay stub) for a worker paid hourly. Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. As required by labor code section 226(a). California mandates detailed wage.

Check Stub

Example itemized wage statement (pay stub) for a worker paid hourly. California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours. In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. Learn what california employers must include on wage statements to.

California Pay Stub Template

In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. As required by labor code section 226(a). Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. In california, wages, with some exceptions (see table below), must be paid at least twice.

California Mandates Detailed Wage Statements For Every Pay Period, Including Employer And Employee Information, Pay Period Dates, Hours.

As required by labor code section 226(a). Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in.